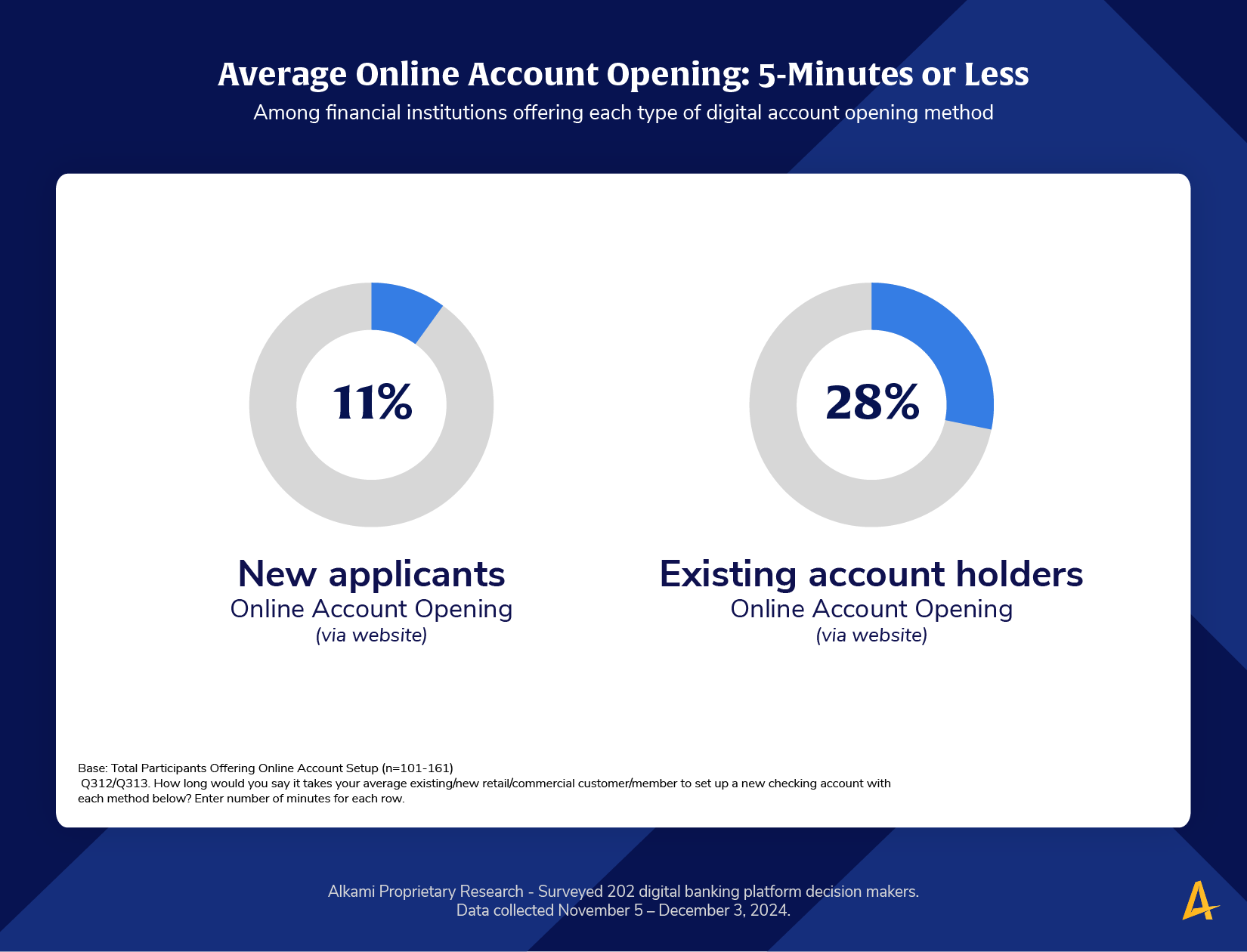

The data highlights a clear and concerning gap in digital account opening performance across the financial services industry. Just 11% of financial institutions offer a five-minute online account opening experience to applicants. For existing customers or members, that number rises to 28% of financial institutions, still not where it could be, but notably better.

This means nearly 9 out of 10 prospective account holders face friction during one of the most critical moments in their relationship with an institution. If financial institutions don’t nail the first impression, consumers may turn elsewhere. Immediacy and ease are no longer preferences, but expectations. Financial institutions that fail to deliver a swift onboarding process risk losing potential customers or members at the very first touchpoint.

Compare this to best-in-class digital experiences outside of financial services. Think of streaming services, food delivery applications, or e-commerce platforms. Users can sign up, personalize, and transact in minutes. These experiences have reshaped user expectations, and financial institutions are being measured against them, whether they realize it or not.

The disparity between new and existing account holders is also telling. Financial institutions may have the tools and data to streamline onboarding but are reserving those efficiencies for users already in the system. This suggests backend systems may not be fully integrated or flexible enough to support true end-to-end digital onboarding for first-time account holders.

Speed matters. Especially during the earliest moments of the banking relationship. Today’s consumers expect frictionless, nearly instant digital experiences whether they’re ordering food, applying for a job, or opening an account. Unfortunately, most financial institutions haven’t yet cracked the code; 89% of financial institutions are potentially unintentionally turning away new business due to outdated onboarding processes.

The chart also suggests an opportunity: becoming one of the minority financial institutions that does offer a five-minute account setup gives your brand a distinct competitive edge. Banks and credit unions that prioritize digital account opening speed are more likely to convert prospects into loyal account holders, while those that lag risk being left behind by both peers and neobanks.

Applicants don’t have time for friction. They just want to open an account quickly, securely, and without feeling like they’re jumping through hoops. The institutions that get this right are poised to win. Why? Because speed not only drives conversion, it shapes perception. A clunky onboarding experience says, “This will be hard.” A seamless five-minute journey says, “This financial institution gets it and understands my needs.”

Start small. Target one high-volume product, like checking accounts, and reimagine what five minutes could look like. Invest in the technology and data strategy that enables simple application fields, real-time identity checks, and easy funding options. Because in an environment where attention spans are short and competition is fierce, five minutes might be the difference between growth and abandonment.