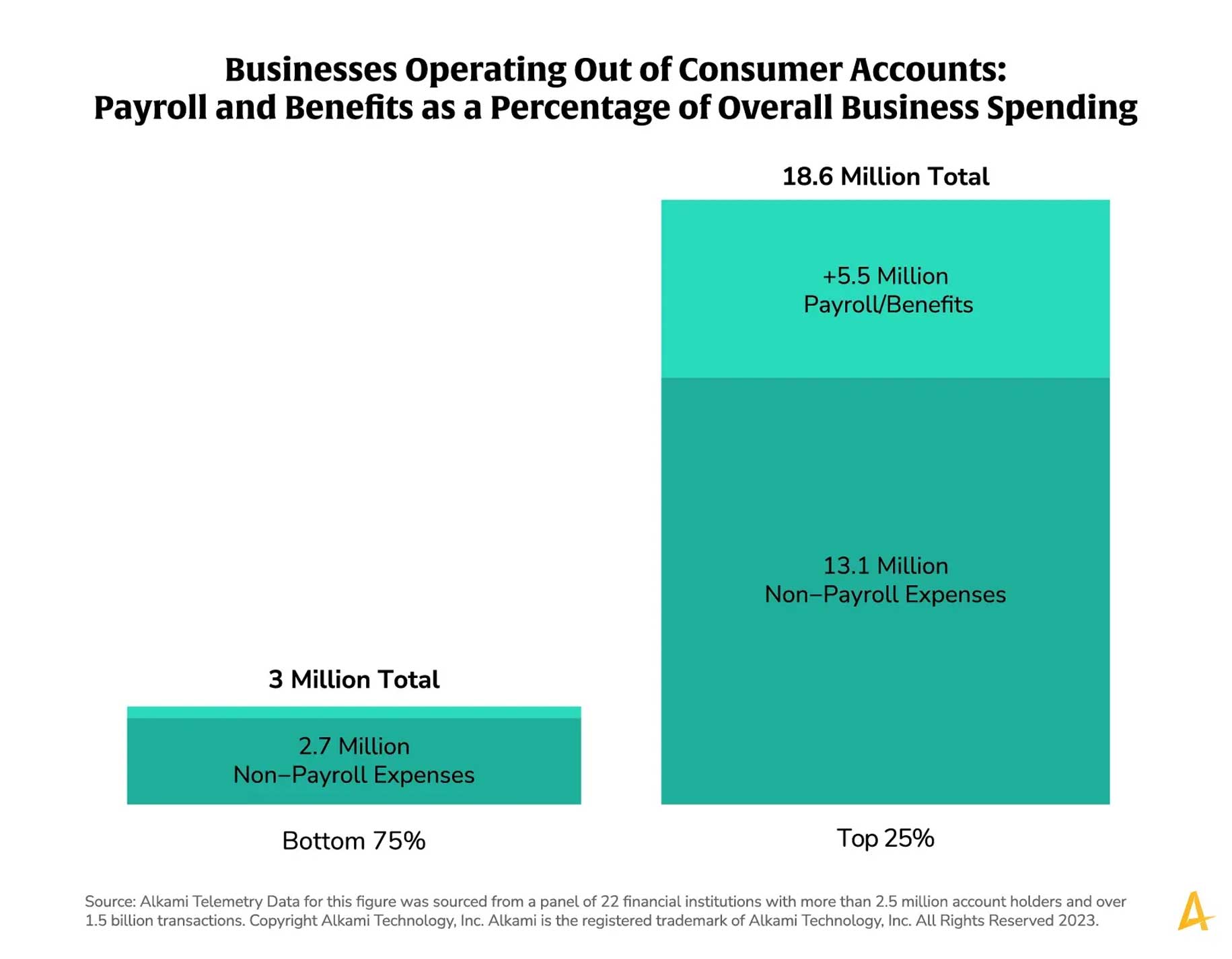

Business activity is not only limited to business accounts. Business specific transactions, such as payroll, wholesale purchases, business information technology expenses, and more are commonly found in retail accounts. Identifying these transactions is a strategic way to uncover businesses that are already at your institution.

It may seem that only a small business would operate out of a personal checking or savings account. However, analysis of the data panel shows that of the businesses operating out of consumer accounts, the median monthly business expenditures was $114K. In other words, half of the businesses in the sample are spending $114K or more each month, equating to $1.36M per year. The top 25 percent of businesses in the sample are spending more than $364K per month or $4.37M per year. The largest businesses found operating out of consumer accounts had more than $15M in business expenditures each month.

Businesses operating out of retail accounts inside your financial institution could have significant monthly business expenditures. These businesses can benefit from the products and services that are built and offered specifically for business banking. Financial institutions should use this as an opportunity to engage with this segment and grow the business portfolio.

Source: Alkami Telemetry Data for this figure was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.