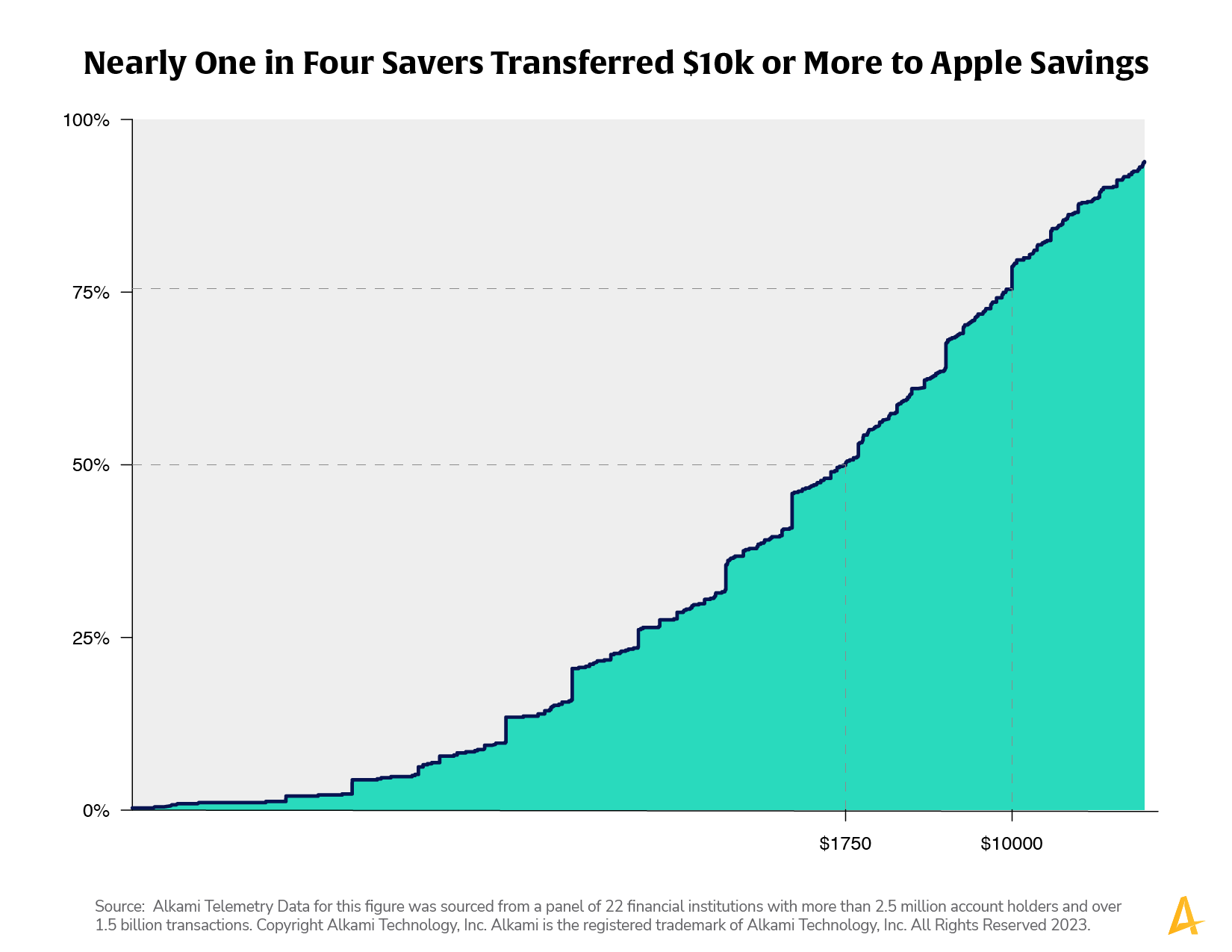

Launched in April of 2023, Apple Card’s high-yield savings account by Goldman Sachs has reportedly surpassed $10 billion in deposits in just a few short months. Apple also says that among Apple Card users, the participation rate is high, with 97 percent of savings account holders choosing to have their Daily Cash reward automatically deposited back into the account. Based on account holder transactions in the panel, of the 2.5 percent of Apple Card users that added funds so far, a median transfer amount of $1,750 was found and close to 1 in 4 transferred $10k or more.

Financial institutions are under pressure to compete with non-traditional players who have made high-interest savings accounts easy to set up for passive saving, such as the savings accounts associated with the rapidly growing Apple Card. Among savers, defined as those who made at least one transfer to Apple Savings from financial institutions in the data panel, transfer amounts are considerable and speak to the appetite for high-yield savings. But there is still time to compete for these dollars by offering easy-to-use savings products that integrate with checking and credit products.

Source:Alkami Telemetry Data for this figure was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.