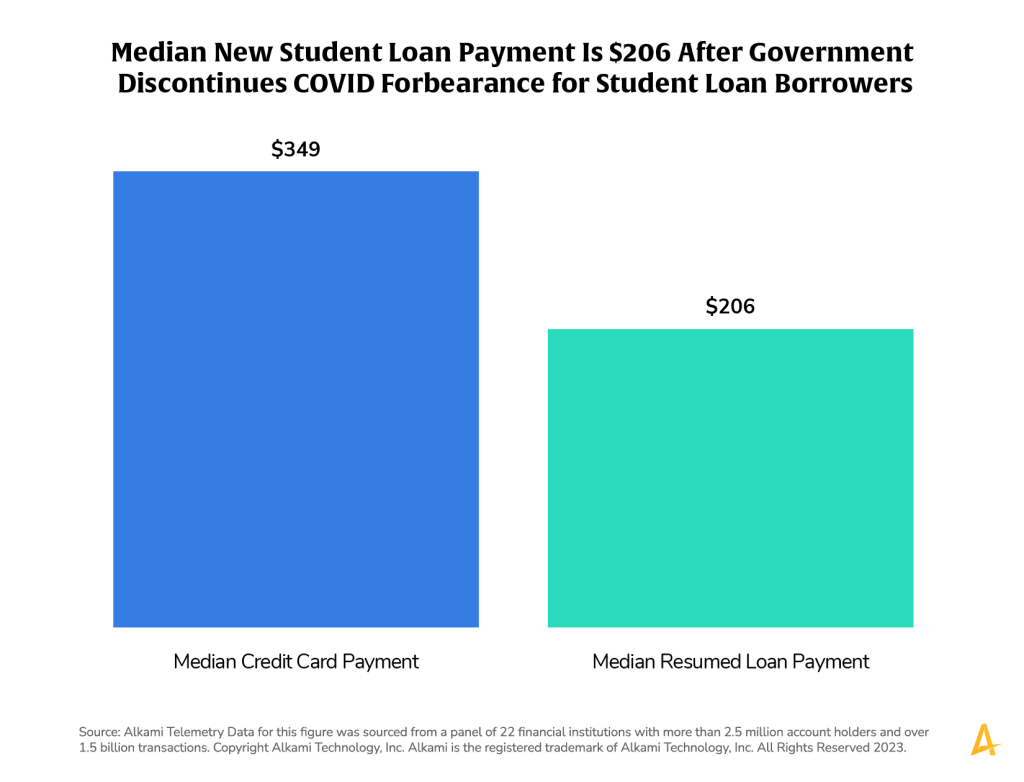

This month’s charts have shown the large increase in the number of student loan payments since federally-backed student loan forbearance ended, along with the magnitude of the new payments. The data panel was analyzed, comparing these new payments to student loan borrowers’ credit card payments in order to contextualize the burden of the new payment.

For student loan borrowers that had payments resume in October 2023, the median amount of that resumed payment was $206. As a benchmark, we compared that to the credit card payments for this same group and found a median payment of $349, suggesting that a $206 increase may represent a significant budgetary increase for these borrowers. Imagine if your credit card bill suddenly grew by 60% and you’ll understand what some of these borrowers are facing.

By analyzing account holder transaction data, a financial institution can compare the size of a resumed student loan payment with the borrower’s other expenses. This can help determine the account holders for whom resumed student loan payments that may be in financial hardship.

Source: Alkami Telemetry Data for this figure was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.