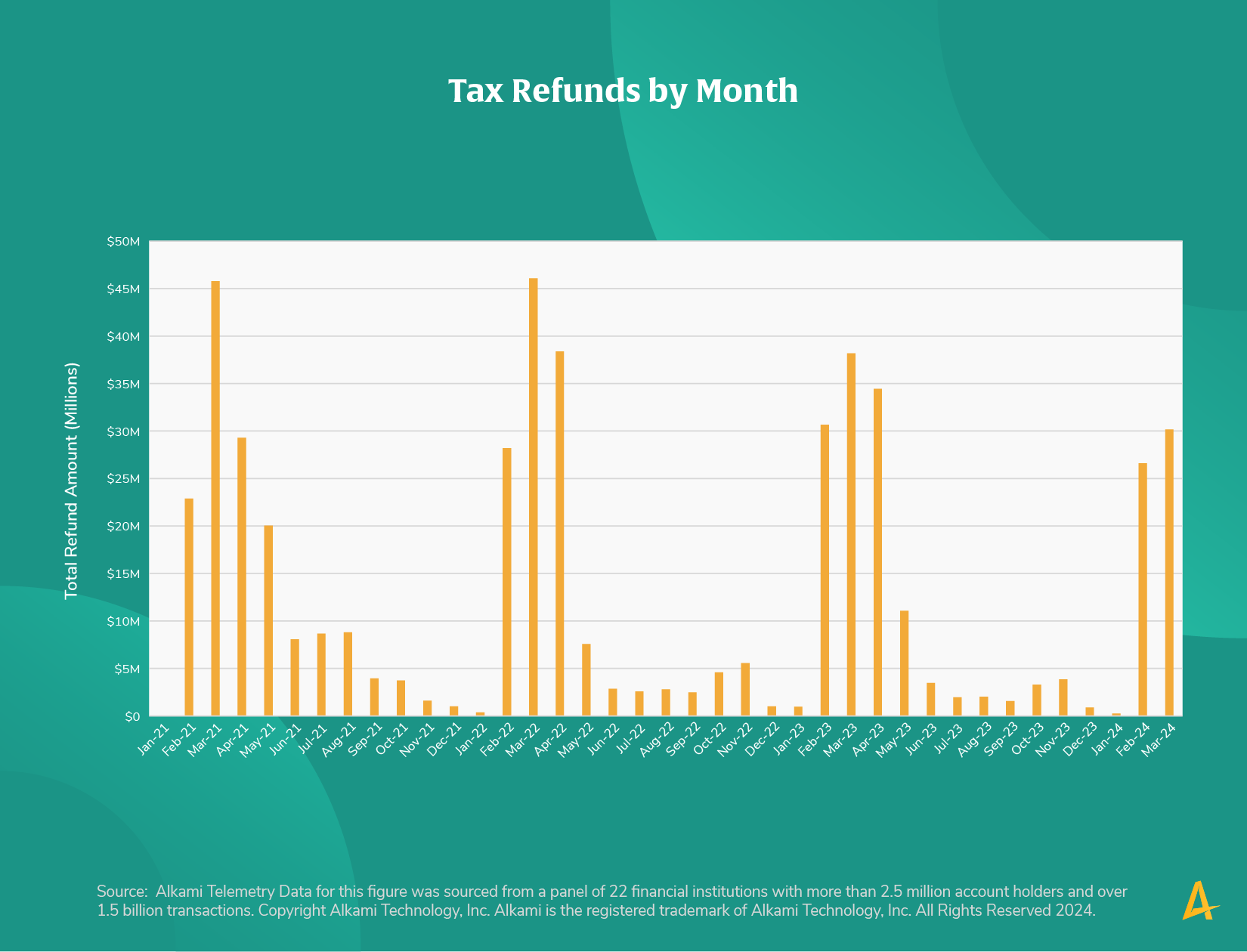

While annual tax filings aren’t due until April 15, those who are getting refunds want their cash. In 2022 and 2023, 52 percent of refund dollars for the year were paid to tax payers in the first quarter of the year. In 2021, only 44 percent of refund dollars were paid out in Q1, but tax day was postponed to May 17 that year in an effort to give relief due to the pandemic.

For financial institutions who want to secure money movement into deposit accounts, communicating to those account holders about products such as certificates of deposit, checking and savings options should start early in the year, with engagement campaigns delivered to a targeted audience. Tracking those who received refunds in the past is a good place to start using transaction data that reveals deposits coming in from the IRS.