***** The following content is for place holder purposes only. This is a private page that only designers and developers can view.

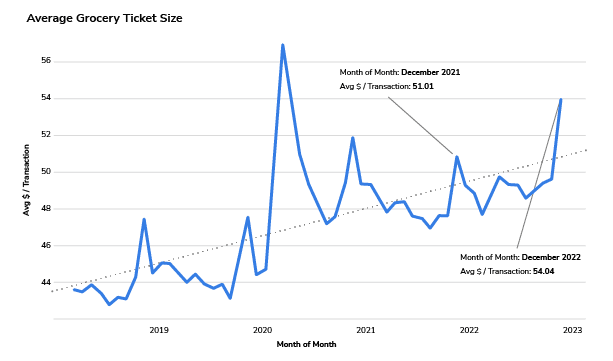

The average size of a grocery bill varies depending on several factors, such as the number of people in the household, the location, the type of grocery store, and the items purchased. According to a report by the USDA in 2020, the average monthly cost of food per person in the U.S. ranges from $184 to $389, depending on age and gender. This includes both grocery store purchases and meals eaten outside of the home.

In terms of the average grocery bill size, a study by Acosta in 2020 found that the average weekly grocery bill for U.S. households was $165. This varies by region, with households in the Northeast spending an average of $179 per week, while those in the Midwest spending an average of $148 per week.

It’s worth noting that these figures are just averages, and grocery bills can vary significantly based on individual circumstances. Factors like income, dietary restrictions, and lifestyle choices can all impact the amount that people spend on groceries.

The cost of groceries can vary depending on where you shop. Discount retailers like Walmart and Aldi tend to offer lower prices than traditional grocery stores like Kroger and Safeway. Online grocery delivery services like Instacart and Amazon Fresh can also have different pricing structures.

The time of year can impact the cost of groceries. For example, fresh produce may be more expensive during the winter months when it’s not in season. Holiday seasons can also affect the cost of groceries due to increased demand for certain items.

Household size is a significant factor when it comes to grocery bills. Larger households tend to spend more on groceries than smaller households, as they require more food to feed all of their members.

Dietary restrictions or preferences can also impact grocery bills. For example, someone who follows a vegan or gluten-free diet may need to purchase specialty items that can be more expensive than their conventional counterparts.

Finally, personal spending habits can influence grocery bills. Someone who is very mindful of their spending may be able to keep their grocery bill lower than someone who is less concerned with cost. Meal planning and couponing can also help to keep grocery bills in check.

Personalized budgeting: With knowledge of the average grocery bill size, banks can help their users create personalized budgets for their grocery expenses based on their income and household size. This can help users stay within their budget and avoid overspending.

Rewards programs: Banks can use data on grocery spending to offer rewards programs that incentivize users to shop at certain grocery stores or purchase certain types of items. This can encourage users to make purchases that align with their budget and financial goals.

Financial education: Banks can use data on grocery spending to educate their users on healthy spending habits and offer resources on how to save money on groceries. This can help users make informed decisions about their spending and improve their overall financial health.

Loan and credit approvals: Banks can use data on grocery spending to assess users’ creditworthiness when considering loan or credit card applications. For example, a user who consistently spends within their budget on groceries may be seen as a responsible borrower and more likely to be approved for a loan or credit card.

Overall, by leveraging data on grocery spending, banks can help their users make better financial decisions, achieve their financial goals, and improve their financial well-being.