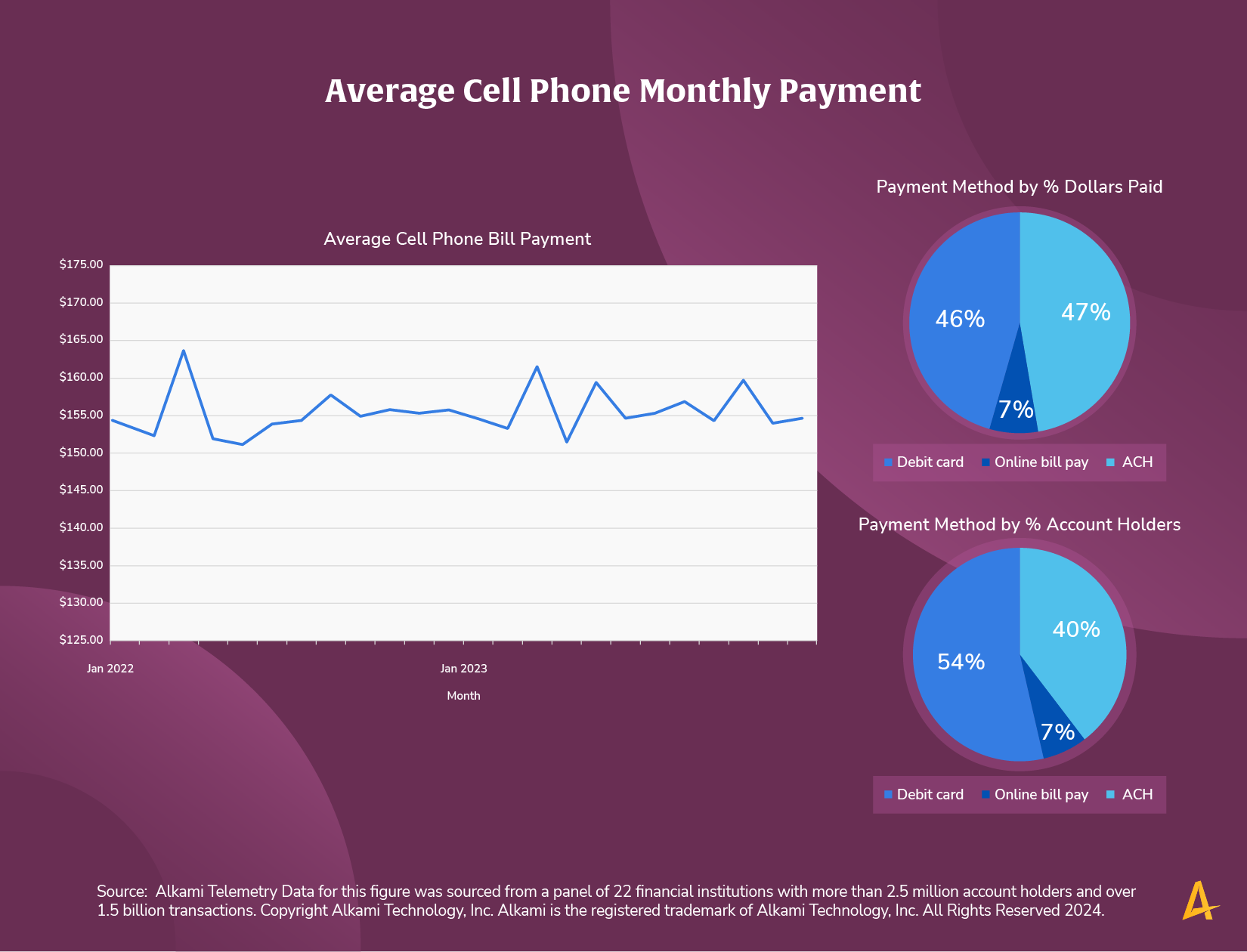

The average cell phone bill was $151.81 per month in 2023. Although inflation has raised the price of most consumer goods, cell phone bills have stayed steady for the last two years analyzed in our telemetry data. In 2022, the average monthly cost was $155.07.

A highly competitive space and substantially the same handsets available across all major carriers limits the ability to increase prices; Consumers are typically on long term contracts, so if inflation hits, it may take longer to make an impact.

Cell phone plans are a staple of every consumer’s budget. Financial institutions should use that to their advantage.

Make sure account holders are using the financial institutions debit card or credit card to pay their cell phone bill to create an interchange revenue annuity. Forty-percent of account holders pay their cell phone via automated clearing house (ACH); 47 percent of the total dollars paid to cell phone bills are paid via ACH. Financial institutions should look at their own internal transaction data to determine interchange revenue opportunity.

Financial institutions can also use transaction analysis to show if account holders are not paying a cell phone bill form their institution, which can be a flag that they don’t have primary financial institution status.

Source: Alkami Telemetry Data for this figure was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.