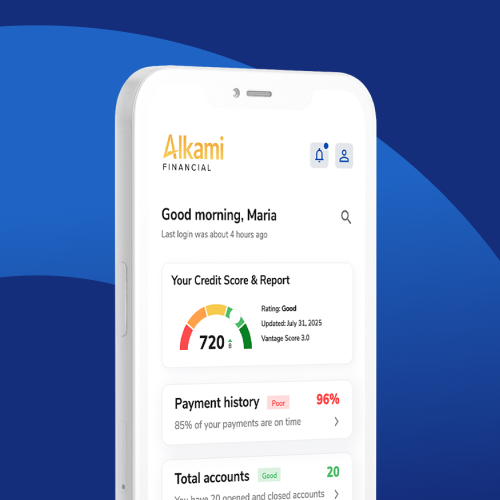

Activate credit score insights

Give consumers peace of mind with credit management solutions, such as credit score monitoring, credit factors, credit utilization, and ongoing education. Let them check scores at log-in, receive real-time score updates, and rest easy knowing their digital identity is being monitored for them.