A Midwest institution launched a CD-focused campaign which targeted consumers with competitive accounts, individuals actively shopping for investment products, and account holders who had recently made significant deposits. By utilizing Alkami digital banking and Data & Marketing Solutions, 1,828 CDs were opened over the 6 month campaign—proving that even in a crowded market, data-driven financial services marketing automation can help financial institutions stand out.

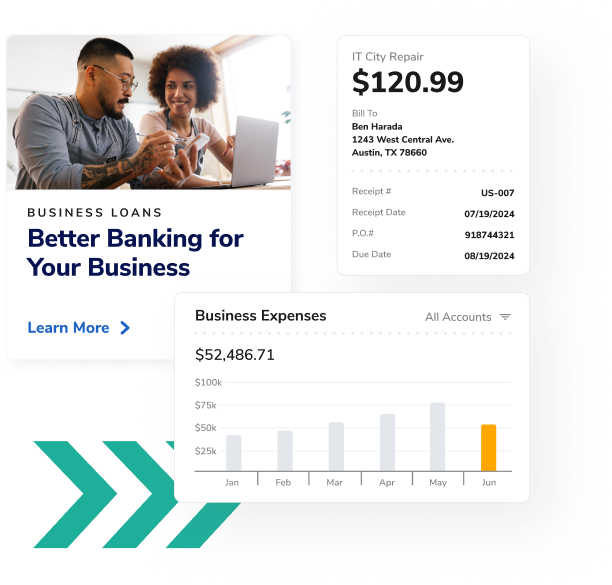

A $1.7B bank on the east coast leveraged their digital banking channel to capture new business loans, targeting business customers who have one business product with the bank. In a 12-month campaign utilizing Alkami Data & Marketing Solutions, they captured $46 million in new business loans.