A clear, actionable breakdown of what a digital sales and service platform is (and isn’t) — and how it helps financial institutions grow smarter and faster.

The Platform Problem (and the Opportunity)

If you work in banking, you’ve probably sat through one too many product demos loaded with terms like “digital-first,” “360-degree view,” or “end-to-end experience.” It all sounds great — until you realize your team is still managing onboarding in one system, digital banking in another, and marketing through a completely separate stack.

That’s the challenge we’re addressing.

The Alkami Digital Sales & Service Platform isn’t just a new label — it reflects a strategic shift we’ve been building toward over the past several years, with focused investment in unifying the digital banking experience. We’re bringing together best-of-breed solutions across digital account opening, digital banking, and data-driven marketing — and evolving them into a tightly integrated platform that supports growth across both consumer and business banking solutions.

This platform also lays the foundation for Anticipatory Banking — Alkami’s vision for helping financial institutions act on data in real time, personalize every interaction, and meet account holders’ needs before they’re even expressed. While our components work exceptionally well on their own today, their future lies in a connected ecosystem that turns insight into action across the full account holder lifecycle.

Because in today’s market, growth doesn’t come from managing disconnected tools like onboarding forms, standalone digital banking apps, or siloed marketing systems — it comes from anticipating needs, removing friction across channels, and delivering meaningful value at every stage of the account holder journey.

What Is a Digital Sales and Service Platform?

A digital sales and service platform is the foundation for Anticipatory Banking — combining best-of-breed solutions into a best-of-suite platform that integrates account opening, digital banking, and data-driven marketing — helping financial institutions onboard, engage, and grow relationships more intelligently and efficiently. At its core, a digital sales and service platform connects three essential capabilities in a single, unified experience:

- Onboarding & Account Opening — MANTL powers fast, secure, omnichannel onboarding for retail and business accounts — automating workflows across front-, middle-, and back-office operations.

- Digital Banking — Alkami’s award-winning solution delivers intuitive, personalized day-to-day banking, with real-time alerts, insights, and tools for consumers, businesses, and financial institution administrators alike.

- Data & Marketing Solutions — Segmentation, targeting, and automation turn passive data into proactive growth strategies.

When these components work together, financial institutions create a continuous, intelligent journey — one that not only meets account holders where they are but anticipates where they’re going. It enables institutions to act in the moment, personalize each interaction, and proactively guide users toward deeper engagement, stronger relationships, and long-term growth.

What It’s Not

A digital sales and service platform is not:

- A dashboard for data that never turns insights into action

- A stitched-together stack of vendors with disconnected logins and workflows

- Just another user experience layer with no business impact

- A short-term fix that creates long-term complexity (you know the kind)

It’s a purpose-built platform that unifies sales and service into a single, intelligent system — one designed to evolve with your institution. It closes the loop between onboarding, engagement, and growth, enabling the kind of real-time responsiveness traditional banking systems were never built to deliver.

Why Banks and Credit Unions Need a Digital Sales and Service Platform — Now

Banking is at a crossroads. Financial institutions that fail to modernize their digital strategy risk losing relevance, deposits, and market share. Here’s why now is the time to act:

- Fintechs are winning early relationships. In 2024, 44% of new checking accounts were opened with neobanks, while community banks and credit unions claimed just 9%.

- Account holders expect personalization. 71% of consumers expect companies to deliver tailored experiences, and 76% feel frustrated when that doesn’t happen.

- Branch usage still matters. 52% of account holders visited a branch 1–4 times last year. Even Generation Z averaged 3.6 visits. The goal isn’t to eliminate branches — it’s to connect them to your digital journey.

- Tech spend must demonstrate an impressive return on investment (ROI). Institutions are being asked to prove that every tool drives acquisition, improves efficiency, or deepens engagement. No exceptions.

1+1=3: Real Use Cases That Show the Power of the Digital Sales & Service Platform

This is where a digital sales and service platform really shines — by turning connected systems into coordinated action. When onboarding, digital banking, and data-powered marketing work together, 1+1=3 — the combined effect creates more value than any one capability alone.

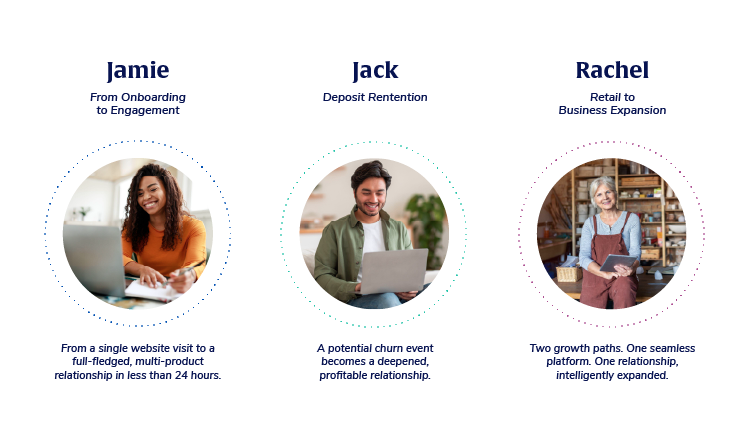

It’s the operational foundation for Anticipatory Banking, enabling financial institutions to act in real time, personalize experiences based on intent, and proactively guide users toward deeper engagement. To make this real, let’s meet our account holders.

Use Case 1: From Onboarding to Engagement

Jamie visits the financial institution’s website. The experience is tailored by insights from Alkami’s Data Insights, which detect her intent and customize messaging in real time. She starts a checking account application but gets interrupted by — of course — life (kids come home).

That evening, a targeted remarketing ad on social media reminds her to complete the process.

Jamie returns — this time in-branch — and the banker seamlessly resumes her application through MANTL. Real-time risk scoring confirms she’s low-risk, and she’s offered instant access to her new account in digital banking, along with a personalized offer to switch her direct deposit and apply for a pre-approved credit card.

She registers for Alkami online and mobile banking, gets her debit card, and makes a purchase that same afternoon.

Jamie’s journey begins with digital account opening — a critical first impression. Learn why omnichannel onboarding is foundational to your platform strategy.

Use Case 2: Deposit Retention and Product Adoption

Jack initiates a small transfer to a new fintech account — a trial deposit. Alkami’s Predictive AI picks up on the pattern and flags him as an attrition risk.

Before Jack can go any further, a retention campaign launches across in-app messaging, email, and remarketing channels. When he logs in again, he sees a personalized CD offer with a competitive rate.

The call-to-action (CTA) leads to a pre-filled MANTL application, and Jack completes the process and funds the CD in minutes.

The campaign automatically ends, and Jack is placed into a new onboarding journey to engage him with helpful content, tools, and cross-sell offers.

This kind of intelligent targeting is only possible when marketing systems are driven by real-time analytics — more on how that works.

Use Case 3: Retail to Business Expansion

Rachel uses her personal account for growing side-gig transactions. Alkami’s Data & Marketing Solutions detect the behavior and automatically present a personalized offer for a small business account.

Rachel clicks through, and thanks to a pre-filled MANTL application, she completes the application in record time.

Meanwhile, James, an existing business client, begins exhibiting personal banking behavior. He receives a personalized offer for a high-interest savings account.

Through MANTL, he opens a personal account and can now manage both in one place via Alkami’s digital banking platform.

Designed for Growth, Not Just Convenience

Alkami’s Digital Sales & Service Platform does more than streamline experiences — it creates measurable momentum across your institution.

Faster Acquisition

Speed matters. Whether it’s a consumer opening a checking account or a business applying for a new product, Alkami’s platform removes the friction from onboarding — with omnichannel access, pre-filled applications, and intelligent follow-ups. It’s not just faster for the user; it’s faster for your team to hit their growth goals.

Intelligent Engagement

Once an account is open, the real work begins. Alkami’s Data & Marketing Solutions make it easy to identify user behavior, segment your audience, and trigger personalized experiences that deepen relationships. From proactive alerts and next best actions to tailored offers, engagement becomes meaningful — not manual.

Higher Retention

The platform identifies and addresses risk before it becomes a retention issue. With early-warning insights, contextual messaging, and timely product recommendations, institutions can step in at the right moment — and keep high-value account holders from walking away.

Platform-Level Return-On-Investment

This isn’t about buying another tool. It’s about investing in a coordinated growth engine. With unified data flowing across onboarding, digital banking, and marketing, every component works smarter — proving value at the platform-level, not just the feature-level.

Best of all, Alkami’s approach is modular and scalable. Start where your need is greatest — acquisition, engagement, or smarter outreach to account holders — and expand over time.

TL;DR: The Platform You Didn’t Know You Needed

Let’s cut to the chase. A Digital Sales and Service Platform is:

Unified, not cobbled together

Gone are the days of swivel-chairing between disconnected systems. One platform, one data source, one connected journey — for your users and your teams.

Proactive, not reactive

Anticipate account holder needs with real-time insights and intelligent automation. The platform acts on patterns and behaviors so your team can focus on strategy — not firefighting.

Built to connect sales and service

Instead of treating acquisition, service, and engagement as separate workflows, this platform merges them into a single, adaptive experience that continuously drives value.

Alkami’s Digital Sales & Service Platform is how forward-thinking financial institutions win — by removing barriers, accelerating growth, and delivering exceptional experiences from the very first touchpoint.

If your bank or credit union wants to compete on more than convenience, this is the foundation you need.