Call center representatives in financial institutions play a crucial role in supporting account holders when they experience issues or friction within digital banking solutions. Prompt and effective customer service, powered by data analytics in banking is essential for building trust and loyalty among end users, ensuring long-term relationships and strengthening primary financial institution (PFI) status.

Think of a time when you needed assistance with a product or service that required you to contact their customer service or support team. Perhaps you had trouble logging into an online account, or maybe you needed help completing a transfer or purchase. In situations like this, when we’re asked too many questions or put on “hold” for minutes at a time, it can create a very frustrating experience for the end user. Likewise, if you have ever worked in a customer service, contact center or support role, you can imagine how hectic it can be trying to assist users under conditions of high stress and scattered resources.

Most of the time, call center representatives are not set up for success, with 80% of contact center agents typically having to access multiple systems when supporting users. Additionally, a study from Forrester reported 84% of contact center leaders report their agents have between 4-10 different applications open during a typical support interaction.

When online banking data is stored in disparate systems and reports, this forces representatives to log in, and navigate to multiple platforms, manually piece together information, and cross-check details across various reports – leading to inefficiencies and increased handling times. Context-switching can also result in incomplete or inaccurate information being provided due to varying data sources, which can result in a poor quality user experience and erode trust.

Consolidated operational data within digital banking solutions is crucial for empowering call center staff to deliver effective support. When call center representatives have access to comprehensive data in one central location, they can quickly retrieve essential information about a user’s account, transaction history, and previous interactions. This immediate access to relevant data reduces the time spent searching through disparate systems, allowing representatives to address user inquiries efficiently and accurately. As a result, the streamlined process not only enhances the user experience but also boosts the confidence and competence of the call center staff.

With consolidated data, call center staff can provide personalized and contextually relevant assistance to each user. Understanding a user’s past behavior, activity and preferences enables representatives to anticipate needs, make helpful suggestions, and resolve issues proactively. This added context eliminates the need for representatives to ask users unnecessary questions, or ask them to repeat themselves.

This elevated level of service builds stronger banking relationships, as end users feel valued and understood. Additionally, the ability to access comprehensive data allows for more accurate troubleshooting and problem-solving, reducing the need for follow-up calls and increasing first-call resolution rates. Ultimately, this contributes to a higher level of satisfaction and loyalty.

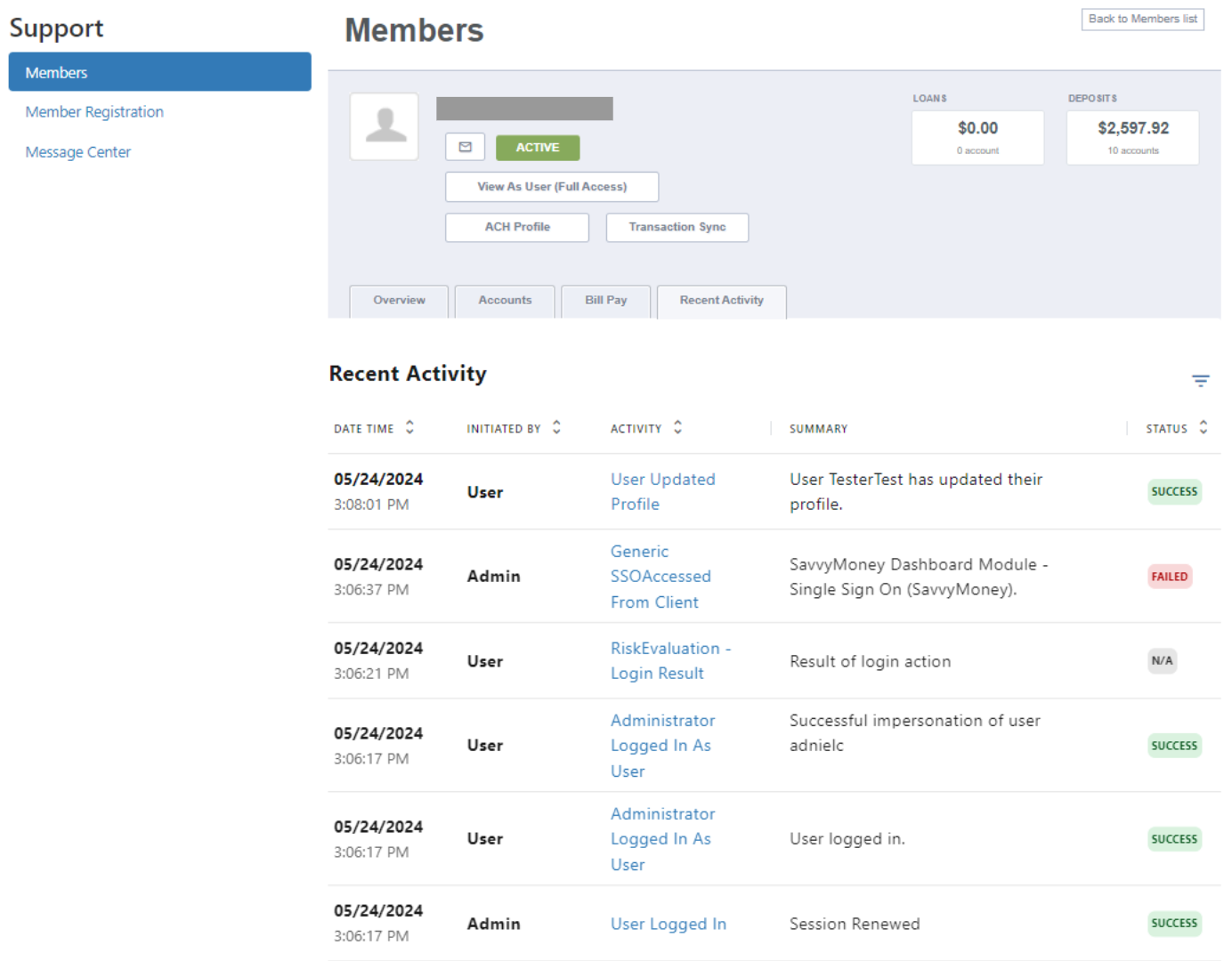

At Alkami, we are solving the very real challenges of data silos and context switching with the introduction of our new User Recent Activity Widget with our Operational Data and Insights product, which was launched in our 2024.4 release.

This widget, accessible in the Admin Portal, provides financial institutions with a chronological and consolidated stream of digital banking activity, by user in near real-time. Financial institutions can view up to 90 days worth of a given user’s activity, and filter this data by time, activity and status. Having this relevant info at your fingertips allows your contact center staff to provide faster, higher quality call center interactions in one central location.

According to financial institutions that participated in our client feedback sessions for the user recent activity widget, individuals were pleased at the ability to see the following data captured within the widget:

This substantial time savings is a testament to how powerful this widget can be in simplifying and streamlining the daily operations of financial institution staff, and allowing them to reclaim valuable time that can be better utilized elsewhere.

When properly equipped with the right tools and information, call center, customer service and support representatives from your financial institution can readily assist their end users, providing relevant advice, and timely assistance. If you are an existing Alkami client, you can start using the user recent activity widget located within the Admin Portal.

Want to learn more? Schedule a demo with an Alkami representative to learn more about our operational data and insights and how you can enhance your operational efficiency and user experience.