We’ve heard from marketing experts that “financial institutions own a tremendous amount of account holder information but are historically terrible at leveraging that data to sell more products and services.” The ability to understand and use data is key to marketing for financial institutions. When data is used effectively, it can significantly improve account holder relationships. To manage and make sense of all this data, institutions of all sizes have invested heavily in data lakes, warehouses, and marketing customer information files (MCIFs).

Organizing data is not just important—it’s essential. To be successful, every financial institution needs to get a handle on their data. However, this task is often harder and more time consuming than expected. Data is usually siloed, making it tough to put together and understand.

The natural next step for most financial institutions is to use their organized data within their MCIF to deliver “targeted” messaging to their account holders. This strategy is a cornerstone of effective marketing for financial institutions and can include direct mail, emails, or outbound calls. Using data to reach your audience with relevant, personalized messaging is vital to the success of financial services marketing. Yet, many institutions find that the returns on these efforts fall short of expectations—if they can even track the results at all.

So, where is the disconnect? The issue often lies in the gap between having data and deriving actionable insights from that data. Data must be standardized, cleansed, and categorized to ensure it is accurate, consistent, and ready for meaningful analysis. Simply having data aggregated in a data lake or warehouse is a great starting point, but it’s only the beginning. If your teams can’t find specific, helpful information from this data, it won’t be very useful. Many believe that knowing an account holder has a checking account but not a mortgage is insight, however, we view this as merely the baseline. Real data insights go much deeper.

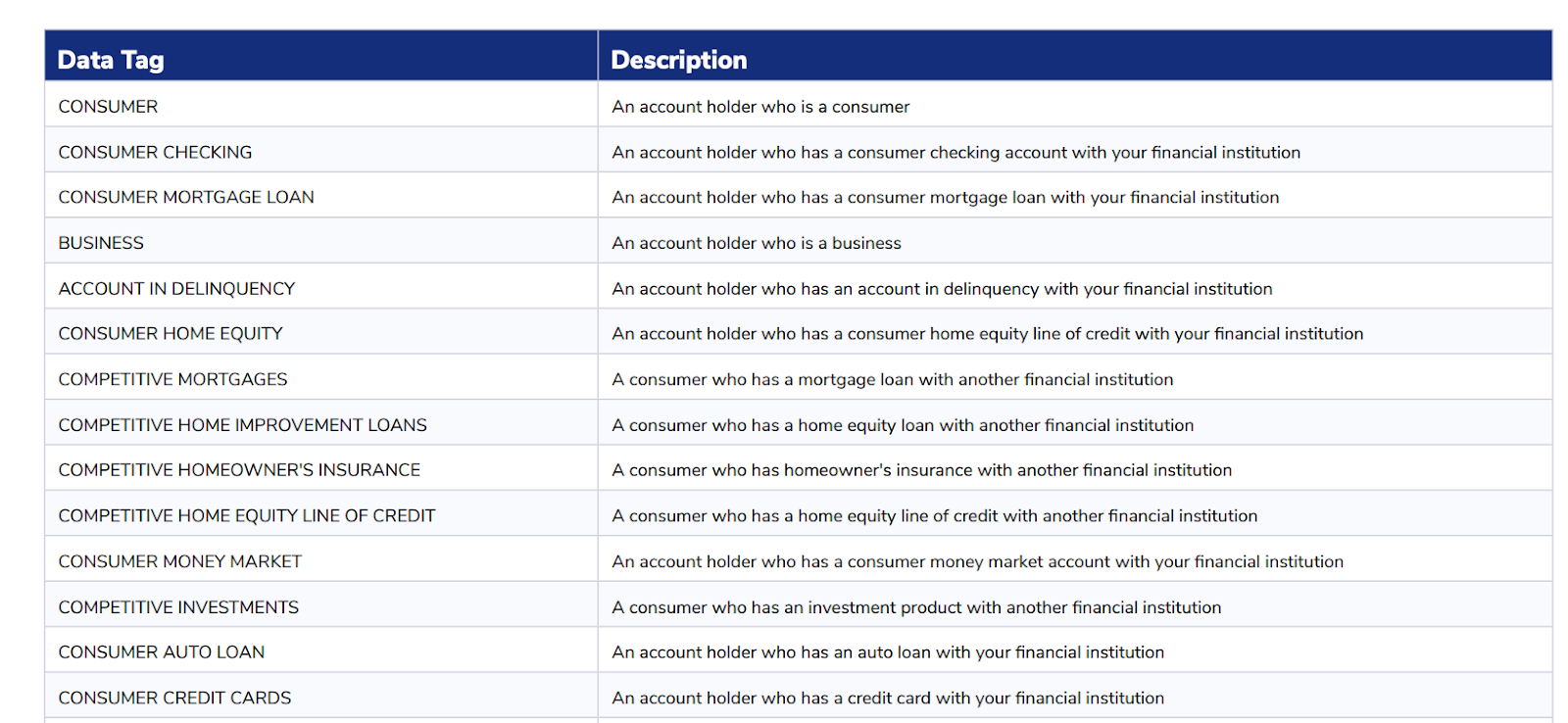

Alkami offers over 50,000 data tags to help you create hyper-personalized, targeted account holder experiences. You can see some of the most popular data tags below and check out the full list of the top 100 most popular data tags.

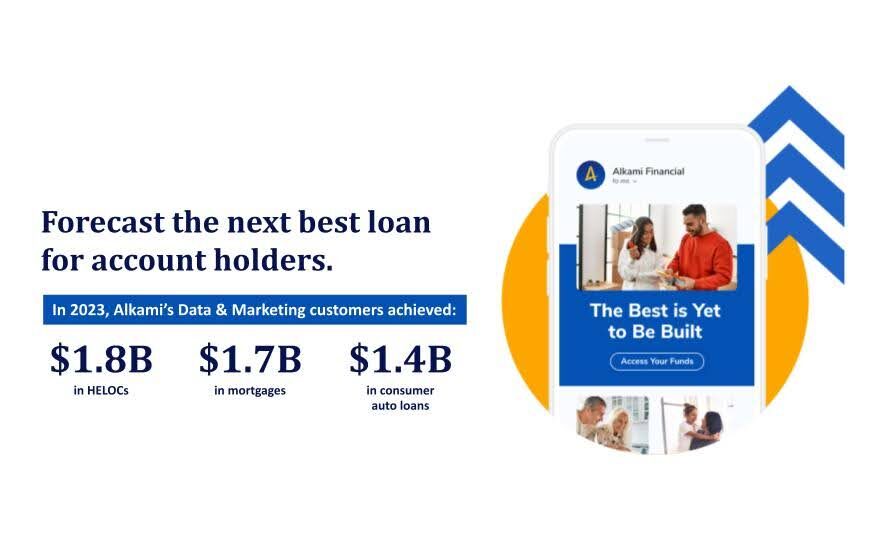

The data that every financial institution sits on can be used much more effectively. To unlock this potential, banks and credit unions need to dive into their transaction data and truly understand what their account holders are doing—and what’s likely to come next in their lives.

There’s a big difference between data and insights, and both are necessary. Data helps you understand the basics like what products account holders have, their balances, and transaction history. However, insights—derived from predictive analytics and contextualization—take this understanding to the next level. Insights enable you to grasp behaviors, preferences, habits, risks, significant life events, and much more. You can go even further with predictive artificial intelligence. This deeper level of understanding is what sets industry leaders apart from the rest, making it a key differentiator in financial services marketing.

For example, a data warehouse might tell you that an account holder is in the market for a mortgage. But if you look at their transaction data, you could learn that this person is a long-term renter who’s planning a wedding and recently adopted a puppy. With this level of detail, you can send messages that are not only timely and relevant but also personal and in context. Instead of just offering a generic mortgage product, you could reach out with tips on buying a first home or even pet insurance as they prepare for marriage and possibly homeownership.

Accessing data is just the beginning. Trying to activate that data without useful insights is like trying to navigate a maze blindfolded—it’s possible, but it’s hard. This lack of clear information might be what’s stopping you from better engaging with your account holders.

To solve this problem, it’s important to look closely at the activities, patterns, and lifestyles of your account holders. Data can provide insights that, in the past, you might have only gotten through face-to-face interactions. By using this information, you can engage your account holders with personalized, relevant experiences that not only meet their needs but go beyond what they expect.

While organizing and managing data is a critical first step, it’s the ability to derive actionable insights that truly drives success. By moving beyond basic data points and embracing the power of prediction and contextualization, financial institutions can forge deeper, more meaningful relationships with their account holders. This approach doesn’t just enhance engagement—it gives you a competitive edge.