What happens when the industry you operate in is in transition and you no longer know exactly who you’re competing against? What happens when change is occurring so rapidly that new market entrants are encroaching on your territory faster than you can react? Worst of all…what happens if you can’t see it coming? If you’re in the banking industry, you’re likely aware that these forces are taking shape all around you. The real question is what are you doing about it?

Neobanks, “big tech,” and fintechs such as Square, Chime and Paypal are helping erode the banking industry. With each new entrant or product, bank brands are being disintermediated from the consumer. Here are just a few examples of the shifting dynamics in the banking industry that have the potential to leave banks and credit unions behind:

According to Segmint’s internal data, comparing year-over-year payment volumes from April 2020 to April 2021, Venmo grew 69%, the Cash App by Square grew 80%, and Apple Cash grew by 42%. At the same time, Zelle, a bank P2P app, grew just 5%; all transactions that could have instead originated from within a financial institution.

The financial institutions that are having the most success competing…and winning…in the battle for wallet share are those that are creating timely and relevant experiences for customers and members. There’s been a greater emphasis placed on personalization over the last few years, but personalization alone is not enough. Just knowing the name of your customer and the products they have at your institution leaves you vulnerable to competitors with better technology that can harness data to create best-in-class and timely experiences. Relevance takes personalization to a whole new level by providing the insights around customer behaviors, mined from actual transactions, and recommendations based on the needs of the consumer at a particular moment in time. It’s time for banks and credit unions to take back banking.

Transaction data is one of the most valuable sources of information that an FI possesses, and used properly, it can drive most strategic business decisions throughout the institution. This rich transaction data can be mined into a lightweight and nimble data set that can guide the institution to a deeper level of understanding behavior and spend patterns. Deep within this data is where the seeds of relevancy live.

Leveraging this first-party transaction data significantly improves the ability to then deliver relationship-building customer experiences, while at the same time, nurturing loyalty through an emotional connection with the FI’s brand. According to the Financial Brand, 86% of U.S. banking consumers say they would be more comfortable with their financial institution having access to their personal data than a big tech company, such as Amazon, Apple or Google.3 These relevant interactions with account holders open the door for FI’s to focus on limiting churn, making strategic decisions around product innovation, gaining intelligence on the competition and knowing where money is leaving your institution. Knowing where money is leaving your institution puts you at an incredible advantage. An FI can use this knowledge to educate internally to develop strategies to steal share of wallet which in turn feeds opportunities for product engagement, financial wellness and account holder satisfaction. Staying relevant means staying top of mind.

Creating relevant experiences requires a deep understanding of an account holder’s data, models that identify propensity to adopt a particular product or service, and the ability to deliver the right message to the prospect in the channel they prefer to interact (online, mobile, email, SMS, etc.).

Here’s an example:

Derek moved into a new house just a year ago, just after getting married. He has a checking account with his credit union, but his mortgage, auto loan, and credit cards are all “held away” with other financial institutions. By analyzing Derek’s specific “home improvement” transactions across a number of merchants, his credit union is able to see that a Home Equity Line of Credit would be very helpful. Rather than running up large credit card balances with another bank’s credit card, Derek could benefit from a low interest HELOC. And guess what, his credit union just benefitted from understanding his needs and being there at the right time! Wins all around.

Finding all the consumers like Derek, before the competition does, is easy once you know where and how to look for them. Easy to use tools that put all of your account holder data in your hands are available, providing you with the ability to match prospects to your strategies and also pivot based on what’s happening today. Predictive models, which are more advanced and more accurate than basic “look alike” models, can then be used to identify exactly the right target, so that they can receive a message that is timely and relevant to their individual situation, in exactly the right channel based on their usage behaviors.

Using the example above, there’s little reason to target Derek for a mortgage, he’s just opened one in the last year. If Derek’s financial institution knows he only uses mobile channels, targeting him with a direct mail offer to come into a branch isn’t likely to be successful. Finally, if the message isn’t delivered at the right time, Derek could wind up opening that HELOC somewhere else. Marrying the consumers you just found with “always on” marketing campaigns ensures that you are able to deliver the right message, to the right individual, at precisely the right time and place for them to engage. You can effectively compete with…and win…against the competition. Data is your secret weapon.

[custom_quote quote=”The insights Segmint provides daily from our customer data gives us the ability to have a holistic view of their behavior patterns and uncover new competition in real-time.” source=’– Marco Bernasconi, President – North Brookfield Savings Bank’]

Segmint’s suite of tools provides a quick and easy way to identify the right audiences for your messages, and then deliver the information they need to act.

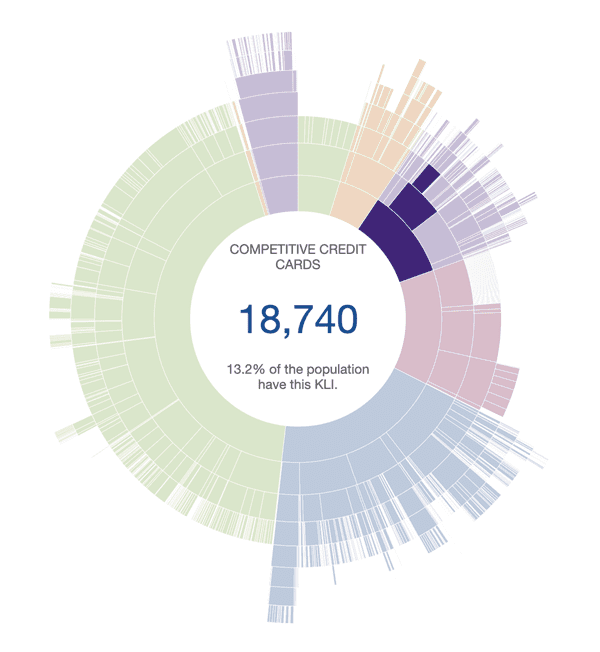

But how do you know where to look in the first place? That’s where the Competitive Insight Report (CIR) comes into play. The CIR is a dashboard that shows payments going to your competitors, with a breakdown by categories including credit card, mortgage, auto loan, investment, student loans, etc. Knowing which competitors your account holders are banking with, and what products they have with each competitor, can help you discover who your true competitors are, how much money is leaving your bank, and where you are falling short. The CIR will help you compete with more intensity by evolving your product offerings, marketing, sales approach and holistic strategy based on your account holder’s first-party data.

Erosion of the banking system is happening so quickly, with brands being disintermediated from their account holders and FIs losing share of wallet. Competitors continue to surface without a moment’s notice, and there’s no sign of that changing anytime soon. In fact, we’re likely to see more competition in the near future, rather than less. One way to combat these new entrants and maintain relationships and wallet share is to leverage your customers’ data to your advantage, while benefiting them with timely and relevant offers. Data being foundational within a financial institution is the game-changing component banks and credit unions need to take back banking.

https://www.emarketer.com/content/chime-no-1-neobank-us?ecid=NL1001

https://www.emarketer.com/content/breaking-down-mobile-p2p-payments-biggest-players

https://thefinancialbrand.com/110584/loyalty-user-experience-digital-design-personalize-big-tech/