Going into the new year, financial institutions (FIs) should be asking themselves a couple of important questions—how do we want our customers or members to perceive us? How can we retain those relationships for years to come through innovation?

In 2022, Forrester Researcher projects that FIs will prioritize investments in their people and technology. In an effort to boost their digital presence, FIs need to turn inward and identify areas of opportunity. This enables them to create a strategy for achievement with measurable benchmarks for each quarter.

As FIs plan for the next stage of their digital growth, we’ve uncovered three banking trends that will enable them to scale their operations and achieve their goals in 2022.

Artificial intelligence (AI) is no longer a concept on the horizon. It’s already a part of our everyday lives. According to The Financial Brand, “81% of bank and credit union executives believe that unlocking value from AI will be the key differentiator between winning and losing institutions.” Furthermore, 75% of executives said that without implementing innovative AI technology, FIs may not be able to survive in the new digital-focused landscape.

The key to success is using AI to drive efficiency for task-related activities. With branch closures and restricted banking activities due to the pandemic, areas like customer service have experienced a transformation in automation. By using AI and the right actionable data to dissolve points of friction, FIs can help customers or members get the service they need before they look elsewhere for a solution. Additionally, boosting departmental efficiencies allows FIs to narrow in on other areas of their business in need of resources.

Can your FI afford a data breach? In 2020, IBM reported that the cost of a data breach in the financial services industry was a whopping $5.85 million —and, “almost half of consumers say they would leave their financial institution in the event of a data breach.”

With fraudulent attempts increasing at an alarming rate, FIs need to implement prevention measures to protect their users and reputation. They must invest in building trust with customers or members through education and advanced security tools. Another great option is to introduce multi-factor authentication for an extra layer of protection when logging into digital banking.

The best way for FIs to protect their customers and members is to bring their operations to a secure, cloud-based platform. Gone are the days of server rooms and paper files — in a digital world, FIs need a partner committed to the security and future-proofing of their solution.

While FIs are sitting on a pile of gold, they may not have the right tools to use it to their advantage. Going into 2022, FIs should put their users’ data to work and, “deliver hyper-relevant content, products and customized pricing based on customer and member behaviors, lifestyle, personality and preferences,” (The Financial Brand, 2021).

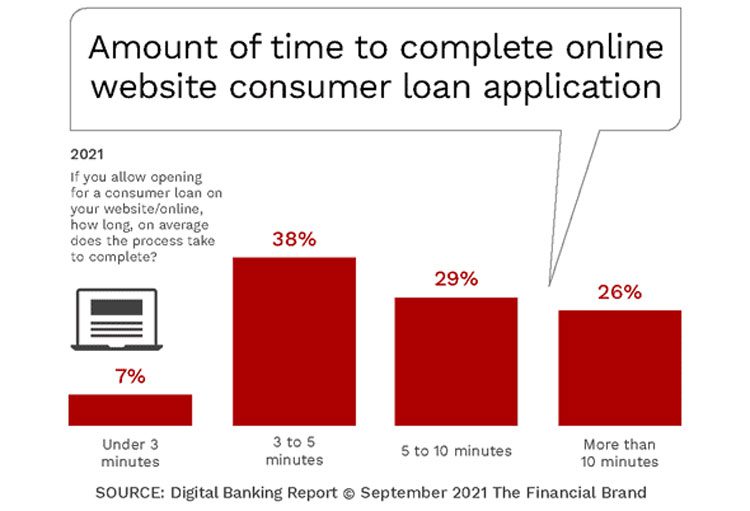

By leveraging data, FIs can tailor their offerings as well as improve the user experience (UX). Consumers have developed an expectation for fast, intuitive applications. When applying for a new deposit or credit card product, for example, users want instant access. Each step in the onboarding process that causes friction for a customer or member significantly increases the opportunity for application drop-off.

Source: (The Financial Brand, 2021)

To exceed consumers’ expectations for seamless experiences, FIs need to:

2022 presents an opportunity for FIs to reinvent themselves. Throughout the year, FIs should regularly evaluate how they are performing in alignment with their goals. By listening to user needs and partnering with the right fintech, banks and credit unions can exceed their growth projections, improve their UX, strengthen relationships with customers or members, and expand market share.