Artificial intelligence (AI) has evolved from a futuristic concept to an integral part of the financial services industry. Today, artificial intelligence in banking is a methodology that spans a wide range of use cases in operations from robotic process automation and predictive analytics to intelligent chatbots. These technologies streamline efficiencies and enhance engagement, transforming how financial institutions operate and interact with account holders. Despite the widespread integration of AI, the conversation often centers on the latest technological advancements and the pathway to integration, overshadowing the profound impact AI is having on digital banking solutions.

Recent research conducted by Alkami that surveyed 150 regional and community financial institutions (RCFIs) and 1,500 digital banking consumers in a separate study, aimed to assess the current and planned use cases of artificial intelligence in banking, the opportunities and challenges it presents, and the outlook from both industry professionals and consumers.

The findings revealed a significant disparity between the perceptions of RCFIs and consumers regarding AI’s potential and adoption. While financial institutions are optimistic about AI’s transformative power, consumers remain skeptical, particularly concerning data security and privacy. This gap underscores a broader conversation within digital banking about the need to manage expectations and build trust alongside technological advancements.

RCFIs are generally bullish on AI’s future in banking, with 96% predicting a critical role for AI in the next five years. In contrast, only 61% of consumers believe AI will significantly influence their banking interactions. This optimism among financial institutions is driven by the anticipated benefits of AI, such as enhanced efficiency, cost reduction, and improved customer service – areas of operational support.

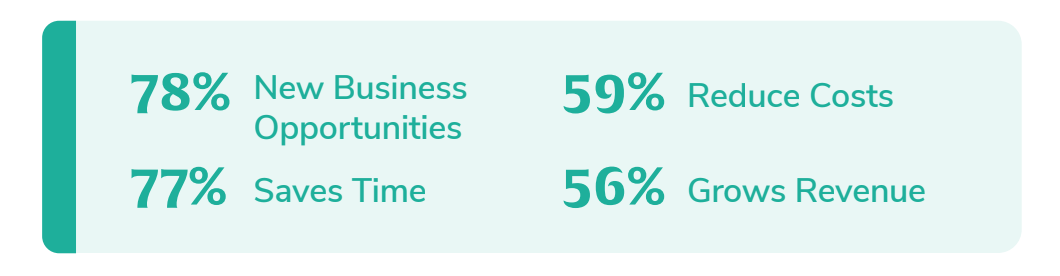

While 78% of these institutions view AI as a catalyst for uncovering new business opportunities,this enthusiasm is tempered by concerns about consumer trust. While 73% of financial institutions believe AI can significantly enhance digital account holder experiences, 54% express concerns about the potential negative impact on trust. This concern is valid, as only 45% of consumers feel comfortable with AI processing their financial data, even if it improves their digital banking experience.

Chart: RCFIs see the potential benefits of AI in the banking sector, highlighting opportunities, time-saving, cost reduction, and revenue growth.

RCFIs are showing a positive position and outlook about AI, but they acknowledge that there are hurdles when it comes to integration, and knowledge around the basics of AI must be acquired to capitalize on AI’s benefits. Only 18% of institutions believe they are effectively leveraging AI. Interestingly, larger institutions do not necessarily have a more advanced understanding of AI; 69% of those with assets over $5 billion are still in the early stages of AI knowledge, compared to 64% of those with less than $1 billion in assets.

This widespread knowledge gap highlights the challenges that financial institutions face in AI adoption, regardless of their size. The top strategic priorities for AI adoption among RCFIs include automating manual processes (57%), enhancing fraud protection measures (44%), and improving account holder experiences (41%).

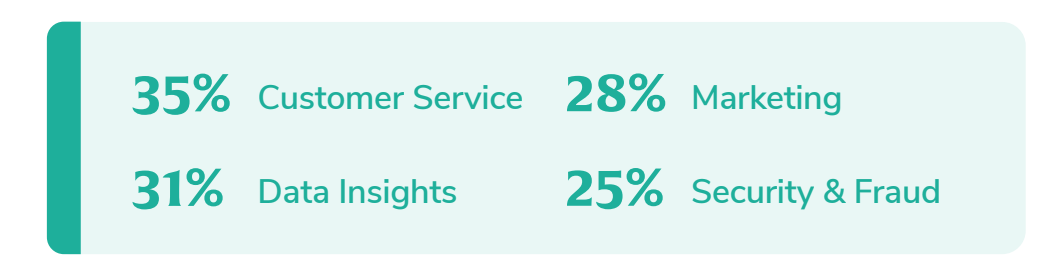

While the strategic priorities are foresight, customer service, data analysis, marketing, and security measures are the use cases that three in four RCFIs are testing with AI technology. For these specific operational areas, at least 88% of RCFIs report mostly or very successful outcomes. Even though these banks and credit unions have the perception of trailing larger institutions, their initiative to experiment with certain use cases that can be beneficial to operations are yielding progression and beneficial results.

Chart: RCFIs state these are the most popular use cases for AI experimentation in digital banking.

As RCFIs toggle with use cases, there are areas within the business operations that are coined to have the most immediate impact—data insights, customer service, security and fraud protection, and marketing. Two of those areas – security and fraud protection and customer service – align with consumers, with the majority saying that the quickest impact AI will have on their digital banking experience. However, consumers are hesitant about the usage of AI in marketing. This is interesting to note, as millennials have a strong affection for a personalized banking experience.

As data continues to be a buzzword in the industry, financial institutions are continuing to find ways to streamline their channels where massive data points are flowing into their ecosystem. There is a fine balance between human data analysis and machine output, but RCFIs are much more likely to prefer an AI model to humans when it comes to reviewing and finding trends in large data sets (89% prefer an AI model to execute vs. 11% for a human). Gleaning data insights is the top digital banking use case (out of ten tested) where RCFIs expect AI to have the most immediate impact (58%).

Along with the success around experimenting with certain use cases comes potential risk around AI related to data privacy and ethics. Financial institutions leaders’ top concern is making sensitive data available to the wrong people, cited by 44%. This lends itself to diligence within the organization around data governance and ethical AI practices as banks and credit unions plan and prepare to incorporate AI technologies across their teams.

Third party vendors become an integral part of a financial institution’s strategic initiative to implement AI in their business. A significant 76% of RCFIs are trusting advice from third-party technology providers for guidance on leveraging AI utilization in their organization, slightly outpacing their confidence in internal information technology (IT) departments, which surveyed at 74%. When RCFIs decide they are ready to start consulting, 29% choose to go to technology partners first for advice. This is an indication that these providers have a niche expertise, and financial institutions seek this knowledge.

Whether a bank or a credit union is in its infancy stages of AI exploration, or are having success in specific use case areas, below are steps to take to ensure integration of technologies and cultivate a test and learn environment:

The financial services industry has been tasked with balancing the benefits of AI as a new technology, with the risk and challenges coinciding with the mindset of consumers. The path to full AI integration comes with navigation security and risk, while leveraging the innovation for use cases that bring the most benefit to the institution. To learn more about each of these steps above to build out your AI strategy, download The Application and Consumer Perception of Artificial Intelligence in Banking market study.