Financial institutions (FIs) are at a critical moment to find and act on statistically accurate data to inform their account holder roadmap, technology plans, investments, and strategy. In our 2022 Digital Banking Transformative Trends Study with The Center for Generational Kinetics, we provide data, context, and recommendations FI leaders need for their success.

This national study includes over 1,500 U.S. participants who currently have a bank account and are active in digital banking (check accounts, transfer funds, pay bills online, etc.) and is weighted to the 2020 U.S. Census for age, region, gender, and ethnicity for a very low margin of error. At a high level, this national study uncovers numerous unexpected and important insights that can be applied to FIs of all sizes, customer or membership numbers, and geographies.

The select insights from the study shown in this blog create the context, understanding, and confidence for FI leaders at all levels to design and act on a strategy that unlocks the potential of digital banking across generations. It all starts with surveying the impact of digital banking experiences today and examining relationships between account holders and their primary financial institutions (PFIs).

Digital banking has changed dramatically over the last five years. Mobile apps, online banking, chat features, personal financial management, and so much more have all evolved to become increasingly preferred and relied upon by account holders. This trend accelerated dramatically through the pandemic, and the traditional adoption curve shortened as millions of people in the U.S. shifted to digital banking. However, FI leaders need to know if digital banking correlates with other key customer and member behaviors that drive product adoption. This is important because greater product adoption leads to better serving customers and members as well as FI growth, stability, referrals, data, innovation, and more.

A key discovery from the 2022 Digital Banking Transformative Trends Study shows that digital banking engagement is highly correlated with greater FI product penetration and adoption. This is really important for FI leaders to know and act on as they determine their product roadmap, technology strategy, resource allocation, and prioritization of investment. The study finds that digital banking users who access their mobile app and/or online banking multiple times per day have 1.71x the number of products with their PFI than those accessing digital banking at least once a year. The correlation is linear across engagement frequency with those accessing digital banking at least once a week having 1.30x the number of products; those accessing it a few times a month having 1.21x the number of products; and those accessing it once a month having 1.08x the number of products. Each of those multiples is compared against those accessing it at least once a year up to once every few months. This much higher penetration, adoption, and engagement are critical as regional and community financial institutions (RCFIs) seek to drive greater growth and loyalty from their customers and members.

FIs and their leaders across the United States are in fierce competition to understand, attract, keep, and best serve customers and members in this unique time. The competitors in the marketplace range from extremely large megabanks to neobanks, big technology companies offering financial services, to fintech companies and RCFIs. We’ve found that the type and size of FI and/or technology company have a big impact on consumers’ expectations about their relationship with that FI going forward. This is one of the most important discoveries from our study because it serves as a call to action for RCFIs and their leaders as they consider the urgency and importance of innovating to best serve customers and members.

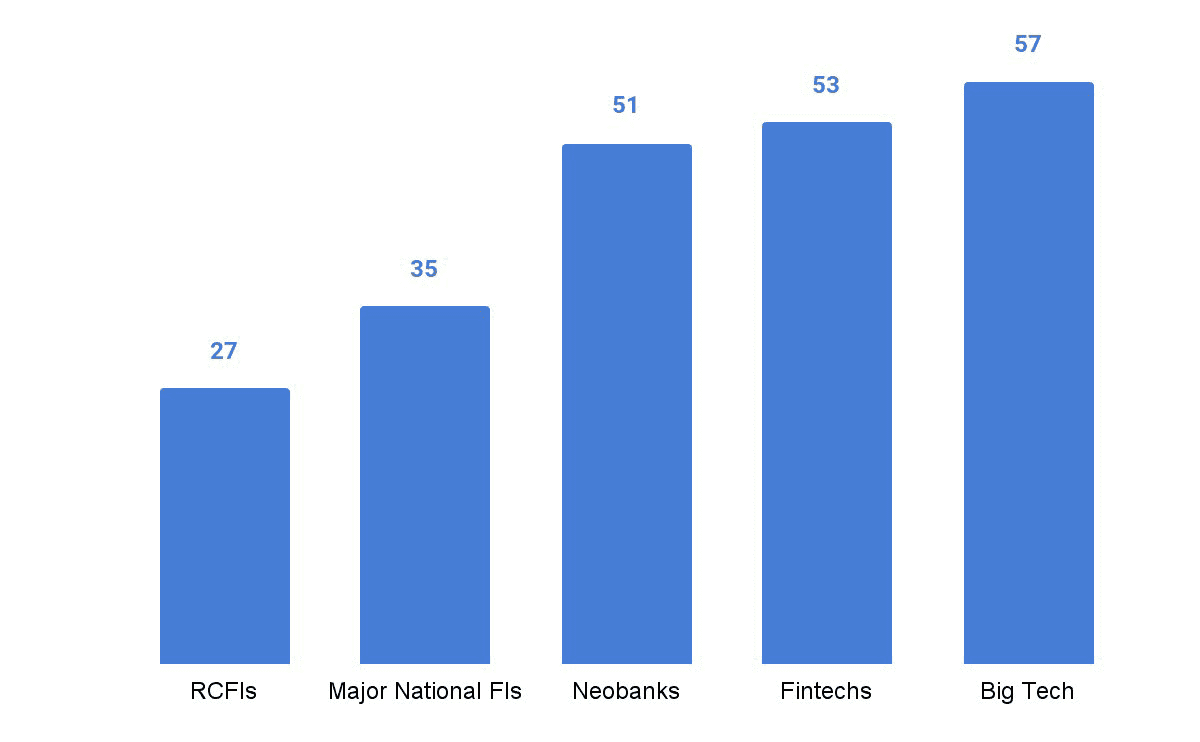

This study shows that consumers at RCFIs are less likely to believe their financial relationship will grow with these providers than all other financial provider cohorts. Specifically, the study finds that 27 percent of RCFI account holders say their relationship will likely grow over the next 12 months compared with 35 percent of major national FI consumers, 51 percent of neobank consumers, 53 percent of fintech consumers, and 57 percent of big tech consumers. This is a dramatic difference in expectations that may influence consumer behavior. RCFIs must act with urgency to address this potential risk to organic growth.

Percent of Digital Banking Consumers Expecting to Grow their PFI Relationship over the Next Year

Percent of Digital Banking Consumers Expecting to Grow their PFI Relationship over the Next Year

N=1,503 US digital banking consumers.

These insights are only a preview of the data in the report, but one discovery is clear: digital banking now connects every generation. It is clearly no longer optional but rather a must-have that drives growth, loyalty, and positive experiences. At the same time, younger generations are bringing new and different expectations that, when understood through the study, create a significant opportunity for every FI willing to adapt.

See more exclusive research led by Alkami in partnership with The Center for Generational Kinetics that informs the future of digital banking through a lens where every generation is valued, included, and championed.