Deposits are the lifeline for any financial institution, and now more than ever, deposits are critical, especially when considering the bank efficiency ratio.

In this competitive rate environment, financial institutions need to shift their strategy to attract new deposits and drive their new money goals.

As interest rates drop, financial institutions need to be ready with the necessary liquidity to fund their lending operations and expand their loan portfolio.

That’s where a digital account opening solution can solve for liquidity, bolster an institution’s lending authority, boost bank efficiency ratio and drive revenue opportunities.

Think of it as your digital sales and service platform – where your financial institution can offer a marketplace of deposit products and applicants can seamlessly checkout.

Besides generating interchange income off of debit cards and fee-based revenue from checking accounts, an effective account opening solution should overall improve your bank efficiency ratio. But how?

Let’s break it down.

Your account origination platform should decrease the non-interest expenses your financial institution incurs by reducing labor hours attributed to processing applications, performing Know Your Customer checks, and completing Suspicious Activity Reports (SARS) if fraudsters are undetected during traditional customer identification methods.

To simplify the process and reduce overhead, financial institutions could:

On the other side of the equation, your digital sales channel can drive product adoption; simultaneously growing interest and fee-based income.

By focusing on reducing costs and increasing revenue, your financial institution will feel confident about strengthening your operations, bank efficiency ratio and achieving business goals.

Consumers and businesses are overwhelmed as neobanks and financial institutions target prospective account holders with attractive offers and flashy interest rates in hopes of capturing deposits.

Neobanks have led the charge with intuitive onboarding technology and instant access to new accounts.

As they gain ground, financial institutions face mounting pressure to compete on experience.

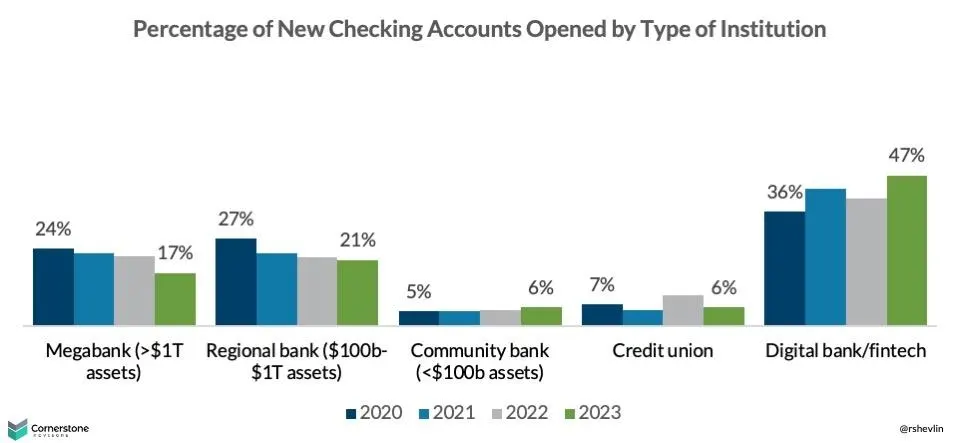

In fact, 47% of new checking accounts opened in 2023 were with neobank challengers.

Unsurprisingly, those who led the pack were fintechs that offer a superior user experience – Chime and Paypal.

However, in the wake of recent bank failures, consumers and businesses recognize the need for a partner who can be trusted, communicates transparently, and delivers a personalized experience.

This makes regional and community financial institutions viable candidates for the primary banking relationship.

While bonuses and high-yield accounts may attract account holders, these promotions will eventually reach their expiration date, and the financial institutions left standing will be those who instill and continuously provide confidence.

While many financial institutions offer a digital account opening solution, they may be losing applicants due to the complexity of their application process.

“Research by the Digital Banking Report found that most digital account opening processes take more than 15 minutes. This complexity of new account opening results in as much as 60% abandonment during the opening process — which equates to the loss of potential customers and the revenue they generate,” (Banking Transformed White Paper, 2023).

Winning neobanks have onboarding experiences that are simple, frictionless, and fast.

How can financial institutions emulate this while elevating the experience through personalization and seamless integrations into digital banking?

Start by facilitating an experience that is intuitive and familiar.

To introduce a best-in-class solution, follow these steps:

Making these capabilities available to your applicants is easier said than done. That’s where Alkami can help.

Our digital account opening solution empowers financial institutions to attract and convert consumers via an e-commerce experience and mobile-first application that can be completed in three minutes or less.

While digital channels may be preferred, there’s still a large percentage of your account holders who want a well-curated in-branch experience.

According to a 2022 study by Aite-Novarica, 43% of U.S. survey respondents visited a branch to open their new checking account.

That’s why your in-branch process should mirror your digital channel – exceeding applicants’ expectations with seamless onboarding and creating efficiency for financial institution staff by processing all applications on a single, cloud-based dashboard.

To compete on experience against neobanks and quickly innovate, your financial institution needs a solution that puts you in the best position to succeed.

At Alkami, we are committed to empowering financial institutions with a digital account opening platform that accelerates acquisition, deepens product adoption, improves retention, develops operational efficiencies, and prevents fraud.

Ready to reimagine your omnichannel account opening solution? Request a demo!