At Alkami, we’re constantly striving to enhance the experience of our digital banking solutions. This fall, we’re eager to announce some updates and product enhancements designed to elevate your experience with Alkami’s digital banking platform.

As we continue to listen to your feedback and anticipate industry trends, our latest release is focused on improving the platform, enhancing operational efficiency with artificial intelligence in banking, providing greater control, and preparing you for changes per the new ISO 20022 format.

For a comprehensive view of our release and roadmap, customers can visit the Alkami Community site. These updates are built to empower your financial institution to achieve more with less effort. Read on to discover what’s new and how you can leverage these enhancements to take your digital banking solutions to the next level.

96% of financial institutions foresee artificial intelligence (AI) playing a critical role in the next five years. A considerable majority of these institutions see AI as a catalyst for time savings (77%) and reduction in operational costs (59%).

Application and Consumer Perception of Artificial Intelligence in Banking, 2024

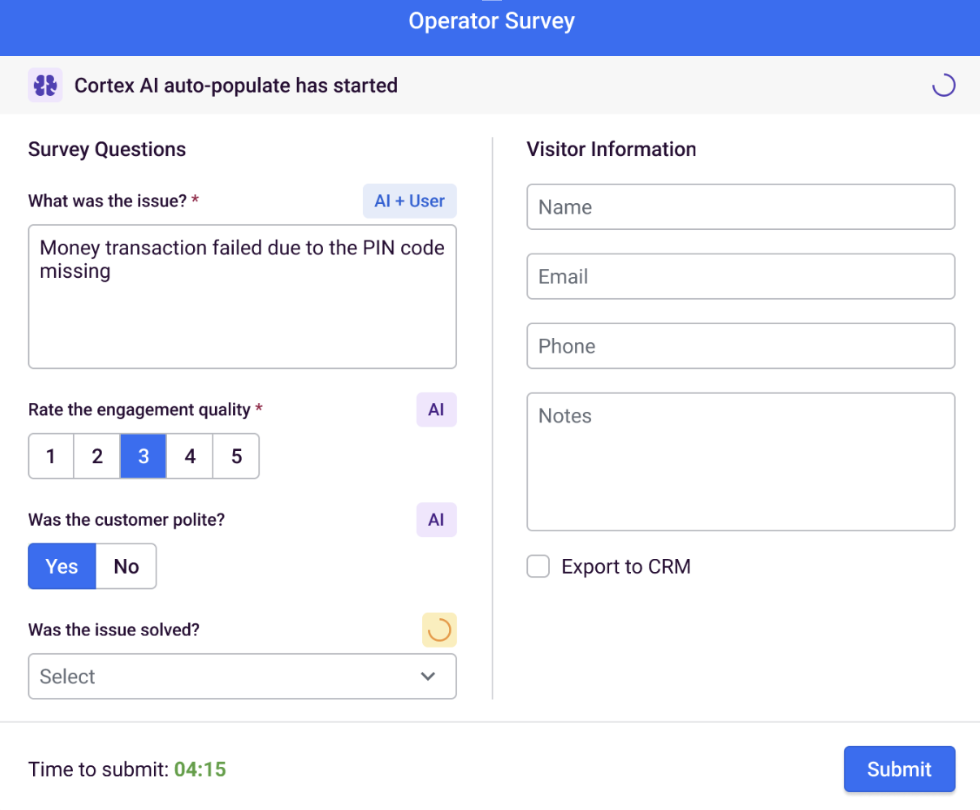

In this release, we are introducing Glia Agent Automation, which is a powerful AI-driven solution that automates and streamlines agent workflows.

This feature reviews the content of engagements to suggest relevant support responses, predicts and suggests responses based on the agent’s input text and the chat history, provides seamless transfer summaries between interactions, and generates automated answers and interaction wrap-up surveys based on conversation history.

By automating these key processes, including post-interaction wrap-ups and transfer summaries, financial institutions can save up to 1-2 minutes per interaction, leading to substantial reductions in average handle times and operational costs. This integration not only boosts agent productivity but also improves the overall user experience and ensures smooth knowledge transfer for agents within engagements.

By automating key call center agent processes with Glia Agent Automation, financial institutions can save up to 1-2 minutes per interaction

Source: Glia, 2024

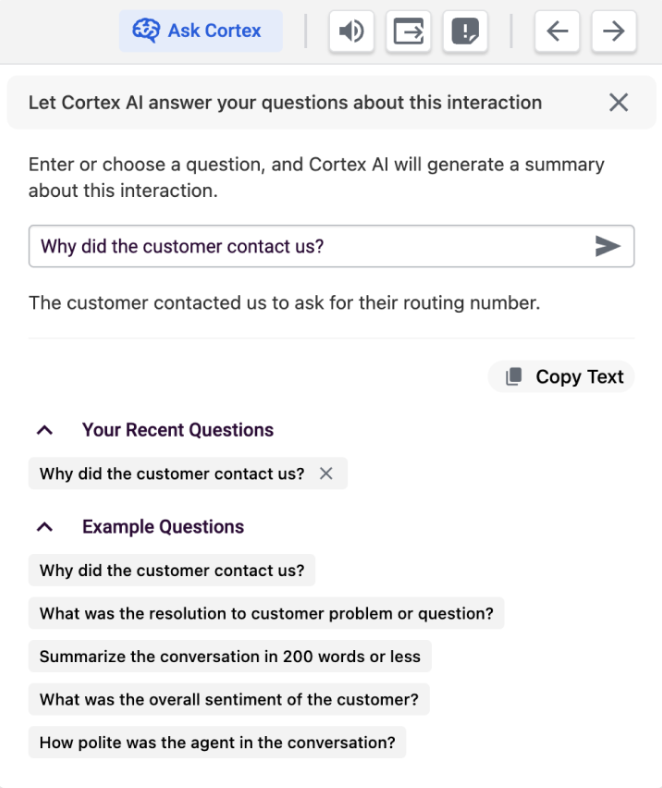

In addition, we are also launching Glia Manager AI Insights, which is an AI-powered functionality that uncovers actionable insights and delivers advanced reporting for call center managers. This solution automatically summarizes agent interactions, enabling managers to quickly identify trends and uncover data insights using natural language prompting.

By delivering real-time insights, Glia’s solution helps supervisors better understand team performance and address issues without manually sifting through data. With this functionality, financial institutions can optimize training, improve service efficiency, benchmark performance against peers, and ensure a consistent, high-quality digital banking experience, all while reducing the overhead costs of managing large teams.

A 2024 survey by FICO revealed that 69% of consumers rank fraud protection as one of their top three considerations when choosing a new financial service provider.

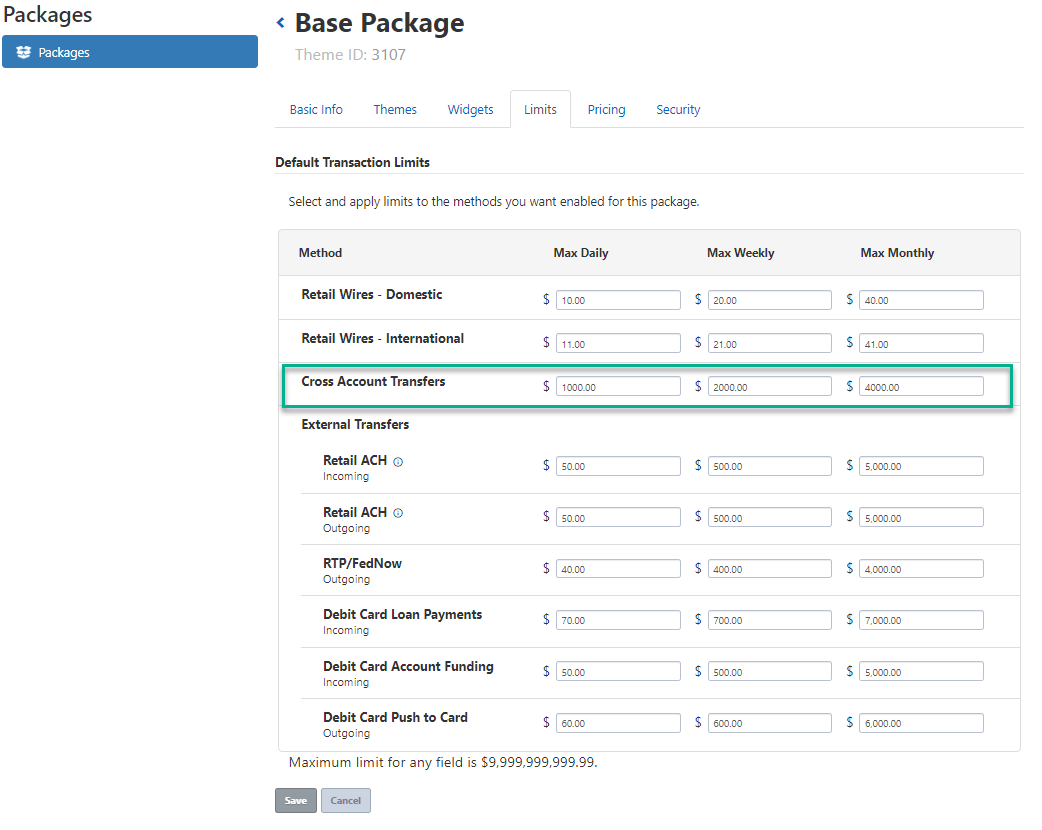

We’ve introduced a powerful new feature within our digital banking platform that enhances risk control by restricting unauthorized high-value transfers. This feature allows financial institutions to manage and limit exposure to financial risk by setting daily, weekly, and monthly limits for cross-account transfers within retail packages.

By offering greater flexibility in managing and enforcing transaction limits within our digital banking solutions, this helps protect end users from unauthorized transfers and reduces the risk of loss in the event of an account takeover. Fraudsters are restricted by the predefined limits set by the financial institution, providing an added layer of security and control over transfer activity.

Over 70 countries around the world have implemented ISO 20022 for real-time payments. This adoption highlights its role in enabling real-time and cross-border transactions .

We are excited to share that on the horizon in our Winter Release, Alkami will convert Business & Retail Wires from the current Fedwire Application Interface Manual (FAIM) FedWire format standard to the ISO 20022 format standard, in support of the formal transition of wire files as required by the Federal Reserve Bank.

This new format improves data quality, increases payment efficiency, and enables faster processing times, helping financial institutions enhance their operational performance. It also facilitates global interoperability by standardizing financial information across different systems and countries, ensuring seamless international transactions. With this change, financial institutions will be well-equipped to meet the new standards while improving security and overall efficiency.

To learn more about ISO 20022 and discover how Alkami supports financial institutions through this transition in digital banking solutions read our recent blog, Demystifying ISO 20022 and the FedWire Conversion.

For a complete list of new and improved features, customers can visit the Alkami Community site.