At Alkami, we’re constantly striving to enhance the experience of our digital banking solutions. Our summer product release is packed with innovative features and capabilities designed to make your operations smoother, safer, and more efficient. We understand the evolving needs of financial institutions and the consumer and business account holders you serve, and Alkami is committed to providing the tools you need to stay ahead in a fiercely competitive landscape.

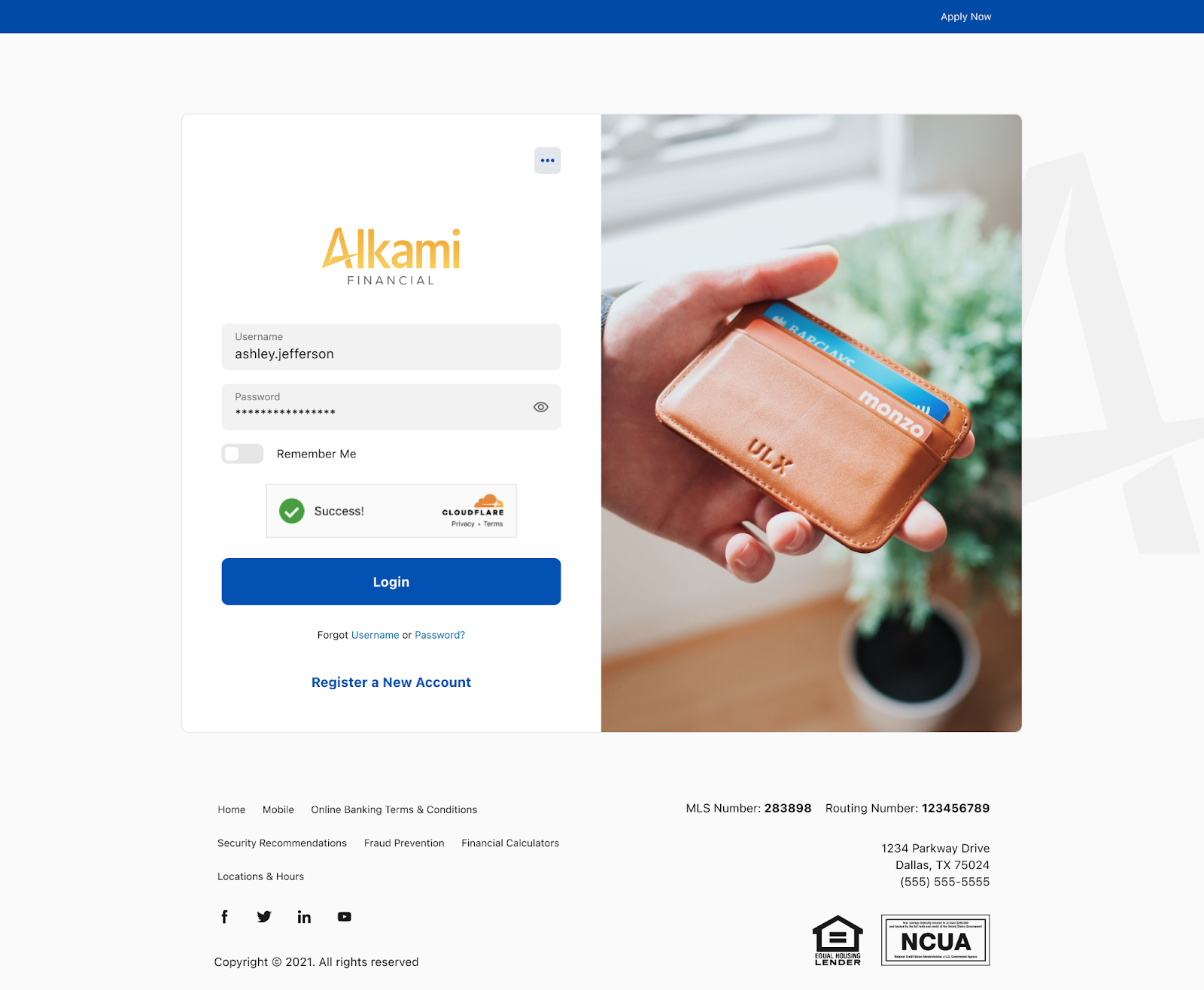

We’re excited to introduce credential stuffing protection, a new edition to the platform designed to provide improved bot and credential stuffing mitigation while enhancing the user experience. This enhancement is a challenge-response authentication alternative that prevents automated abuse while ensuring visitors are genuine, offering a seamless and frustration-free user experience. With this enhancement, users will land on the normal branded login page and, in many cases, will not have to interact with the widget at all as it performs automatic verification. For those who do, a simple, dynamically generated “Verify you are human” checkbox will complete the process. This seamless integration ensures a smoother, more consistent user experience, maintaining the brand’s integrity and reducing interruptions.

Introducing a new feature designed to streamline business transactions: Alkami now allows business users to request temporary or permanent transaction limit increases for Automated Clearing House (ACH) and Wire Transfers directly within the platform when their transaction exceeds the financial institution’s pre-approved limits. This request and approval process is seamlessly managed within the Alkami digital banking platform, ensuring efficiency and convenience while maintaining full security and audit-ready reporting. This optional feature is complimentary for our commercial banking solution customers.

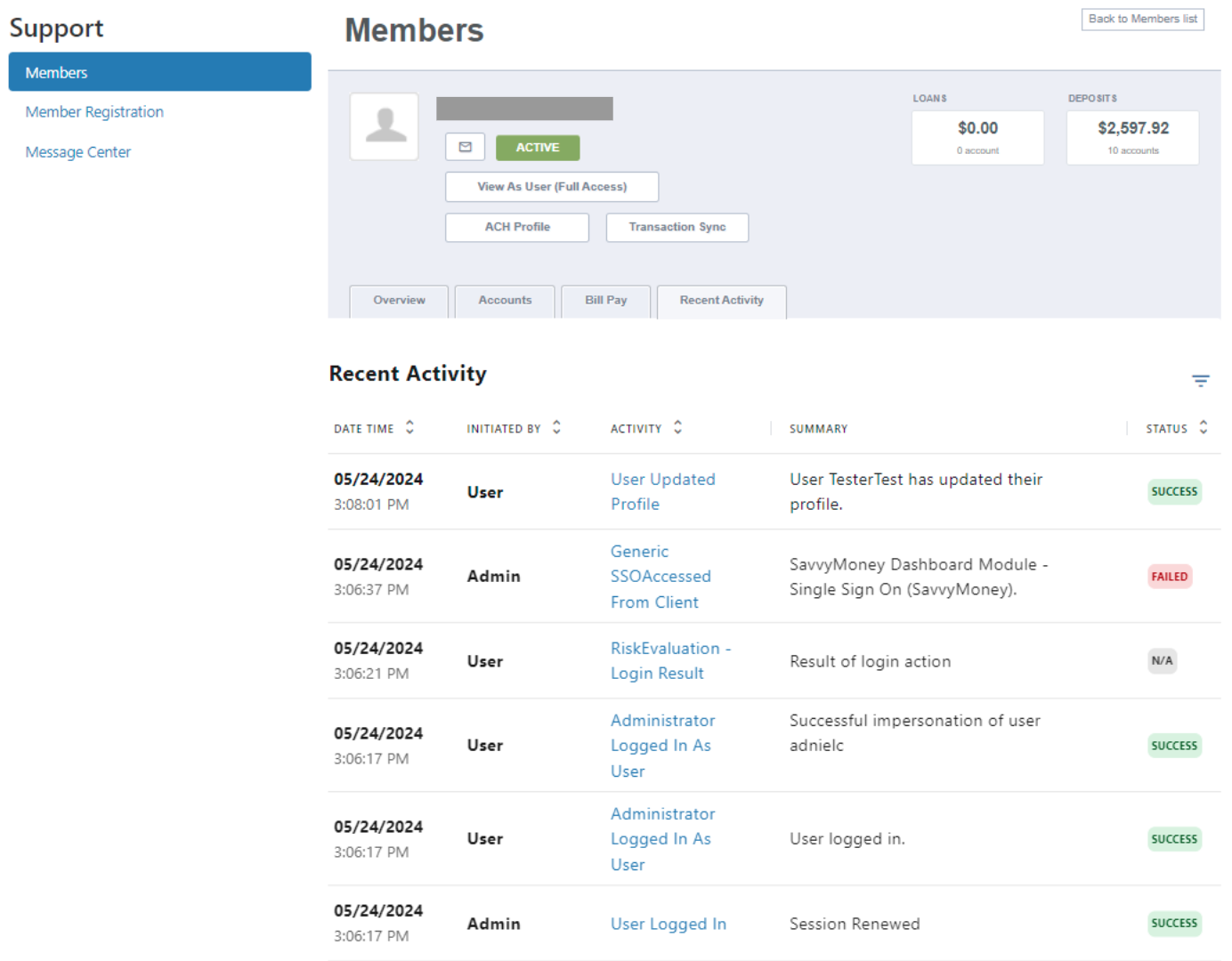

We are thrilled to announce the release of our User Recent Activity Widget located within the Admin console, which is a consolidated activity stream that displays chronological user activity data in near real time. Displaying up to 90 days of data, this is an invaluable feature for call centers, fraud researchers, and any other financial institution admin that is seeking consolidated user activity, without having to navigate to multiple reports, pages and extracts.

To keep banks and credit unions leveraging our partnership with SavvyMoney at the forefront of innovation, we’ve elevated our offering to automatically enroll digital banking users into the credit score solution. Now, users can simply log in to digital banking and accept the Terms & Conditions of the platform to seamlessly register for the SavvyMoney solution – driving engagement, delivering credit insights, and unlocking credit data for back-office teams to better serve and target account holders with personalized offers.

Consumers are looking for support on the channels they use most, which is not always a financial institution’s digital banking solution. Through Alkami’s partnership with Glia, we are extending the support experience to the following licensed third party messaging channels: SMS, WhatsApp, Facebook, and Apple Business Chat. This enhancement will enable financial institutions to automate routine sales and service interactions in the channels their customers and members prefer – reducing wait times and improving user satisfaction.

For a complete list of new and improved features, customers can visit the Alkami Community site.