Cash flow forecasting has become increasingly important for businesses and financial institutions, especially in volatile economic conditions with rising interest rates and market uncertainties. Accurate projections of cash inflows and outflows help businesses avoid liquidity challenges and make smarter financial decisions. Financial institutions, leveraging advanced business banking solutions, are increasingly offering powerful forecasting tools to their business accounts to help improve financial health and foster long-term growth. Solutions that focus on providing real-time insights and actionable data are making these processes more accessible and effective.

In this blog, we’ll explore three key reasons why accurate cash flow forecasting is essential for the success of modern business banking solutions for both companies and the financial institutions that serve them. From ensuring liquidity to enabling strategic decision-making and improving operational efficiency, accurate forecasting plays a crucial role in driving financial stability and growth for businesses today.

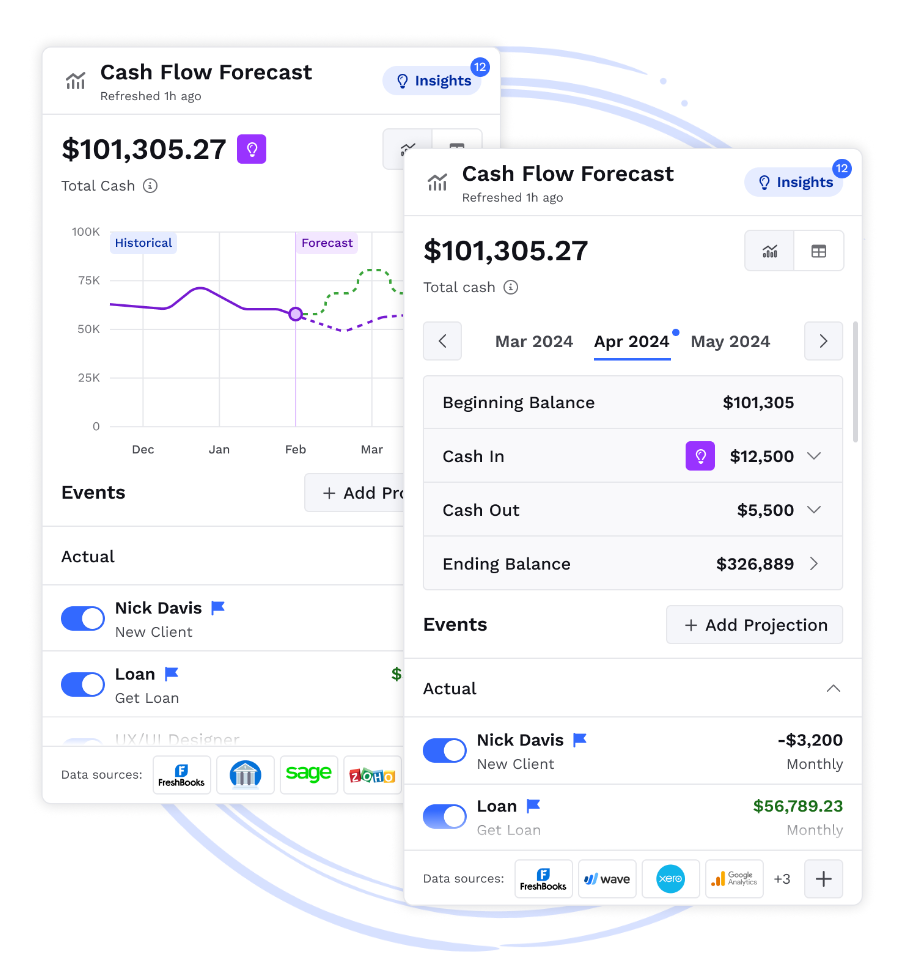

Accurate cash flow forecasting helps businesses maintain financial stability by providing them with clear visibility into their future cash availability. This enables better decision-making regarding operations, investments, and growth opportunities. Financial institutions offering integrated solutions, such as those powered by platforms like upSWOT, are giving their clients real-time access to critical data, which enhances their ability to avoid cash shortages and make informed financial decisions.

For businesses, accurate cash flow forecasts can also improve their chances of securing credit. Financial institutions that use such solutions can better assess a business’s financial health by analyzing real-time data, which results in more confident lending decisions. Businesses with clear cash flow projections are more likely to receive favorable credit terms, improving their ability to invest in growth opportunities.

Cash flow forecasting is not only important for short-term financial health but also for long-term growth planning. Businesses can anticipate future financial needs, allocate resources efficiently, and make strategic decisions for expansion. Financial institutions that partner with fintechs like upSWOT can provide businesses with the tools they need to forecast cash flow over time, ensuring that they are well-prepared for future growth.

Accurate cash flow forecasting also enables financial institutions to better understand their clients’ financial behaviors and needs. Currently, 57% of small business customers are receiving financial advice from their bank or credit union, according to the 2023 U.S. Small Banking Satisfaction Study from J.D. Power. Small businesses are particularly seeking guidance on how to avoid fees, improve spending and savings strategies, and enhance their credit score or creditworthiness. However, sole proprietors remain an engagement challenge for banks and credit unions, as they are less likely to use bank-provided tools like spending analysis, budget tools, and cash flow projections. By offering personalized solutions based on cash flow insights, financial institutions can improve satisfaction and position themselves as essential partners in their clients’ financial success.

By leveraging data from upSWOT, bank or credit union relationship managers can offer tailored product and service recommendations that meet the unique financial requirements of each business. With real-time insights into cash flow patterns, financial institutions can identify when a business might benefit from services such as lines of credit, treasury management solutions, or advisory services.

Accurate cash flow forecasting is critical for modern businesses and the financial institutions that support them. It enhances financial stability, facilitates access to credit, and supports strategic growth. By leveraging forecasting data, financial institutions strengthen client relationships, enhance customer satisfaction, and position themselves as key partners in their clients’ financial journeys. With innovative business banking solutions provided by partners like Alkami and upSWOT, financial institutions are better equipped to help businesses manage their finances effectively, ensuring mutual success. By embracing these solutions, financial institutions can not only offer valuable services to their clients but also foster lasting growth and financial health.