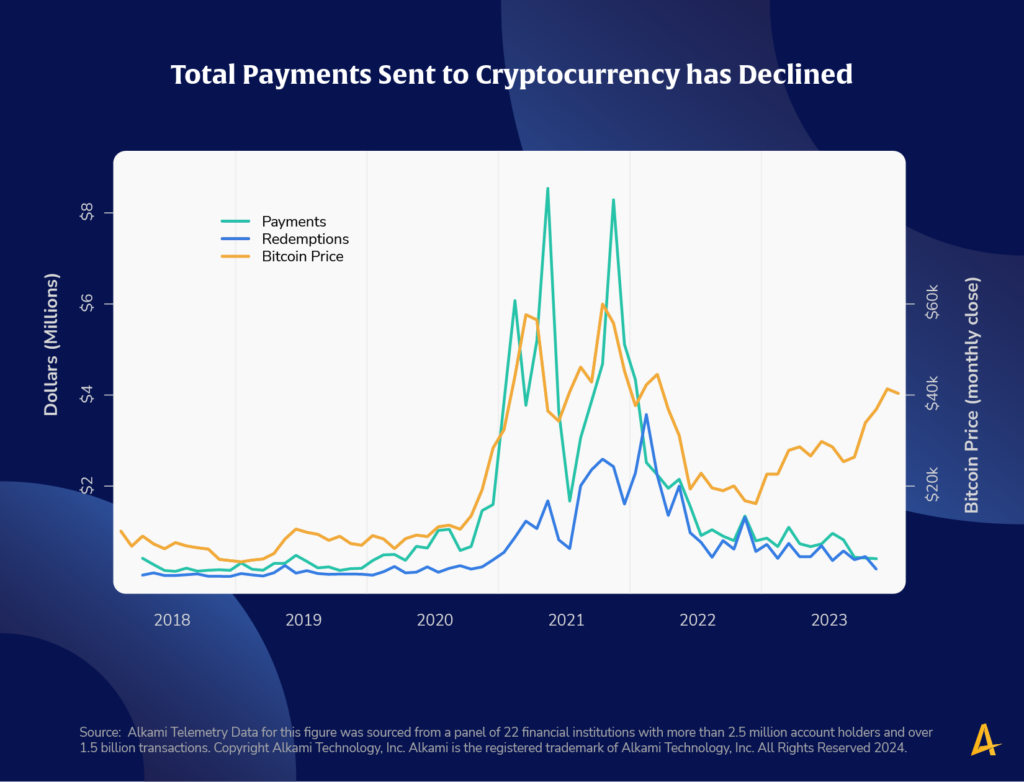

In Alkami’s 2023 Telemetry Report, analysis of transactions to identified cryptocurrency (crypto) exchanges showed that transaction volume and dollars sent to those exchanges on a monthly basis roughly tracked the price of Bitcoin. Our hypothesis at the time was that the increase in the price of Bitcoin drew increased participation from consumers which reversed when the asset class declined. Our previous analysis was based on data through the end of 2022.

An updated analysis through the end of 2023 illustrates the relationship between payments to cryptocurrency exchanges and the price of Bitcoin is no longer linked. In 2023, the price of Bitcoin jumped from $16,125 on 1/1/23 to $44,961 on 1/2/24. However, the data shows payments sent to cryptocurrency exchanges declined throughout the year.

Retail crypto investors, the type that we see in our panel, may have been spooked by 2022 price declines and the implosion of crypto exchange FTX in late 2022. U.S. Regulatory action caused one crypto exchange, Bittrex, to shut down U.S. operations entirely and caused another popular exchange, Binance, to become crypto only in June 2022 – meaning it no longer accepts U.S. dollar transfers at all.

In January 2024, the first bitcoin exchange traded funds were launched, giving investors a means to speculate on the price of bitcoin without actually owning the asset. Going forward, this may further reduce the transactions and dollars that regional and community financial institutions (RCFIs) see going to specialized cryptocurrency exchanges as investors can purchase these funds through traditional brokerages.

Financial institutions should continue to stay educated and informed on the crypto space. While cryptocurrency is still in early stages of maturation, it remains an investment option for some customers and could become a threat to a bank or credit union’s deposits.

Alkami Telemetry Data for this figure was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.