Banks and credit unions have a wealth of monetizable insights within their retail and business account holder data, but many still struggle to leverage that data to grow revenue. They face the challenge of DRIP—an apt acronym for being “data rich, information poor.” The opportunities missed by not using the unparalleled quantity of data available to financial institutions (FIs) now is like a dripping faucet, with valuable account holder insights constantly swirling down the drain.

In a tricky economic climate—with rising credit card usage resulting from consumer struggles to keep up with inflation and mortgage originations down due to rising interest rates—there’s no better time than now for FIs to stop the DRIP. Using data intelligently delivers a holistic view of each account holder’s financial journey, enabling financial institutions to employ predictive artificial intelligence (AI) modeling, integrate data with email channel delivery, and better leverage marketing technology to drive account holder revenue.

Those are some of the key takeaways from an ebook, Navigating the Economic Impact: 2023 Financial Institution Budgeting & Data Strategies, newly released by Segmint, an Alkami company. Here are some highlights of how financial institutions can better leverage their data next year and beyond.

Financial institutions need to commit to being data-driven organizations, with adoption across every department in the ecosystem. It has been said that data is the oil of the 21st century. And with 2.5 quintillion bytes of data created each day and the pace accelerating, financial institutions need to get on board.

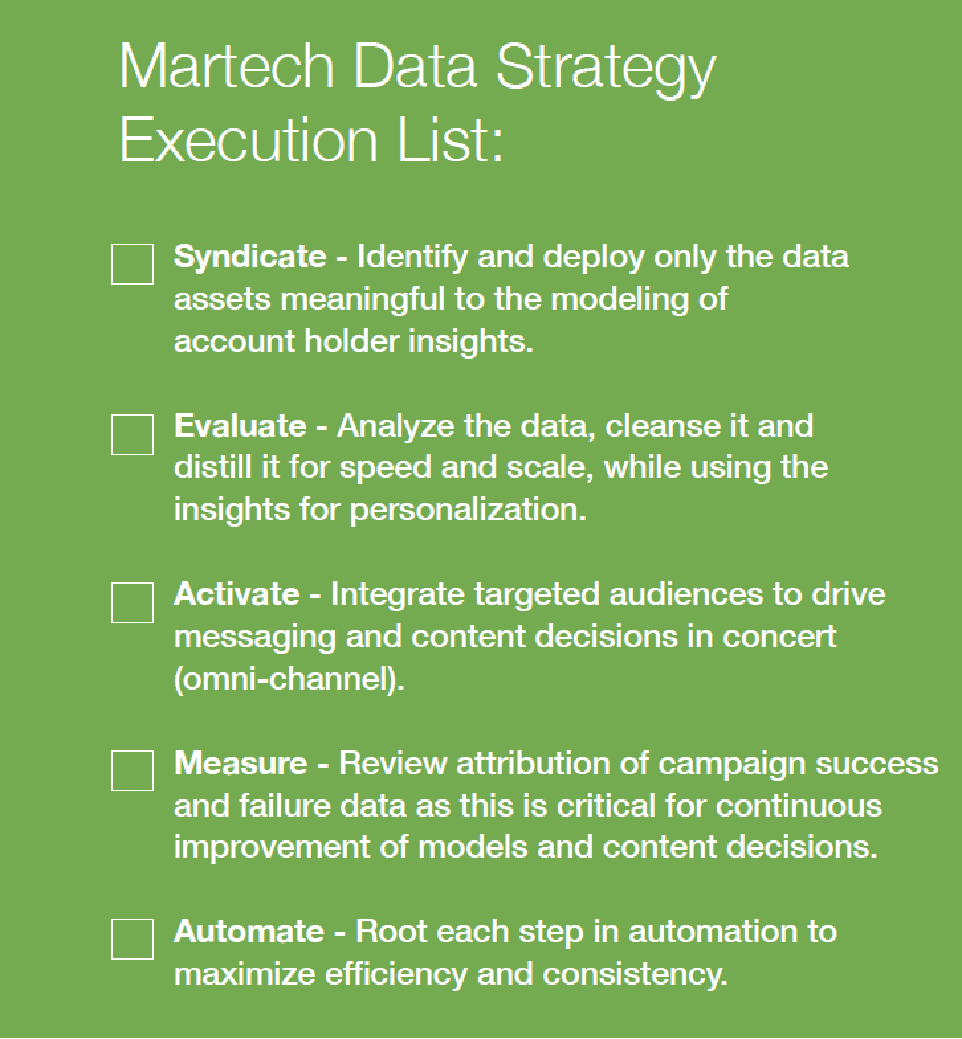

Some banks and credit unions try to engage in DIY data transformation initiatives to manage their data at speed and scale, and analyze it for insights, but quickly discover they don’t have the bandwidth to execute with internal resources.

Most organizations need a fintech partner that understands data and how to connect it to different systems, cleanse it, and then categorize it. That’s the path to creating actionable, on-demand intelligence and ongoing data insights. A critical part of transaction data cleansing and analysis is a better understanding of account holder behaviors and spend patterns. Insights from this process can deliver:

In this rapidly changing economy, it is important to identify account holders’ wants and needs before they initiate outreach to you on their own. Everyday purchase behaviors are highly predictive of an account holder’s financial priorities. And when you know what your account holders need, you can more easily craft messaging to offer it.

You don’t have to be a large financial institution to reap the benefits of AI. Partnering with the right vendor can take a data strategy to the next level. Analyzing account holder transaction data and assigning insights to describe financial behaviors, spend patterns, and activity with competing institutions creates a holistic view of the account holder.

These insights are the ideal input, enabling FIs of all sizes to deploy custom predictive account holder behavior models with incredible speed and scale. The most sophisticated models deliver continuous optimization with on-demand access to model results while observing the data produced by account holders daily to determine impact of spend on future behaviors. Deployed alongside a full suite of insights, predictive modeling equips banks and credit unions with the intelligence to power myriad multi-channel engagement options and automation, while driving informed decisions about your marketing spend and strategies.

Many FIs struggle to leverage their data for targeted email offers that accelerate revenue generation for both current account holders and acquisition campaigns. Adopting a data-driven approach to email marketing means combining insights with email automation to deliver the highest level of targeting efficiency and relevant engagements.

FIs can get the most out of their email platform when it aligns their marketing efforts with a full suite of media channels, while also utilizing their own account holder transaction data. On-demand access to the insights produced from this data allows banks and credit unions to:

It’s impossible to survive in today’s market without Marketing Technology (martech)—a set of software solutions used by marketing leaders to support mission-critical business objectives and drive innovation within their organizations.

Understanding account holder behavior both within your institution and with your competition requires tools that can combine all sources of data into one platform. Driving analytics, engagement, attribution, and reporting—these all sit alongside the traditional technology stack to provide a full view of an institution’s ecosystem. Martech, fueled by data insights, also aligns marketing and sales to focus on demand generation, prospects, and the right campaign orchestration. An integrated martech strategy is key to transitioning digital banking and other channels into strong revenue producers.

With the addition of Segmint, Alkami helps financial institutions of all sizes cleanse, contextualize, and activate their data with Merchant Payment Cleansing, Customer Insights, Marketing Automation, and AI Modeling. Powered by data scientists and artificial intelligence, our innovative product line offers a variety of ways to deepen your account holder relationships and grow your business by better leveraging your own data.

Click below to download the full ebook, Navigating the Economic Impact: 2023 Financial Institution Budgeting & Data Strategies.