As financial institutions navigate through the complexities of account holder expectations, regulatory requirements, and competitive pressures, the role of data analytics emerges as a beacon of innovation and efficiency, especially in marketing for financial institutions. There is significant investment in data analytics in banking because it can be transformative, from reshaping customer service and risk management to propeling marketing strategies to new heights. At the heart of this evolution are data scientists, whose expertise in managing, interpreting, and leveraging data is pivotal for the success of modern banking.

In the competitive landscape of financial services, the key to success lies in understanding and meeting the unique needs of each account holder. This understanding forms the cornerstone of effective marketing for financial institutions, guiding them towards more personalized and impactful engagements. Data analytics emerges as a transformative force, offering financial institutions an unparalleled advantage. The ability to personalize marketing efforts through data analytics in banking empowers financial institutions to offer products and services that are precisely tailored to the individual preferences and requirements of their account holders, significantly enhancing satisfaction and loyalty.

Furthermore, the strategic application of data analytics in marketing for financial institutions enables precise account holder segmentation based on preferences and behaviors, empowering financial institutions to design more targeted and efficient marketing campaigns. This strategic approach not only optimizes marketing return on investment (ROI) but also elevates the overall account holder experience.

However, despite the critical importance of personalized marketing in digital banking, a gap exists between consumer expectations and the capabilities of many financial institutions. According to Alkami Primary Research conducted in 2023, only 29% of regional and community financial institutions believe they are effective at delivering data-driven, relevant product recommendations. This highlights a significant opportunity for improvement.

The missing piece in bridging this gap is the effective utilization of data. Many financial institutions, particularly smaller regional and community banks and credit unions, face challenges in leveraging the vast amounts of data they collect to inform their marketing strategies. To truly revolutionize marketing and meet consumer demands for personalized experiences, these institutions must invest in data analytics capabilities. By harnessing the power of data to understand consumer behavior, preferences, and financial needs in depth, financial institutions can unlock the potential of personalized marketing, transforming the way they engage with customers and members and setting new standards for account holder satisfaction in the digital age. Such investments in data analytics are also critical in refining the approaches to marketing for financial institutions, ensuring they remain competitive and innovative.

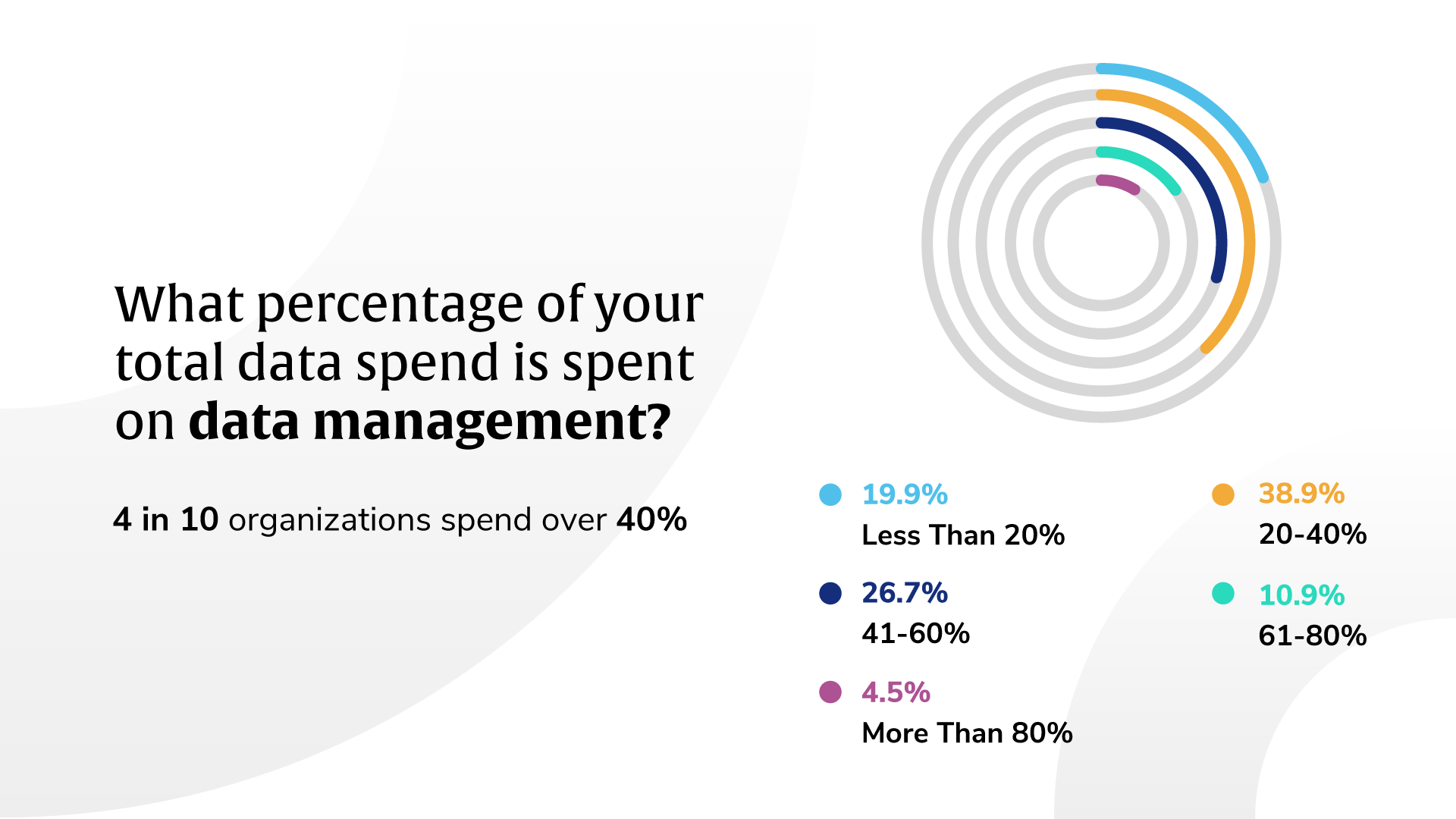

The findings from Snowflake’s Financial Services Executive Survey reveal a compelling narrative about the banking industry’s strategic priorities. The fact that 4 in 10 organizations spend over 40% of their total data spend on data management underscores the critical importance of data analytics in banking.

The substantial allocation of resources to data analytics in banking highlights the industry’s reliance on data analytics as a key driver of operational excellence, innovation, and staying ahead in the race against competitors. This trend is indicative of a broader shift towards data-driven decision-making and strategic planning in the financial sector.

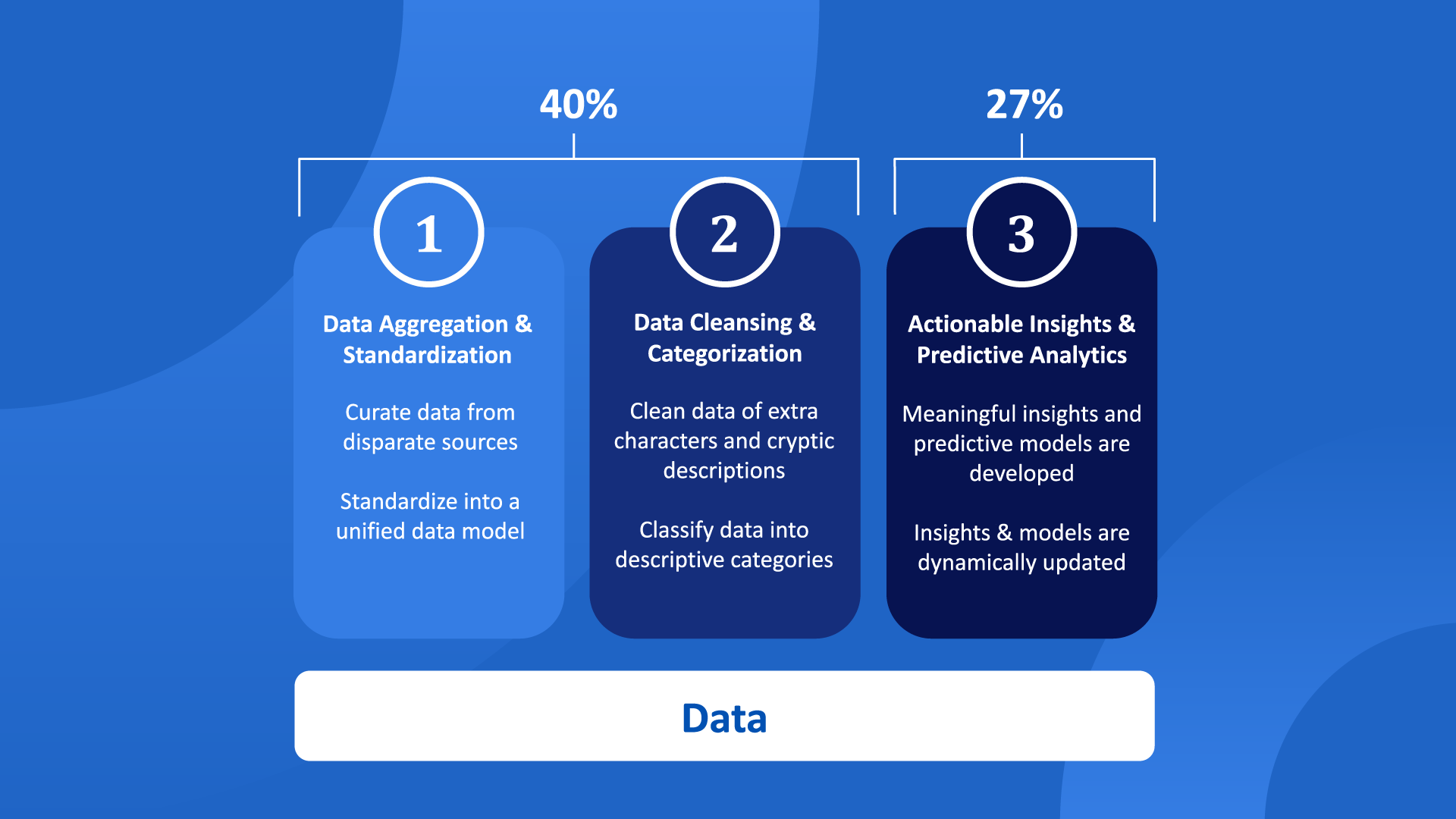

According to Anaconda’s State of Data Science Report, data scientists spend 40% of their time gathering, analyzing, cleaning, and reorganizing data. Unstructured data is the most time-consuming aspect of the typical data scientist’s job. These findings highlight the intricate and time-consuming nature of data science, especially in the banking sector where accuracy and reliability are paramount. The report sheds light on the challenges and opportunities facing data scientists, emphasizing the need for improved data management tools and technologies to enhance efficiency and effectiveness in banking analytics.

Another 27% of data scientists’ time goes into developing actionable insights and predictive analytics. Yet, to achieve truly predictive and prescriptive outcomes, a substantial amount of data is required.

Despite the promising potential of data analytics in banking, data scientists face several challenges. Foremost among these is the issue of data quality and accessibility. Inaccurate or incomplete data can lead to flawed insights, undermining decision-making processes. Additionally, the rapid pace of technological advancement necessitates continuous learning and adaptation among data scientists to stay ahead of the curve. Addressing these challenges is crucial for leveraging the full potential of data analytics in banking.

Looking ahead, the integration of emerging technologies such as artificial intelligence (AI) and machine learning is set to further revolutionize data analytics in banking. These advancements promise to enhance the predictive capabilities of data analytics, offering deeper insights into account holder behavior and market dynamics. Moreover, data analytics will increasingly underpin strategic decision-making in financial institutions, emphasizing its importance in achieving competitive advantage and fostering innovation.

The integration of data analytics in banking is no longer a luxury but a necessity for financial institutions aiming to thrive in the digital age. As we look to the future, the continued investment in data analytics capabilities and the development of data science skills will be crucial for the success of the banking sector. Financial institutions that embrace these challenges and opportunities will not only survive but flourish in the evolving landscape of digital banking.

By prioritizing data analytics and marketing strategies that resonate with today’s consumers, banks and credit unions can unlock new levels of engagement, loyalty, and growth.