In the Age of Personalization, the Winners Aren’t the Biggest. They’re the Fastest to Act.

In our recent Alkami-hosted webinar, financial leaders from Red Rocks Credit Union and Mascoma Bank offered a transparent and compelling look into their digital transformation journeys. The conversation, moderated by Jennifer Cortez, Alkami’s Chief Marketing Officer, went far beyond strategy. It focused on outcomes. Tangible, measurable outcomes that regional and community financial institutions are achieving by transforming digital banking into a sales and service channel.

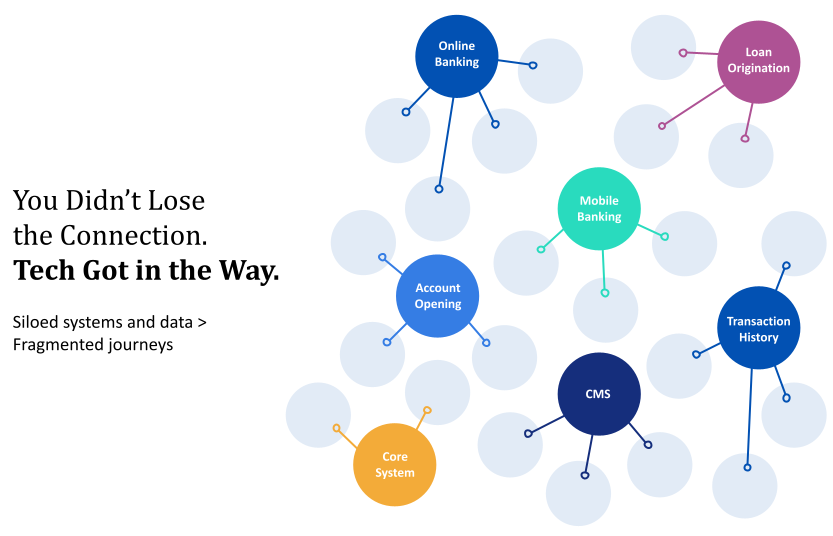

From shifting siloed systems to streamlined processes and creating seamless account holder experiences, our panelists explored what it takes to thrive in a world where account holders expect you to anticipate their needs, not respond to them with a one-size-fits-all approach.

At the center of the discussion is a platform that powers transformation. Alkami’s Digital Sales & Service Platform is that engine. It’s where onboarding, digital banking, and data-driven marketing converge to create a seamless ecosystem of engagement. This unified experience goes beyond convenient service to unlock the ability for banks and credit unions to truly predict 1:1. By breaking down silos and activating data, the Platform equips institutions to delight account holders with personalized interactions that arrive before the need is ever voiced.

Red Rocks Credit Union (Red Rocks), based in Colorado, is guided by a clear mission: to become the most people-centric financial institution in the communities they serve. Their strategy is rooted in empathy and driven by a deep desire to deliver meaningful outcomes to their members. Growth for Red Rocks is about alignment: ensuring their systems, teams, and service model all work together to serve their members better.

We're not just competing with other financial institutions. We're competing with every digital experience that our members and customers have… whether that be Amazon or Netflix.

– Darius Wise, President & CEO at Red Rocks Credit Union

Rather than layering on more technology to solve surface-level issues, Red Rocks took a foundational approach to reimagine their digital banking experience. They rebuilt their infrastructure, starting with a new core and Customer Relationship Management (CRM) to support long-term scale. MANTL Onboarding & Account Opening Solution helped them simplify the application experience, making it easier to attract and serve new members. And with Alkami’s Digital Banking Solution and Data & Marketing Solution on the way, Red Rocks is putting the final pieces in place to bring their vision of delivering meaningful, timely, and relevant engagements to life.

Mascoma Bank (Mascoma), a 125-year-old mutual bank serving Northern New England, has always prioritized trust, accessibility, and doing right by its customers. Their focus on relationship-based banking is as strong as ever, but now it’s being extended into digital channels. With a forward-thinking strategy, Mascoma is investing in tools that enhance their ability to serve customers more personally and efficiently.

We are able to focus a lot more on how are we going to support our customers with this data or how are we going to improve employee experience with these faster, or more streamlined platforms.

– Monica Barker, AVP Digital Banking Product Owner at Mascoma Bank

Their digital transformation began with MANTL’s Onboarding & Account Opening Solution, followed by Alkami’s Digital Banking Solution in early 2024. These tools gave Mascoma the ability to modernize the user experience without compromising the high-touch service that defines their brand. Now, as they prepare to integrate Alkami’s Data & Marketing Solution, their focus is on converting real-time insights into relevant actions. Aligning technology with their mission, Mascoma is building a model that delivers value and connection at every step of the journey by empowering their team to understand their customers in a deeper way, and act on that understanding in real time.

Throughout the webinar, both financial institution leaders returned to a shared truth: this transformation is about outcomes. Technology is the enabler but trust, relevance, and results are the goals.

During the session, Cortez highlighted the latest findings from Alkami’s research, including how:

These stats confirm what our panelists shared: the opportunity to lead is wide open, but the bar to win over account holders is only getting higher.

This is precisely where Anticipatory Banking sets leading financial institutions apart from their peers. It’s more than a great user experience, speed, or access to data, but what you can do with those capabilities paired together. Banks and credit unions that connect insights across onboarding, engagement, and marketing can move from reactive interactions to predictive, proactive experiences. Anticipatory Banking isn’t a buzzword. It’s a vision that enables financial institutions to sharpen their competitive edge—one made possible by Alkami’s Digital Sales & Service Platform that activates every corner of your digital ecosystem.

When account holders expect you to know them and show up for them, the difference between maintaining a presence and driving real growth comes down to how connected and intelligent your digital strategy is. The research makes it clear: speed, relevance, and proactivity are expected. Whether you’re just beginning your digital evolution or looking to accelerate what’s already in motion, the tools and strategies shared by Red Rocks and Mascoma prove there’s a path for everyone. Remember…