Financial institutions (FIs) are at a critical moment to find and act on statistically accurate data to inform their account holder roadmap, technology plans, investments, and strategy. In our 2022 Digital Banking Transformative Trends Study with The Center for Generational Kinetics, we provide data, context, and recommendations FI leaders need for their success.

This national study includes over 1,500 U.S. participants who currently have a bank account and are active in digital banking (check account balances, transfer funds, pay bills online, etc.) and is weighted to the 2020 U.S. Census for age, region, gender, and ethnicity for a very low margin of error. At a high level, this national study uncovers numerous unexpected and important insights that can be applied to FIs of all sizes, customer or membership numbers, and geographies.

The select insights from the study shown in this blog create the context, understanding, and confidence for FI leaders at all levels to design and act on a strategy that unlocks the potential of digital banking across generations. Our last blog on this topic explored the generational trends among those account holders who regularly use digital banking. Now we’ll explore two services that regional and community financial institutions (RCFIs) should prioritize to attract and keep customers regardless of their age.

When it comes to designing and offering a great digital experience, the urgency and importance have never been higher than right now. New expectations, norms, and trends are all showing that digital banking is critical to best serving every generation of consumer. This is true across the different types of FIs. Equally as true—and potentially even more important—is that offering a great digital banking experience is not just key to winning younger generations. In fact, delivering a great digital banking experience leads to significant gains when it comes to attracting and keeping every generation. This is important because it means that when FIs offer great digital banking experiences, they’re not only positioned to attract and keep emerging generations but every other generation of customers and members, too.

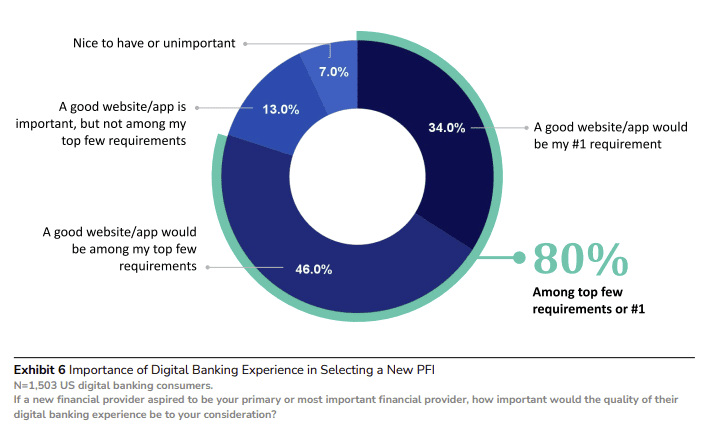

Our study uncovers that offering a great digital experience is valuable to every generation. On one hand, the study finds that almost half of all Generation Z and Millennials have opened an account with a new financial provider due to a frustrating digital banking experience. This highlights the frustration, challenge, and pain of outdated digital experiences driving emerging generations to new and different FIs. On the other hand, the study finds that a huge percentage—73 percent of Baby Boomers, 78 percent of Gen X, 84 percent of Millennials, and 81 percent of Generation Z—say the quality of the digital banking experience would be essential or important in selecting a new PFI. The solution and opportunity across generations are abundantly clear. A great digital banking experience is necessary for attracting and keeping younger generations but also older generations as well.

This is an important finding as many companies historically struggle to appeal to a new generation of buyer while not disenfranchising their core consumer. In the case of digital banking, a great experience is age-agnostic, allowing regional and community banks and credit unions to confidently evolve their capabilities to meet their existing consumers and an untapped market of emerging account holders where they currently are. This is one of the key insights that holds promise for growing a FI regardless of its current customer base or membership.

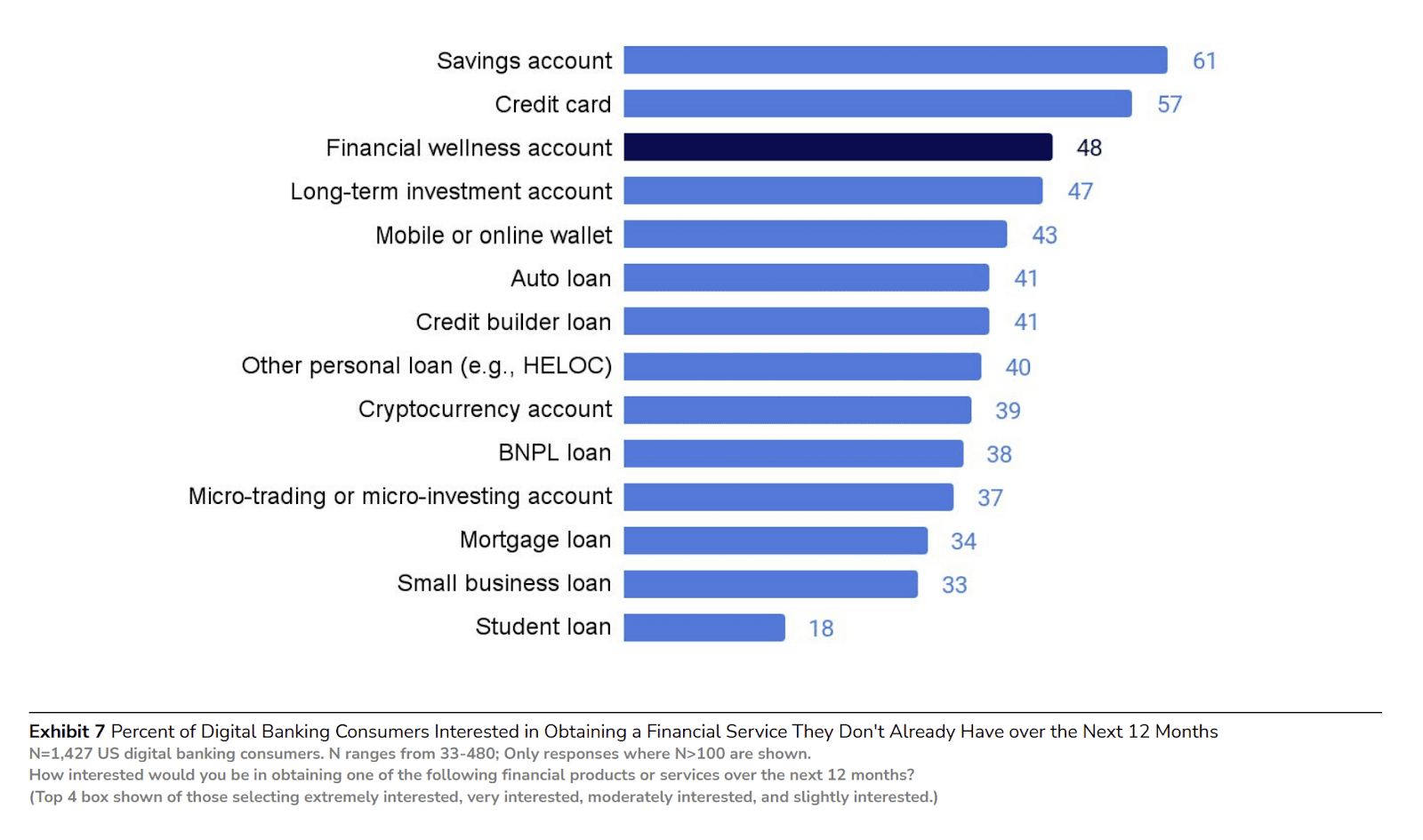

In addition to offering a great digital banking experience, the rise of personal financial management is creating new expectations and clear differentiators for FIs to take the lead in serving their stakeholders. This is especially true when it comes to standing out with services, tools, and solutions beyond the traditional banking services that are offered at FIs. The study finds that not only is personal financial management highly desirable across generations, but it can drive engagement and connection with consumers at a critical time in the current fiercely competitive marketplace. Our study reveals that personal financial management is an attractive service for RCFIs to increase penetration. In addition, personal financial management appeals to a very broad market and, in particular, to younger generations that are increasingly earning more money, adding financial commitments, and facing new levels of financial complexity.

Our study finds that a very large 64 percent of the market does not have a financial wellness offering and that interest in personal financial management ties with investment accounts for third place in what consumers want now from FIs. This is an important discovery because out of 15 different services tested in the national study as potentially being offered by FIs, personal financial management only trails the basics many consumers want: a savings account and credit card. This means that after the essential banking solutions consumers need, personal financial management is tied for first place, thus representing a significant greenfield opportunity for financial providers to seize.

The insights we’ve explored here are only a preview of the data in the full report, but one discovery is clear: digital banking now connects every generation. See more exclusive research led by Alkami in partnership with The Center for Generational Kinetics that informs the future of digital banking through a lens where every generation is valued, included, and championed.

See more exclusive research led by Alkami in partnership with The Center for Generational Kinetics that informs the future of digital banking through a lens where every generation is valued, included, and championed.