Digital banking has quickly evolved beyond a simple service channel; it’s the cornerstone of account holder engagement, cross-selling opportunities, and operational efficiency. Many financial institutions view their digital banking solutions and mobile app as their digital branch; making it the most visited and sometimes one-and-only channel a customer or member interacts with.

For millennials, the price of entry is an exemplary digital banking experience, where the digital banking channel is equal parts sales and service. The path to differentiation will compel banks and credit unions to leverage data to deliver increasingly personalized offers, thereby evolving into the data-informed digital bankers of the future.

Allison Cerra, Chief Marketing Officer, Alkami | Generational Trends in Digital Banking Study, 2024

We understand that replacing a digital banking platform is one of the most complex technology transformations many will experience in their careers. But what if you could be the catalyst for innovation at your financial institution? While change can be intimidating, it also creates an opportunity for you to be the hero in your transformation journey.

As financial institutions evaluate their digital banking solutions, they often look to providers to meet their evolving needs and want a partner that’s not only offering the technology platform but who is truly invested in their long term growth and scalability.

The J.D. Power 2024 Mobile App Platform Certification ProgramSM recognition is based on successful completion of an audit and exceeding a customer experience benchmark through a survey of recent servicing interactions. Read more about Alkami’s mobile banking platform.

For more information, visit jdpower.com/awards

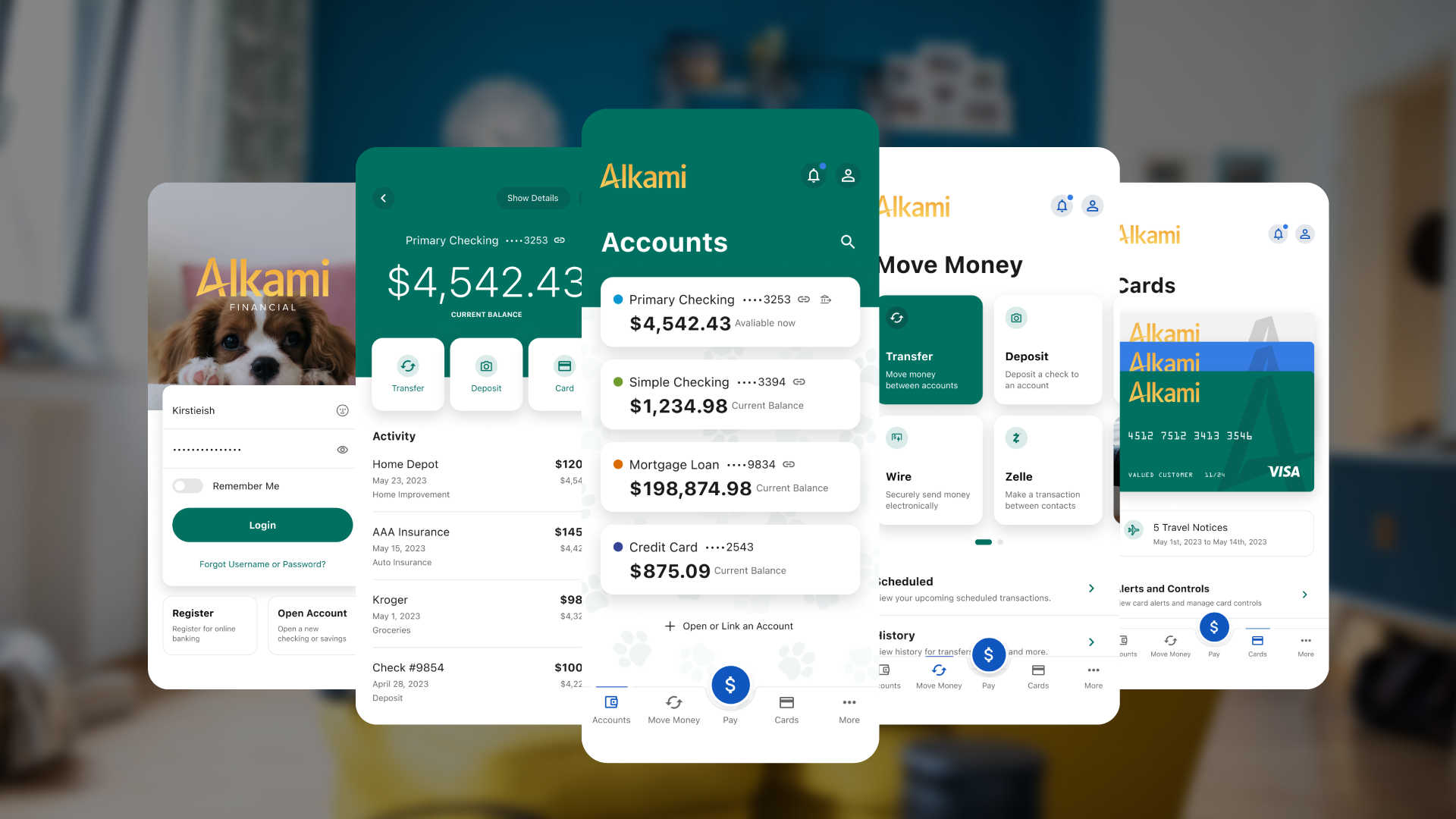

At Alkami, we understand that a seamless user experience is critical. Our digital banking platform is designed with a user-friendly interface that allows account holders to navigate effortlessly through their banking tasks, from checking balances to transferring funds and monitoring their credit score.

We offer extensive customization capabilities, enabling institutions to tailor the digital banking experience to their unique brand identity as well as the preferences and needs of individual account holders. This ensures that your digital presence is consistent and engaging, while giving your financial institution freedom to develop differentiated solutions with the use of Alkami’s Software Development Kit (SDK) and developer tools.

By leveraging native functionality in the admin portal, financial institutions can customize their experience across desktop and mobile by defining how users will navigate the solution and changing theme and account colors, fonts, background images, logos, and more. In addition, financial institutions can deliver personalized banking experiences with the use of packages. Packages consist of themes, widgets, and limits that apply to specific groups of end users, allowing financial institutions to serve the needs of various consumer and business groups.

For example, you might construct and offer a youth package so that all end users under a certain age have an experience customized for their needs, or if you have a group of account holders who regularly have pet-related transactions, you may customize their experience with a furry friend.

Modern consumers are inundated with information, making it more challenging than ever to capture their attention and loyalty. They crave experiences that are not only relevant but also anticipate their needs and preferences. Personalization has moved from a nice-to-have to an expectation.

Business decision makers were consumers first, and they increasingly demand the same frictionless, intuitive experiences they have grown accustomed to from Google, Apple, and Amazon in their workplace. The same goes for the financial institution administrators who support business accounts, often today under a patchwork of manual processes. And the fact that Generation Z (Gen Z), who came of age when the iPhone was launched, will represent 30% of the workforce by 2030, puts the user experience in even sharper focus.

Financial institutions sit on a treasure trove of data. Every transaction, interaction, and inquiry is a valuable piece of information that can be transformed into action by activating insights from data analytics in banking. By tapping into this wealth of data, financial institutions can gain a deep understanding of account holders’ behaviors, preferences, and needs. This knowledge enables you to create tailored solutions and targeted offers that resonate on a personal level and successfully drive conversions.

Millennials (ages 28-44) (65%) are significantly more likely than Gen Z (ages 22-27) (47%) and baby boomers (ages 59-65) (46%) to say that relevant product recommendations are very important or important when it comes to their digital banking experience.

For consumers, 1:1 personalization equates to more relevant and engaging experiences, greater satisfaction, and institutional loyalty due to personalized advice, education, and offers. For financial institutions, it translates to increased retention, more profitable account holders, cross-sell opportunities, and a competitive edge in the market.

Prioritizing compliance, advanced security and proactive fraud detection isn’t just about safeguarding assets; it’s about building a resilient, trusted framework that empowers account holders to engage confidently in a digital-first financial ecosystem. By leveraging AI-driven analytics and real-time monitoring, financial institutions can not only preempt potential threats but also foster a culture of continuous improvement and innovation in security and compliance practices, leading the way in user-centric financial services.

Alkami places a strong emphasis on these priorities by integrating leading security and fraud protection vendors into our digital banking solutions. Our sophisticated security features include multi-factor authentication (MFA), behavioral biometrics, real-time transaction anomaly detection, and check and ACH positive providing layered protection against evolving cyber threats.

Alkami is also deeply committed to regulatory compliance, ensuring our digital banking platform meets all relevant financial regulations and standards. We adhere to imperative industry regulations, helping institutions avoid legal and financial penalties while maintaining trust with their customers or members. We have a comprehensive compliance management system that is integrated in the business operations of our company in accordance with Federal Deposit Insurance Corporation (FDIC), National Credit Union Administration (NCUA), and Consumer Finance Protection Bureau (CFPB), and Federal Financial Institutions Examination Council (FFIEC) requirements. With knowledgeable compliance experts, Alkami simplifies the process of meeting regulatory obligations, allowing financial institutions to focus on delivering exceptional digital banking solutions with confidence and peace of mind.

Harnessing the latest fintech innovations through application program interfaces (APIs) is key to maintaining a competitive edge. Alkami’s digital banking platform is designed for seamless integration with your institution’s existing systems, including core processors, card processors, financial services marketing automation, and partner fintech solutions. This compatibility minimizes the complexity of transitioning to a new platform and ensures operational continuity, allowing your institution to deliver consistent and reliable services to your customers or members. The digital banking platform’s ability to integrate smoothly with various systems also helps streamline processes, reduce operational costs, and enhance overall efficiency.

At the heart of Alkami’s integration capabilities are our open APIs, which empower financial institutions to connect easily with a wide array of third-party services and expand their digital ecosystem. This flexibility enables your institution to offer a diverse range of products and services tailored to your account holders’ needs. Our platform’s scalable and flexible architecture supports growth by accommodating increased transaction volumes and expanding service offerings to keep pace with market changes and consumer demands. At Alkami, we empower our customers with open APIs to stay competitive in a dynamic financial environment, driving innovation and growth while providing exceptional digital banking experiences.

Choosing the right digital banking platform is a critical decision for financial institutions. With Alkami, you can be confident that you are selecting a partner committed to continuous innovation, security, and exceptional experiences for your account holders and institutions. We are here to support your journey toward a brighter digital future.