The future of digital banking solutions isn’t just fast. It’s intelligent.

At Alkami, we’re building beyond limits by integrating artificial intelligence (AI) across every layer of the Alkami Digital Sales & Service Platform (the Alkami Platform). From data transformation to real-time decision-making, we’re helping financial institutions shift from hindsight to foresight, enabling them to anticipate needs, personalize experiences, and act with greater confidence.

Our next-generation digital sales and service platform is purpose-built to help financial institutions thrive in a digital-first world. It places data at the center and integrates AI to turn insights into action, delivering smarter, faster, and more personalized banking experiences.

With the Alkami Platform, financial institutions can:

This approach powers Anticipatory Banking, enabling institutions to move beyond reactive service models and proactively support account holders at every stage of their financial journey to help institutions drive growth, deepen relationships, and stay competitive in a rapidly evolving market.

Our next-gen digital platform puts data at its core and AI in every layer—delivering solutions that anticipate account holder needs and empower financial institutions to lead with foresight, not hindsight.

Smarter banking from insight to action, in real time.

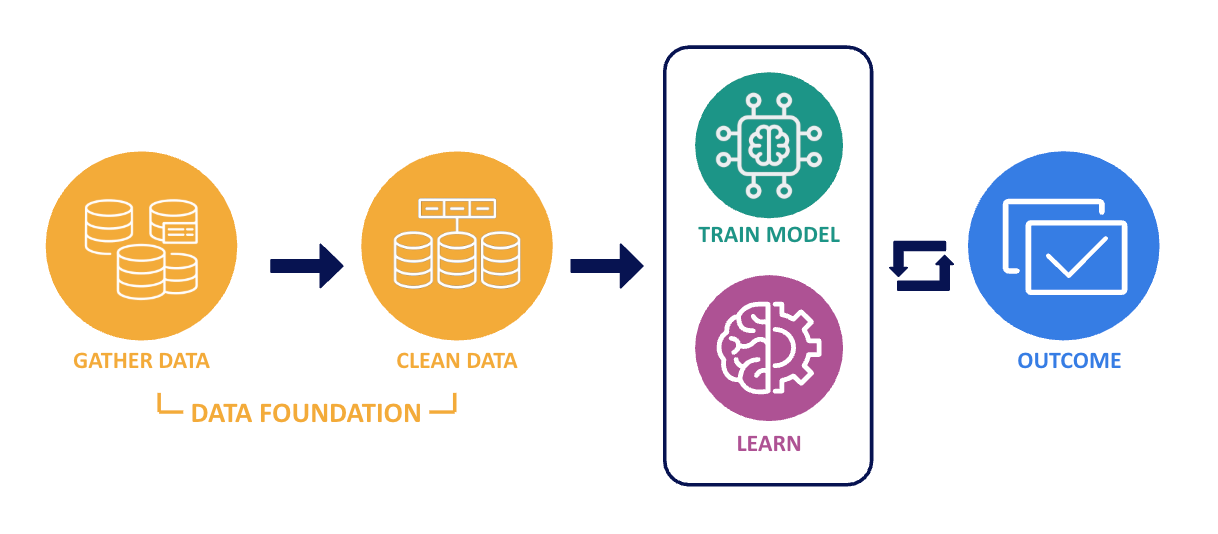

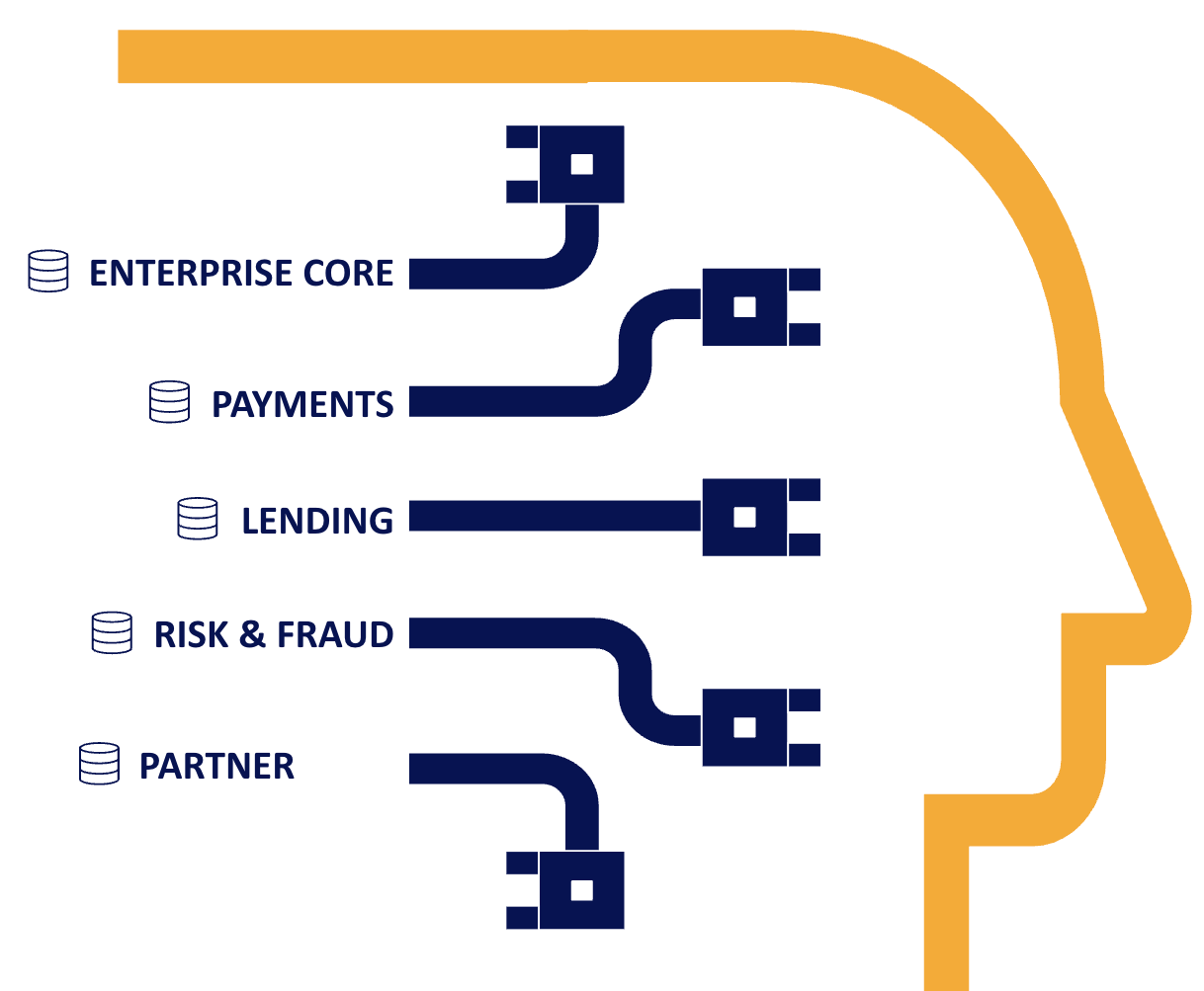

AI innovation depends on more than algorithms. Its true power lies in the quality of the data behind it. Alkami has already invested in a platform that transforms billions of raw transactions into clean, model-ready, enterprise-wide data. With the recent acquisition of MANTL, Alkami’s data foundation now extends even further. It integrates data not just from core banking, lending, payments, and risk, but also from critical upstream moments in the account holder lifecycle. By incorporating data from digital account opening and onboarding experiences, financial institutions gain deeper insights into intent, identity, and behavioral patterns from the very first interaction. Combined with Alkami’s growing ecosystem of partner integrations, we can unlock insights that go far beyond transaction. The result? Endless opportunities to scale AI use cases across the banking lifecycle to fuel more intelligent, proactive engagement to enable banks and credit unions to predict and meet account holders’ needs before they know they need them. (Anticipatory Banking.)

Source: Strategies to Prevent ‘Garbage In, Garbage Out’ in AI Applications | by Dickson Lukose | Medium

We’ve moved beyond theory to deliver measurable impact across security, marketing, and engagement. Through ongoing research and development, Alkami continues to build our own AI capabilities while also integrating best-in-class solutions from trusted partners. Together, these technologies power advanced data security, intelligent automation, and proactive fraud mitigation, delivering meaningful outcomes tailored to the needs of financial institutions.

Alkami’s broad network of partners brings best-in-class, AI-powered solutions to help financial institutions protect and serve their account holders with confidence. Solutions from partners like BioCatch and Appgate, account holders stay safe thanks to advanced fraud detection and prevention that works behind the scenes without adding friction. These tools help institutions stop fraud before it happens, reduce operational risk, and build trust through smarter, more seamless security. It is all about keeping account holders protected while delivering a better experience every step of the way.

Source: The AI Revolution in Banking — Are we ready? by Theodora Lau

In the same spirit, partners like Glia and Eltropy make it easier for financial institutions to automate their call centers, helping teams serve account holders faster and more consistently. By bringing smart automation into both chat and voice support, they reduce hold times, free up staff for more complex needs, and lower the overall cost of service. Account holders get quicker help when they need it, and institutions see real efficiency gains without sacrificing experience. As part of Alkami’s larger engagement ecosystem, these solutions play a key role in making service more scalable, responsive, and cost effective.

At the core of Alkami’s AI capabilities is our Data & Marketing Solutions, which transforms billions of raw transactions into actionable data insights purpose-built for financial institutions. This powerful data foundation enables institutions to seamlessly apply our predictive AI models to real-world use cases, like smart segmentation, timely product recommendations, and proactive outreach to account holders. By pairing enriched data with automated, full funnel marketing tools, financial institutions can engage account holders with relevant, personalized experiences to drive deeper relationships and measurable growth.

Source: Predictive Artificial Intelligence in Banking: Transforming Financial Services The predictive AI model allows us to hit members that we probably wouldn’t be able to identify on our own. It works as an easy button to unlock members that we may have missed otherwise. - Mariah Martz, senior digital marketing strategist at Arkansas Federal Credit Union

At Alkami, we believe that powerful technology must be paired with intentional design and responsible governance. That’s why we’ve invested significant time and research into understanding the implications of AI and establishing clear internal guidelines for how it should be implemented across the Platform. These governance practices ensure that AI is used in ways that are safe, transparent, and aligned with regulatory standards while still meeting financial institution’s expectations. This foundation not only protects account holders and promotes ethical innovation, it also reinforces the trust our customers place in us and supports their ongoing compliance readiness. As AI capabilities continue to evolve, our commitment to building and deploying them responsibly remains unwavering.

Our teams follow rigorous model development and testing protocols that prioritize fairness, explainability, and compliance. This helps ensure that decisions made by our AI tools, whether powering marketing automation or identifying account holders at-risk of attrition, are grounded in integrity and trust.

We are also investing in research and development to deepen internal expertise and support long-term innovation. Our product teams are focused on building solutions that are extensible and modular, so financial institutions can scale AI in ways that are right for their unique strategies and risk tolerance.

Beyond internal development, we work closely with customers and partners to ensure responsible data use. From fraud prevention to engagement automation, we evaluate every partner integration through the lens of security, privacy, regulatory compliance, and the overall impact on the account holder experience.

We don’t treat ethics in AI as a checkbox. Responsible design and governance are foundational principles that shape how we build, deploy, and continuously improve every intelligent solution on the Platform.

As AI capabilities continue to evolve, Alkami remains focused on deepening our Platform and expanding the ecosystem of products, data sources, and partner solutions that support them. Our vision is to ensure financial institutions have the tools, insights, and intelligence they need to sell and serve with greater confidence in a digital-first world.

Looking ahead, our areas of focus include:

Source: Harvard Business Review | Ensure High-Quality Data Powers your AI | by Thomas C. Redman

At Alkami, we believe the future of financial services will be led by institutions that can turn data into insight and insight into action, delivering anticipatory experiences that deepen relationships and drive growth.

AI is more than a feature at Alkami. It is a key enabler of our mission to help financial institutions thrive in a digital-first world. By embedding AI into every layer of the Platform, Alkami is helping institutions move from reacting to needs to predicting them. We are turning intelligence into action and possibilities into progress so our customers can deliver smarter, more personalized experiences at every moment that matters.