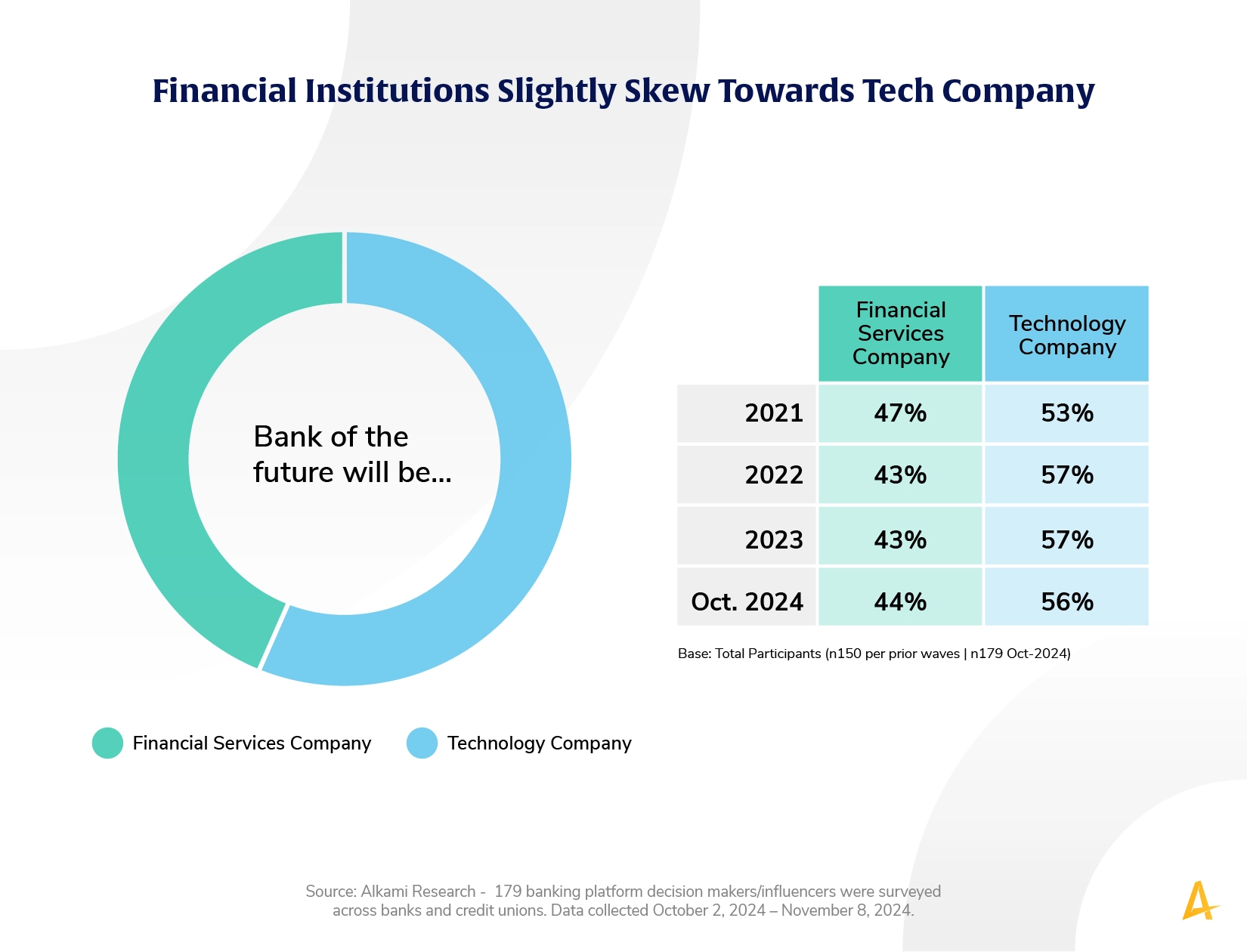

Alkami Research conducted a study that surveyed bank and credit union banking platform decision makers/influencers to explore their digital banking provider perceptions and experience. The analysis revealed that financial institutions today think that the bank (or credit union) of the future is less likely to be an actual financial institution, and more likely to be a tech company. For the past four years Alkami has asked the same question, and our observations are two-fold:

Even though big tech is still a significant player in the market, account holders still want and need to work with regional community financial institutions as they adopt top tech features themselves. Financial institutions can use this intelligence to support digital transformation strategies and understand the importance of instituting a forward-thinking tech mindset.