What we’re seeing:

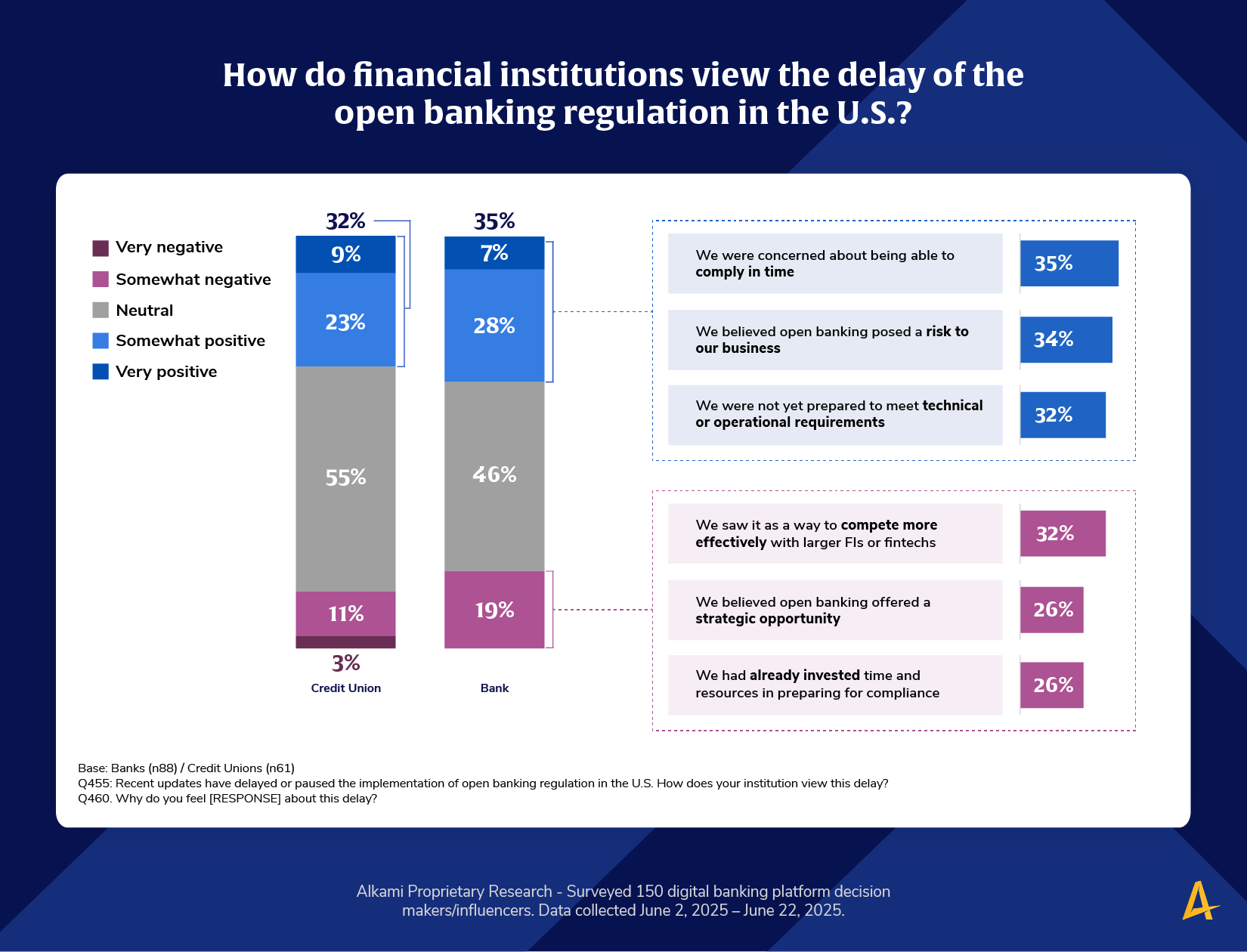

A recent Alkami survey of 150 digital banking platform decision-makers sheds light on how credit unions and banks perceive delays in open banking regulation. While nearly half of both credit unions (55%) and banks (46%) maintain a neutral stance, there’s a clear divergence in sentiment at the extremes. However, both credit unions (32%) and banks (35%) held a positive view of the delay. Meanwhile, banks were slightly more likely to report a negative view of the delay (19%) versus credit unions (14%).

When asked about why the delay matters, concerns about timely compliance were the top issue across the board. Additionally, institutions were looking for help to improve their digital banking experience to retain account holders who may be more tempted to switch.

Interestingly, for those that viewed the delay in a more negative light, many institutions saw open banking as an opportunity to better compete with larger financial institutions or fintechs, or had already invested their time and resources in preparing their compliance strategy. This bifurcation suggests institutions are not aligned on readiness. For many, the delay is a necessary breather to prepare foundational systems and protocols. For others, it’s a chance to get ahead, positioning themselves as proactive, agile institutions ready to meet consumer expectations with confidence.

Takeaway and Call-to-Action:

The key message here is simple but powerful: regulation doesn’t wait for technology trailers. If your institution is treating the delay of open banking rules as a break, rather than a runway, you’re likely to fall behind. Digital-first competitors are not standing still, and the best institutions won’t wait for regulations to force modernization. They’re investing now—not just in compliance, but in experience, agility, and data-readiness. They’ll proactively align their digital banking strategies around transparency, interoperability, and flexibility—so they’re prepared not just to comply but to win.

Now is the time to double down on your infrastructure, data pipelines, and partner strategy. Ensure your digital sales and service platforms are open-banking ready, even if the external clock is paused. Your most tech-savvy competitors already are gearing up.

Source: Alkami Proprietary Research – Surveyed 150 digital banking platform decision makers/influencers. Data collected June 2, 2025 – June 22, 2025.

*These findings have not been previously published.