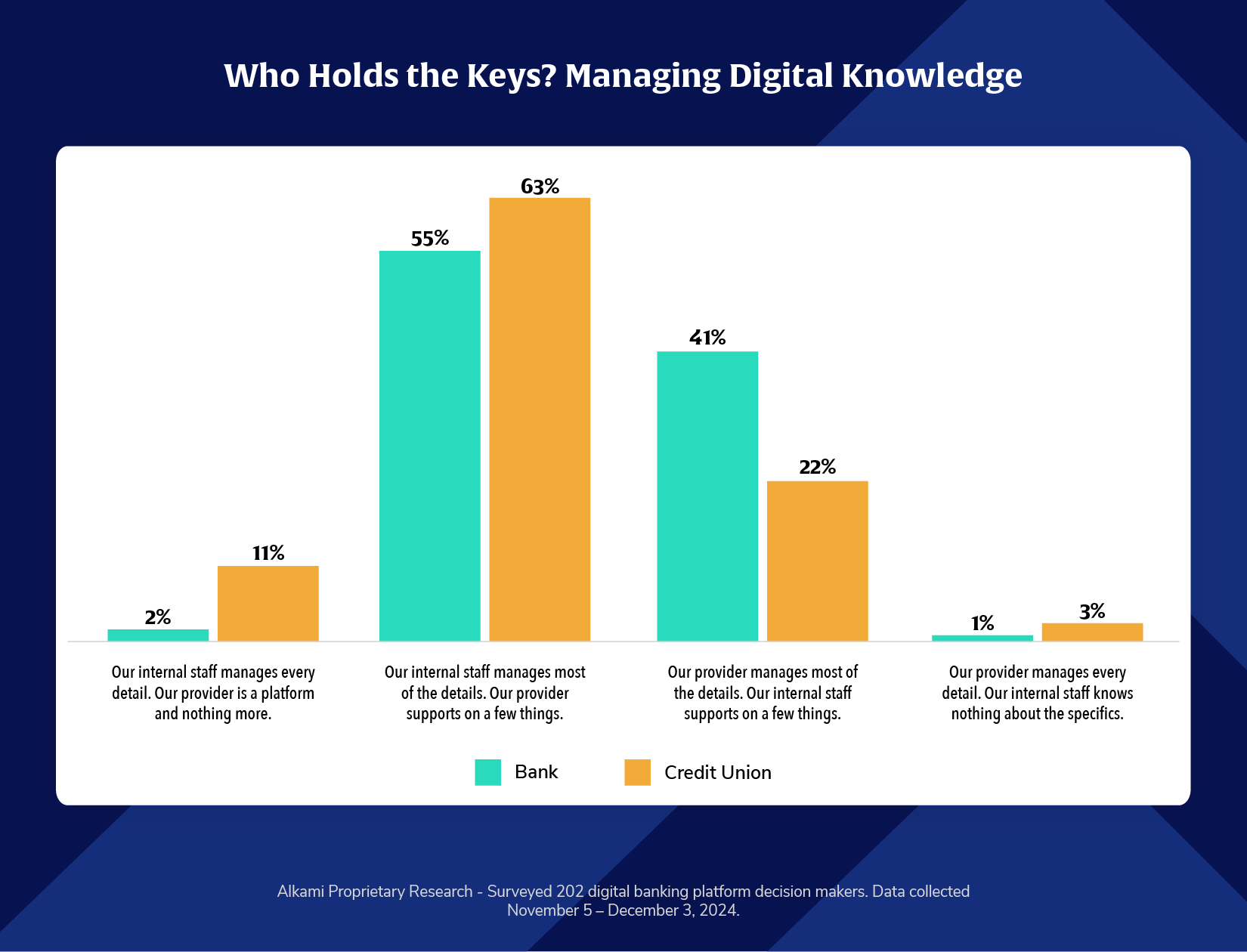

A majority of both banks (55%) and credit unions (63%) report that internal staff manages most of the digital banking platform’s details, while their provider offers support for key components. This hybrid model suggests a shared priority across financial institution types: maintaining internal ownership and expertise, while leveraging a partner to fill gaps or add efficiency where needed.

Where the paths start to diverge is in how much each institution type leans on external providers. Forty-one percent of banks say their provider manages most of the platform’s details with limited internal support. A stark contrast to 22% of credit unions who say the same. This suggests banks are more likely to take a managed-service approach to digital operations, possibly due to scale or staffing strategy. On the other hand, credit unions appear more committed to owning digital knowledge in-house, even with leaner teams.

Most financial institutions are choosing digital banking platform vendors for partnership, not full outsourcing or insourcing.

Digital banking is an ongoing operational commitment. How financial institutions manage that commitment matters. Whether looking at a bank or credit union, the chart shows that most financial institutions want to stay close to the details, even if they’re getting help from a provider. That’s a smart strategy, because owning digital knowledge is foundational to agility, innovation, and trust.

If internal staff manages most platform details, ask: Do we have the right documentation and skill coverage to sustain this as we scale? Are we over-reliant on a few key individuals? Are we investing in training and succession planning for digital roles?

If the digital banking platform provider manages most of the details, ask: Do we have enough internal visibility to hold our partner accountable? Are we regularly reviewing KPIs and SLAs? Are we confident we can pivot if priorities or technologies shift?

If in the minority fully owning or fully outsourcing platform knowledge, be honest about the risks. All-internal may equate to higher agility, but also higher staffing costs and technical risk. All-external may be efficient today, but it can become fragile tomorrow if internal teams aren’t enabled.

The most effective financial institutions view digital banking as a co-managed asset. They retain knowledge and governance in-house while strategically partnering to fill in gaps.

Source: Alkami Proprietary Research – Surveyed 202 digital banking platform decision makers. Data collected November 5 – December 3, 2024.