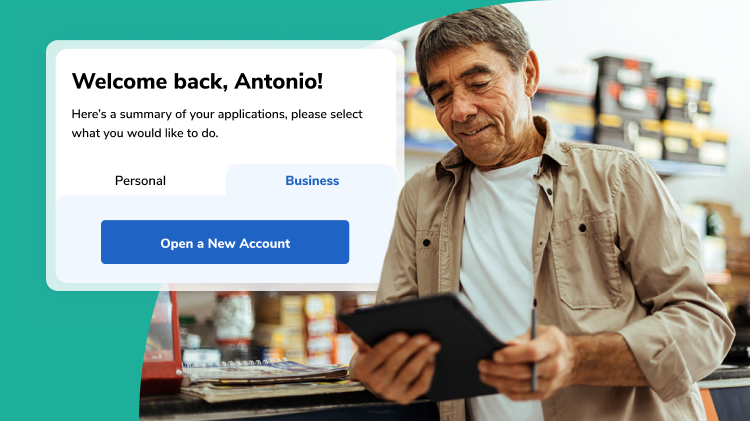

Put business owners in control

Business owners want to delegate—without losing control. With Alkami, you'll help them manage sub-users, set permissions, and act fast with real-time alerts, all without calling your team for every update. More time for them—and you—to focus on growth, not grind.