Mergers and acquisitions (M&A) in the financial services sector are increasingly common as financial institutions seek to enhance their capabilities, expand their customer or member base, and improve operational efficiencies. This trend is especially prominent among smaller institutions that need to stay competitive in a rapidly evolving marketplace. Navigating these complex processes requires a strategic approach. Selecting the right digital banking solutions provider can play a crucial role in facilitating successful M&A activities and growing market share.

According to PwC’s 2024 Outlook Global M&A Trends in Financial Services, the financial services M&A landscape faced a downturn in 2023. Macroeconomic factors, such as high inflation and rising interest rates, dampened M&A activity. Despite these challenges, the need for digital transformation, sustainability, and workforce optimization continues to drive M&A efforts as institutions strive to remain relevant and profitable.

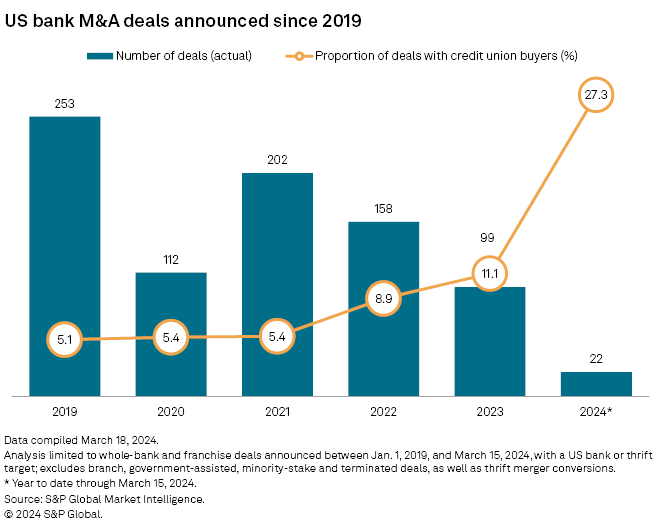

So far in 2024, credit unions account for 21% of buyers in whole bank acquisitions as of June 3.

In the context of mergers and acquisitions, determining success is complex. It isn’t merely about who completes the transaction but rather about achieving long-term strategic growth. The ultimate goal is clear: market share expansion, whether that is accomplished through financial gain, deeper product support, or territory expansion. However, the path to achieving this goal is often lined with challenges, from substantial upfront costs to the extended timeline required to realize a return on investment. As financial institutions strategize for success, one critical question emerges: how can you evaluate vendors to reduce your time to cash and accelerate value realization?

The success of a merger or acquisition hinges on the ability to integrate operations swiftly and efficiently. A significant part of this integration is choosing the right digital banking platform—a decision that can either expedite or hinder your path to profitability.

To ensure that the digital conversion process is positioned to accelerate your value realization, consider these key factors when evaluating vendors:

Speed and Efficiency of Digital Conversion

The faster your institution can convert to a new digital banking platform, the sooner you can start reaping the benefits of the merger. By consolidating operations, the merged institution can expand market share and geographic reach while reducing costs and improving efficiency through economies of scale. With access to new technologies and a wider range of products and services, the institution can enhance the user experience and sharpen its competitive advantage in the market. Additionally, stronger financial stability and increased capital provide a solid foundation for future growth; empowering the merged institution to combine talent, expertise, and innovation to attract new account holders and strengthen existing relationships.

Look for vendors with a proven track record of swift, efficient conversions. Ask for case studies, references, or examples where they have successfully managed conversions in tight timelines without sacrificing quality.

Scalability and Flexibility

In the dynamic environment of a post-merger integration, your needs may change rapidly. Choose a vendor that offers a scalable digital banking solution capable of growing with your institution. Flexibility is also crucial; the platform should easily adapt to evolving business requirements without necessitating a complete overhaul.

Comprehensive Support and Training

Vendor support doesn’t end at implementation. A vendor that provides ongoing training and support can significantly reduce the learning curve for your team, ensuring that your institution can maximize the platform’s potential from day one. This minimizes downtime and helps in achieving quicker operational efficiency.

Proven Return on Investment (ROI)

It’s essential to choose a vendor who can demonstrate a clear ROI on their platform. This includes understanding how the platform can reduce costs, improve self-service and engagement, and ultimately drive revenue growth. Vendors should offer transparent metrics and case studies showing the financial impact of their digital banking solutions.

Security and Compliance

In the financial industry, security and regulatory compliance are non-negotiable. A vendor with layered security measures and a deep understanding of regulations can help avoid costly compliance issues down the line. This not only protects your institution but also ensures that you can focus on driving value from your digital investments.

Culture & Partnership

The company you choose as your digital banking platform should be more than just a provider, they should be a true partner. One whose culture aligns with the merged institution’s values and approach to customer service can create a stronger partnership, ensuring that the platform supports the institution’s goals and delivers a consistent user experience. Cultural alignment also facilitates smoother transitions during the merger, as a provider that prioritizes collaboration and long-term partnership will better understand the institution’s needs and work closely to overcome challenges. In contrast, a cultural mismatch can lead to friction and misaligned goals, undermining the success of the integration.

When two financial institutions merge, one of the most critical decisions they face is choosing the right digital banking provider. With two platforms on the table, the stakes are high: the selected provider must facilitate a seamless user experience during and after the conversion process.

During a merger, account holders and members are often concerned about how the transition will affect their day-to-day banking activities. A seamless user experience is crucial to maintaining their trust and satisfaction. The right digital banking provider will not only ensure that the conversion process is smooth and efficient but also that the new platform enhances the overall user experience.

Successful mergers and acquisitions require a strategic approach that goes beyond just the financials. Financial institutions must tackle a laundry list of regulatory and compliance requirements before they can focus on crafting critical communication to ensure a smooth transition. Clear communication is essential to keep all stakeholders—employees, account holders, investors, and regulators—well-informed and confident in the process. This, coupled with a comprehensive integration strategy, ensures that systems, data, and operations from the merging entities are seamlessly aligned, reducing disruptions and creating operational efficiencies.

In addition to these foundational elements, financial institutions need to carefully manage the costs associated with M&A activities through effective financial planning. This involves evaluating the return on investment of digital banking solutions and other critical technologies to ensure they provide long-term value to the merged entity. Equally important is the integration of employees and cultures from both institutions. By fostering a unified culture and retaining top talent, the merged entity can build a cohesive and motivated team that is well-equipped to drive future success.

Ultimately, the narrative that should drive your decision is simple: Who can bring you to realize the value of your merger or acquisition the fastest? The right digital banking platform isn’t just about features and functionalities; it’s about how quickly and seamlessly it can integrate into your operations to start delivering financial returns. When evaluating vendors, prioritize those who can demonstrate a history of rapid, successful conversions, comprehensive support, cultural alignment, and measurable ROI.

Choosing the right partner can transform a complex and costly merger into a streamlined process that accelerates your path to profitability. In high-stakes M&A decisions, selecting a digital banking platform vendor with a compatible culture is essential for a seamless transition and long-term success. By focusing on speed, scalability, and proven results, your institution can create a vision for success that turns strategic decisions into swift financial gains.

Mergers and acquisitions offer tremendous growth opportunities, but the path to realizing financial gains can be complex and time-consuming. At Alkami, we specialize in helping financial institutions navigate these challenges swiftly and efficiently. Our digital banking platform is designed for rapid integration, allowing you to start seeing the benefits of your merger or acquisition faster than ever before.

With Alkami, you gain more than just a vendor—you gain a partner committed to your success. Our platform provides scalable, flexible solutions tailored to your unique needs, supported by a team dedicated to ensuring a smooth transition and maximizing ROI. As the financial industry evolves, Alkami stands at the forefront, driving innovation and delivering value that positions your institution for long-term success.