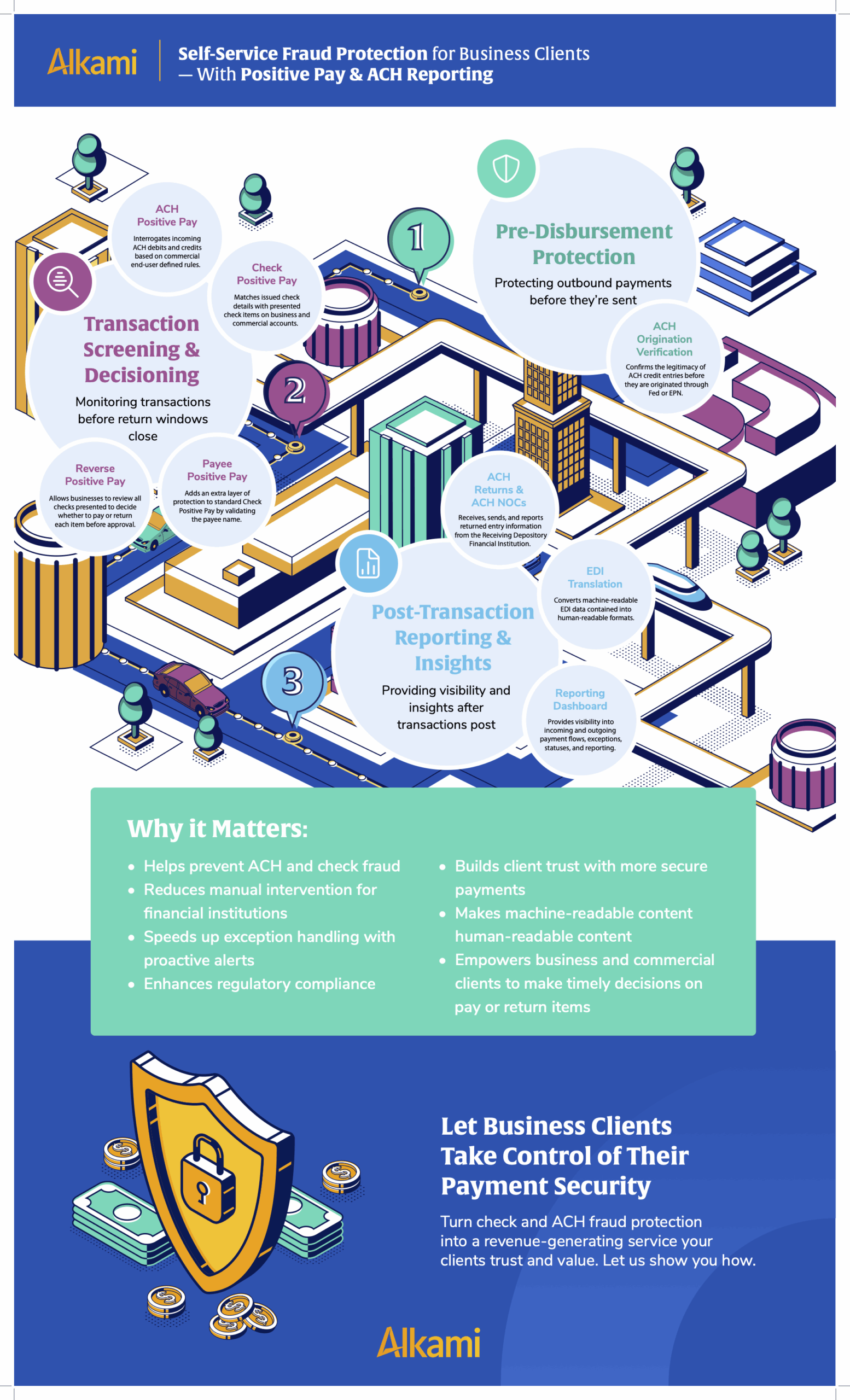

Positive Pay in banking is a self-service fraud prevention tool that protects business and commercial users against unauthorized ACH and check activity by validating transactions at key points in the payment lifecycle.

Designed to work seamlessly across any core or digital banking platform, our all-in-one front- and back-end system helps financial institutions boost operational efficiency, improve client satisfaction, and create new revenue opportunities—without adding complexity.

Protect your business and commercial clients from unauthorized ACH debit and credit transactions by validating incoming transactions against user-defined rules.

Help business and commercial clients protect their accounts from check fraud by automatically matching checks presented for payment against an electronic list or file of those checks they have issued.

Add an extra layer of security to Check Positive Pay by confirming the payee name on the presented check matches the payee name submitted by the business.

Provide business and commercial check writers with an easy way to review and decision checks, without requiring check issuance data.

Promptly notify commercial ACH Originators of Returns and Notifications of Change in easy-to-understand, readable reporting formats.

Automatically convert ACH addenda containing EDI-related information, such as EDI 820 and 835 formats in Commercial Trade Exchange (CTX) and Commercial Credit and Debit (CCD) Entriess, into standardized reporting for faster, more accurate payment application and reporting by your business clients.

Verify outgoing ACH credit entries before they are sent to ACH processors to ensure funds are only disbursed to authorized Receivers.

With our Positive Pay in banking solution, everyone wins: your clients stay protected and in control, and your institution gains a scalable, secure, and profitable advantage.