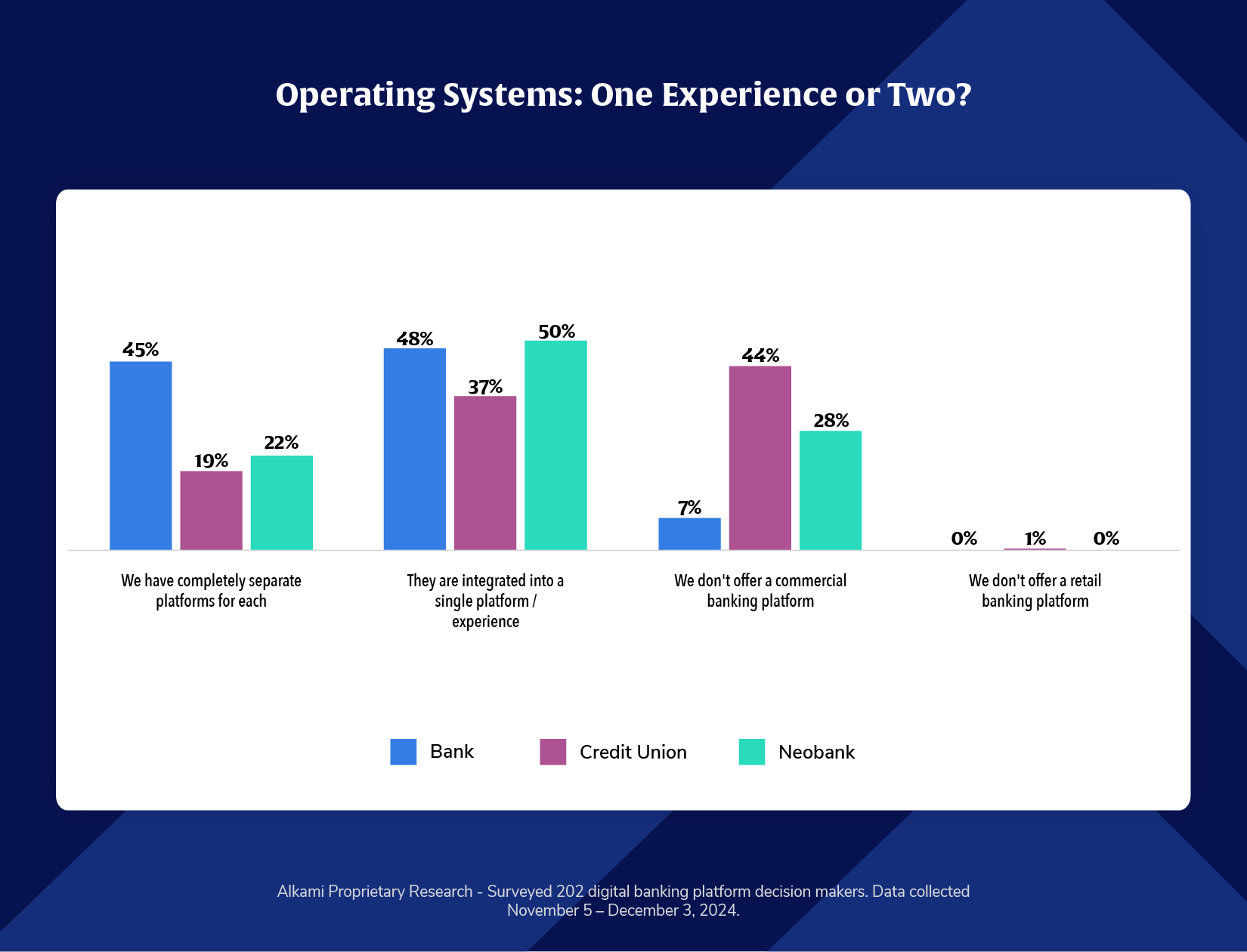

This chart provides a revealing snapshot into how different types of financial institutions structure their digital banking platform across retail and business. Among neobanks, half (50%) have fully integrated their business and retail platforms into a single, cohesive experience. Banks follow closely at 48%. This means nearly half of these institutions recognize the strategic importance of delivering a unified experience to their account holders regardless of whether they’re managing personal finances or running a business.

On the other side of the spectrum, a significant number of banks (45%) and nearly a quarter of credit unions (22%) maintain separate platforms for retail and business. Even more striking, 44% of credit unions report not offering a commercial banking platform at all. However, over the last several years, more credit unions have started to serve businesses in recognition of the revenue and growth potential associated with high-deposit accounts.

This data speaks volumes about both capability and strategy. It underscores how digital maturity varies widely across the industry. Neobanks, born in the digital age, often build with integration in mind. Traditional institutions may still be grappling with legacy systems that make platform unification a challenge. Oftentimes, while reimagining the digital banking platform financial institutions take a phased approach; starting first with retail before addressing the business experience.

The lack of commercial offerings at many credit unions reflects missed opportunity. Business accounts are often high-value, sticky relationships that lead to lending, treasury, and payroll solutions. Not offering business banking could mean walking away from meaningful deposit growth and long-term profitability.

The distinction also affects user experience. Business owners who also hold personal accounts at that institution expect continuity and ease. They don’t want to juggle logins, navigate entirely separate interfaces, or feel like they’re working with two different financial institutions. Instead, they want a single pane of glass where they can manage their finances seamlessly. The banks and credit unions that deliver on this promise are better positioned to win loyalty, drive deeper engagement, and increase share of wallet.

Many financial institutions still treat retail and commercial banking as siloed experiences. The data tells us that while integration is on the rise, it’s far from universal.

Business owners are often also consumers. They don’t think in “platforms.” They think in outcomes: Can I manage my money, move funds, and access insights from one login, one dashboard, one application? If the answer is no, they may look elsewhere.

Financial institutions that successfully unify their platforms are winning loyalty by removing complexity. Integrated experiences can drive usage, reduce call center volume, and open up new cross-sell opportunities by identifying business owners masquerading as retail accounts.

Commercial deposits are too valuable to ignore. Starting with even a basic offering can open the door to deeper, more profitable relationships. To differentiate themselves in a crowded market, financial institutions should consider unifying their digital banking platforms for retail and business in order to make business and retail account holders feel like their financial journeys are understood.

Discover how Alkami’s Digital Sales & Service Platform can deliver a comprehensive banking journey from account opening to everyday banking needs for both retail and business users.

Source: Alkami Proprietary Research – Surveyed 202 digital banking platform decision makers. Data collected November 5 – December 3, 2024.