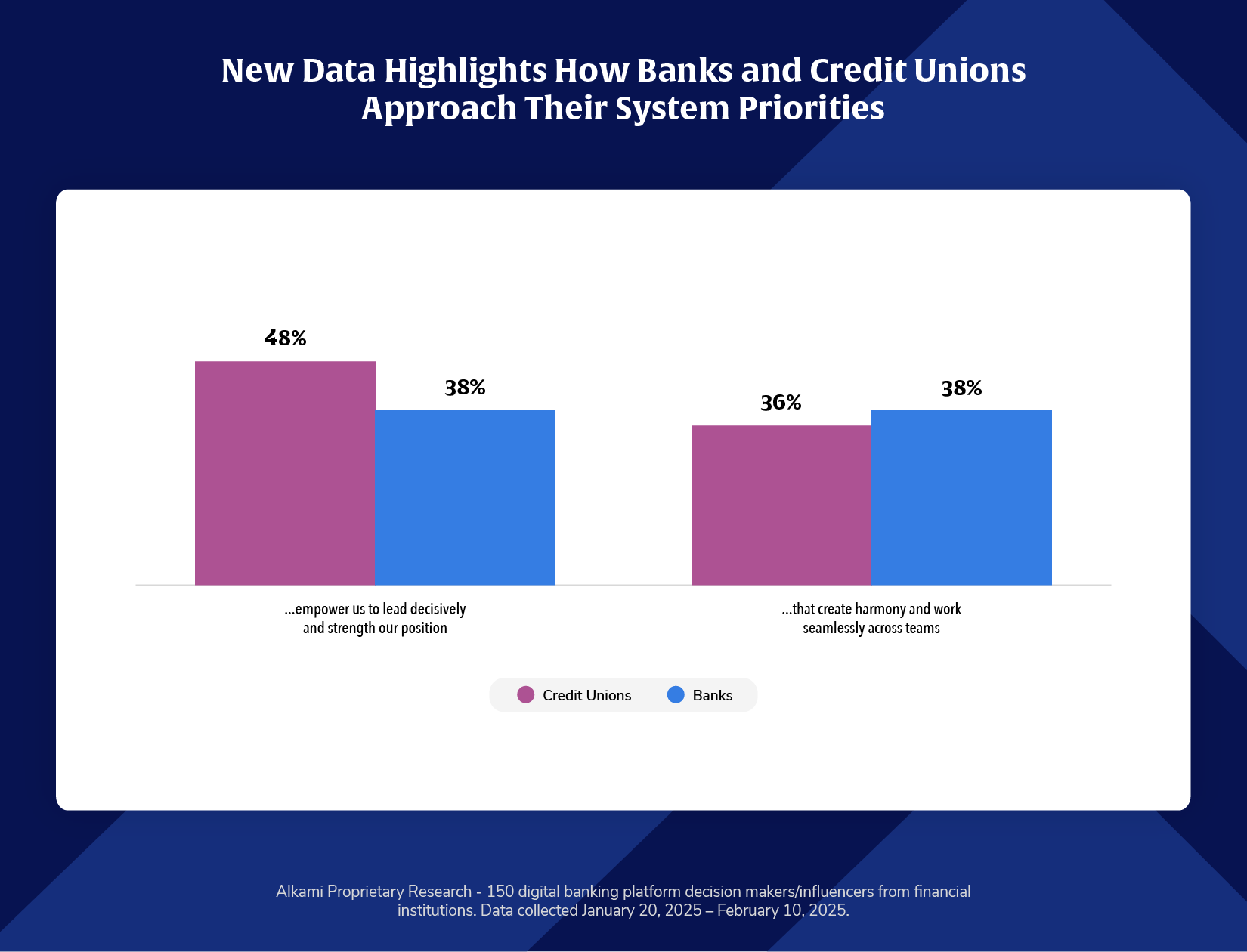

What we’re seeing:

When it comes to system priorities, credit unions and banks reveal meaningful perceptions in what they value most. In recent market research* conducted by Alkami, credit unions tend to favor systems that empower them to lead decisively and strengthen their strategic position—highlighting a clear focus on agility, member-centric leadership, and competitive resilience. In contrast, banks are more evenly divided between that same priority and the need to create harmony and cross-functional cohesion across teams, suggesting a heavier emphasis on operational efficiency and cross-functional alignment – possibly reflecting more complex organizational structures.

Takeaway and Call-to-Action:

When considering investments for internal or external systems, evaluate the options for interoperability and extensibility, so there is flexibility to shift and grow with technology. Align the financial institution’s technology strategy with company values; whether the goal is speed, trust, innovation, or community, make sure the technology stack amplifies what sets the bank or credit union apart. Lastly, be sure to incorporate predictive analytics and behavioral data to anticipate member/customer needs, drive personalization, and reduce churn—without compromising trust.

*Alkami Proprietary Research – 150 digital banking platform decision makers/influencers from financial institutions. Data collected January 20, 2025 – February 10, 2025.