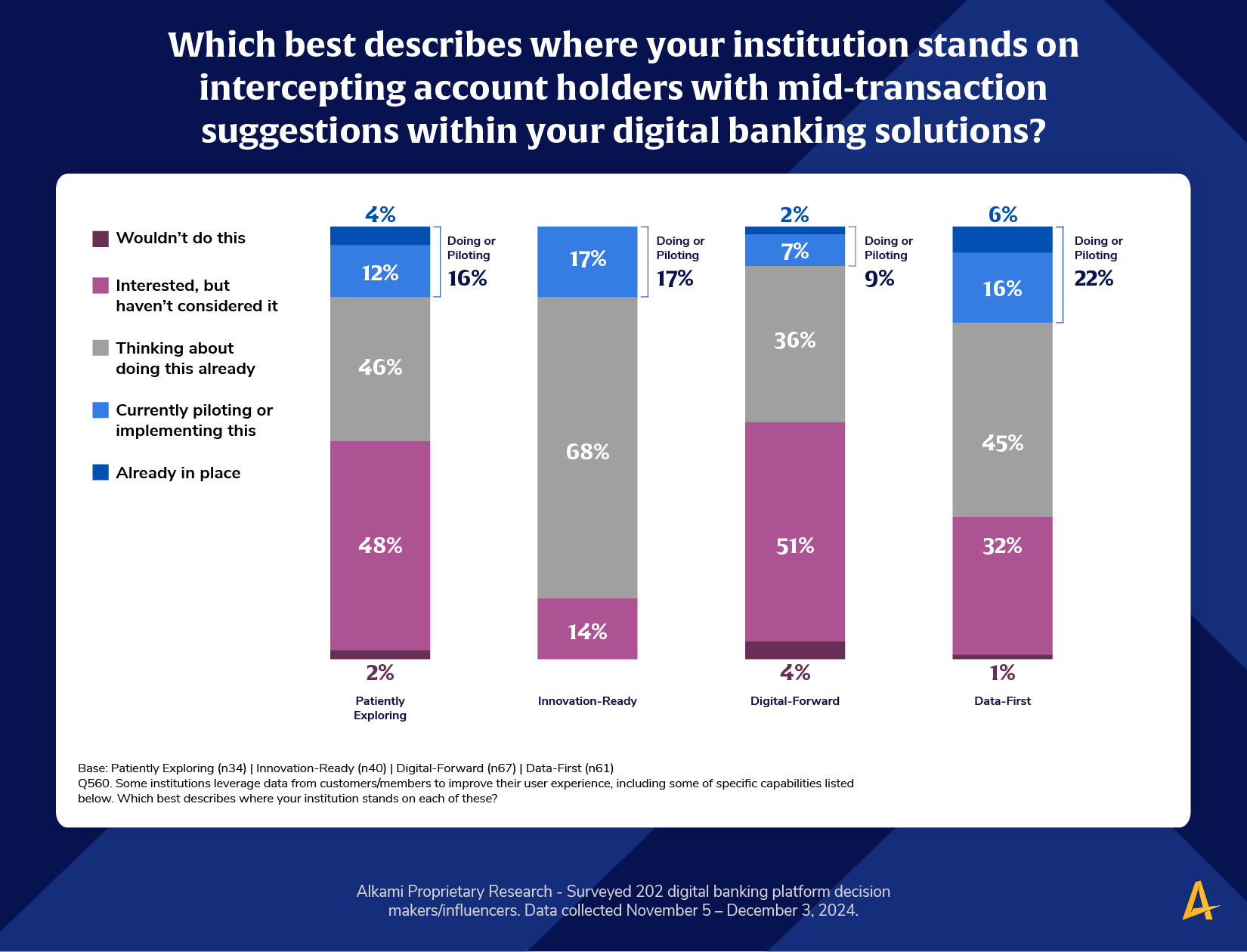

Alkami’s proprietary research reveals a wide spectrum when it comes to the use of mid-transaction suggestions—automated, real-time nudges made during account holder interactions. While the majority of institutions are still in exploratory phases, the most digitally advanced segment is already deploying these features within their digital banking solutions.

Twenty-two percent of the most digitally mature institutions, those categorized as Data-First, are currently deploying mid-transaction suggestions in a meaningful way. This low adoption rate highlights a broader gap between aspiration and execution, even among institutions with advanced digital strategies. It reveals that simply having the infrastructure or tools is not enough; success depends on the will and capability to integrate these tools into a real-time, account holder-first strategy. Meanwhile, a majority of Patiently Exploring institutions (48%) remain in the earliest stages that are interested, but have not even considered the strategy. This widespread inertia suggests that many institutions still underestimate the transformative power of meeting account holders in the moment, despite growing expectations for proactive digital engagement.

This discrepancy shows that digital maturity isn’t just about what you’ve implemented; it’s about how proactively you shape the account holder experience. Anticipating needs before they are expressed, and more importantly before attrition becomes reality. Institutions that are embedding intelligent nudges within the flow of a transaction are creating real-time value, increasing satisfaction, and driving product engagement when intent is highest.

Automated suggestions during digital interactions are becoming foundational to a modern experience. Institutions that want to engage account holders in a meaningful way must evolve past reactive marketing and toward predictive, context-aware experiences.

If your institution is still in the exploratory phase, this research can be used as education to take action. The gap between consideration and implementation is widening. The data tells us that a small majority of institutions aren’t waiting around. They’re already piloting personalized engagements that meet account holders in real-time, without waiting for the next campaign cycle.

The takeaway? Start building or expanding your capability now. Mid-transaction suggestions boost engagement and product adoption, as well as create operational lift by reducing the need for manual follow-up or redundant marketing pushes. Pairing this functionality with a modern digital sales and service platform ensures you have the infrastructure to act on insights as they happen so financial institutions can do more than meet their account holders’ needs, but anticipate them.

Read more in the 2025 Update to Alkami’s Retail Digital Sales & Service Maturity Model.