Picture this: a well-meaning business client calls your operations team at 4:45 p.m. on a Friday. They just noticed an unauthorized commercial ACH debit hit their account—and now they want to know how it happened, how to stop it, and how it got past the blocks they swore were set up.

Cue the collective sigh.

For banks and credit unions, protecting business accounts from fraudulent or unauthorized ACH transactions has traditionally meant relying on ACH blocks and filters. While these tools have served a purpose, let’s be honest—they’re starting to show their age. The more volume and complexity you manage, the more these band-aid solutions start to feel like a game of digital dodgeball.

Enter ACH Positive Pay with Alkami—a smarter, cleaner, and more user-friendly way to manage ACH fraud prevention that brings efficiency and consistency to your operations and control back to your business clients.

ACH blocks and filters are legacy fraud prevention tools used to stop unauthorized electronic withdrawals from business accounts. Think of ACH blocks and filters as the bouncers of your ACH club—keeping unwanted transactions from entering the party.

While these tools work, managing the addition and removal of ACH blocks and filters usually falls squarely on your operations team. It’s a manual, time-consuming task that often requires inputting filters one by one, responding to exceptions, and dealing with panicked calls from clients when something goes wrong.

Now, multiply that by dozens—or hundreds—of business accounts. You see where we’re going…

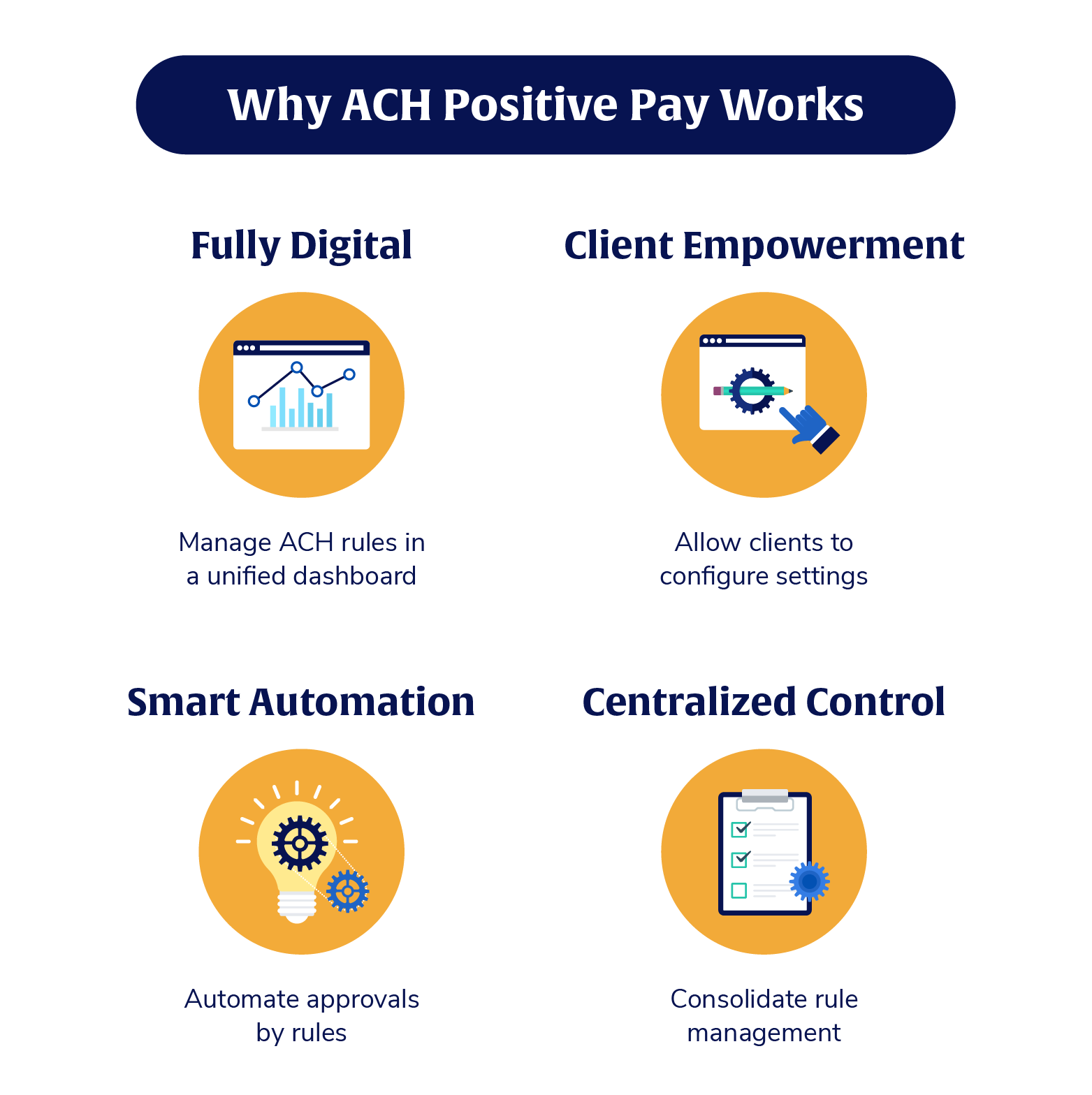

ACH Positive Pay takes the foundational concepts behind ACH blocks and filters and levels it up. It replaces reactive, fragmented workflows with a proactive, streamlined process. Here’s what sets it apart:

No more internal spreadsheets, shared inboxes, or legacy systems that crash more than they process. With ACH Positive Pay via Alkami, you move to a completely electronic process for managing ACH activity. Exception handling, rules management, and approvals can be done through a modern digital experience—no swivel-chairing between systems.

Imagine empowering your business clients to set up and manage their own ACH filters and exceptions—within clearly defined controls. Alkami’s platform offers self-service capabilities, so your operations team isn’t bogged down with every single change request or transaction review. This isn’t about handing off responsibility—it’s about giving businesses the tools to handle their own security with confidence.

Here’s a game-changer: ACH Positive Pay lets users define trusted companies (and blocked companies) and automate approvals based on rules like amount limits, frequency, and timeframes—so everyday transactions from known vendors don’t clog up your exception queue. That means fewer exceptions to review, fewer errors, and way less stress. Instead of catching every fish with the same net, you’re setting smart rules that handle the routine transactions automatically.

Many financial institutions manage ACH fraud protection through a patchwork of Demand Deposit Account (DDA) blocks and ACH platform filters. This setup can lead to inconsistent rule application, errors, and frustration. By enrolling business clients directly in ACH Positive Pay, you consolidate control in one place, reducing confusion and simplifying operations.

The result? A streamlined process for your team and a better experience for your business clients.

While legacy ACH blocks and filters do their best to patch the problem, Alkami’s ACH Positive Pay is built to solve it—with less effort, more control, and scalable fraud protection that meets your institution where it is today (and where it’s growing tomorrow).

Here’s why financial institutions choose Alkami:

Forget managing multiple systems. Alkami’s Positive Pay & ACH Reporting solution is core and digital banking agnostic—so you can implement advanced fraud prevention tools without painful patchwork integrations; giving you flexibility without sacrificing functionality.

Empower your business clients to do more on their own—with confidence. With Alkami, users can set ACH transaction rules for amount limits, frequency, or authorized originators, and approve or block items. The platform even automatically generates WSUDs (Written Statements of Unauthorized Debit), minimizing your internal workload while improving the client experience.

Alkami’s solution is built for growth. Whether you’re offering basic compliance or full-scale treasury services, ACH Positive Pay gives you the tools to reduce manual work, increase reporting accuracy, and automate exception handling—including ACH returns and ACH NOCs. It’s protection that scales alongside your commercial portfolio.

We get it—ACH blocks and filters have been reliable companions over the years. But at some point, it’s time to move on. Between the manual work, the inconsistency, and the reactive nature of the process, it’s clear they’re not built for the digital banking experience your business clients expect.

With ACH Positive Pay from Alkami, you’re not just adding another feature—you’re building a modern fraud prevention framework. You’re reducing risk, increasing efficiency, and improving client satisfaction—all while giving your operations team a much-needed breather.

Let go of the ACH filter drama, embrace the modern ACH Positive Pay solution that does the job better, smarter, and with fewer headaches.

Ready to upgrade your ACH fraud protection?

Let’s talk about how ACH Positive Pay from Alkami can make life easier for your teams—and safer for your business clients.