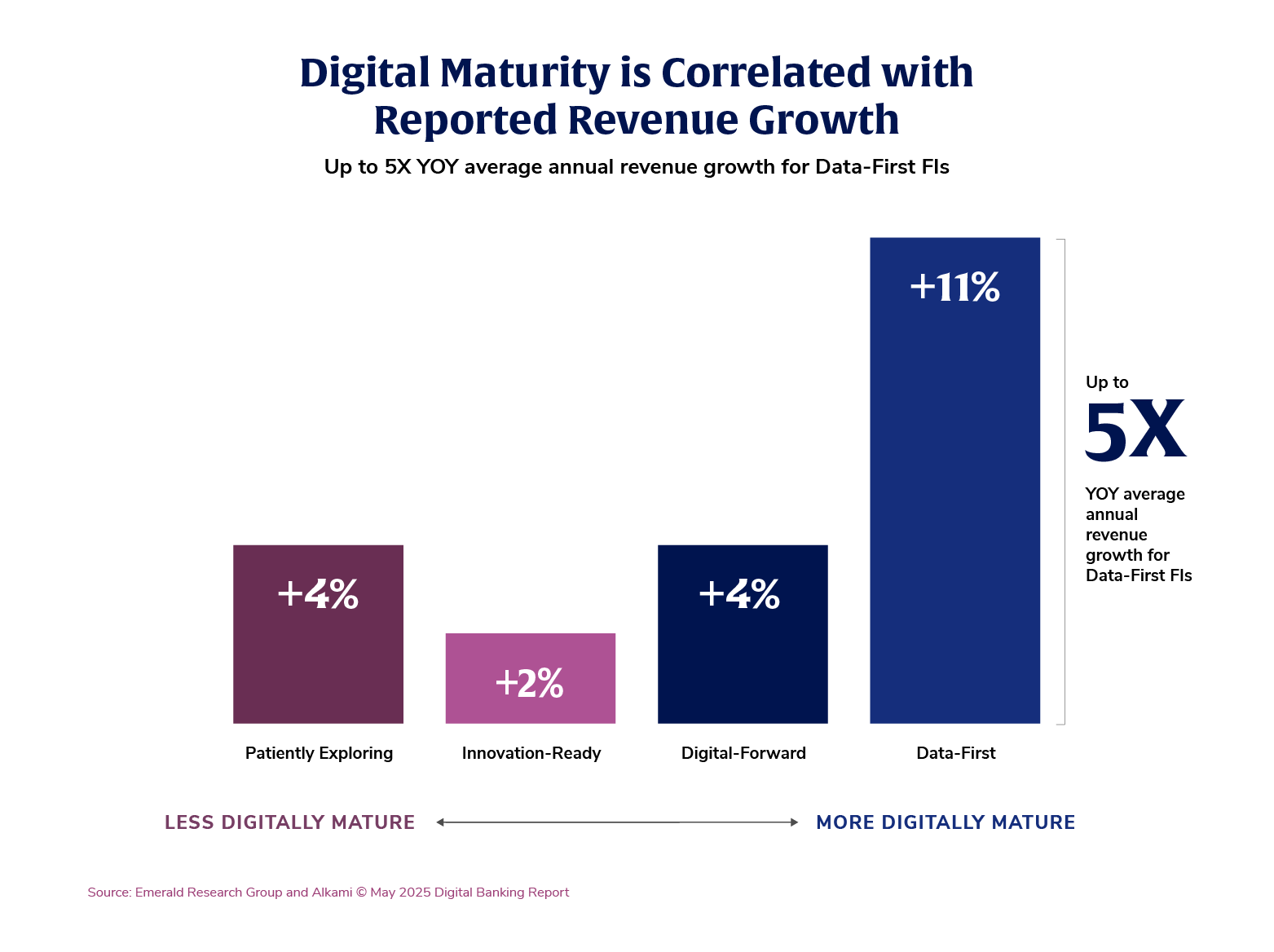

Banks and credit unions know that growth today is fueled by data. As shown in The 2025 Digital Banking Playbook, data is the foundation across a financial institution’s technology stack. Financial institutions that put data first and execute a data modernization strategy represent the most digitally mature institutions in the market, and also report up to 5x the average annual revenue growth compared to their peers. But institutions can’t just collect data. They must activate it to engage the right people, at the right time, with the right offer.

INB, a $2 billion national bank headquartered in Springfield, Illinois, has found that sweet spot for marketing for financial institutions. On a recent webinar, two marketers from the team at INB—Alysse Hewell, Director of Marketing and Communications and Lindsay Van Zele, Communications Officer—shared their wins using data-driven financial services marketing automation to drive deposit growth while attracting younger customers to the bank.

One of INB’s most recent successes came from a targeted certificate of deposit (CD) cross-sell campaign. By identifying customers with competitive investments who were also browsing for CD products, while excluding those who had recently opened a CD, the bank zeroed in on high-potential prospects.

The ads ran both on INB’s public website and within its digital banking portal, a channel where customers are already actively managing their money. This “moment of relevance” approach delivered big: in less than a month, the campaign generated more than $646,000 in new CDs.

The ability to place targeted ads inside the digital banking platform was a game changer. “We were able to add those targeted ads to our digital banking site where we know people are going to do the activity that they need to do throughout the day,” Alysse said. “That’s where we’re going to capture the audience. That was a huge win for our team.”

To attract younger customers, INB developed a creative “Baby Bundle” campaign, bundling a high-rate CD with a savings account intended for a new child.

“We were trying to think of new and fun ways to get younger folks to come bank with us,” Lindsay said. “For young families, let’s open a high-interest-rate CD and a savings account at the same time. Once that CD gets to the maturity date, then that money can just be moved right into a savings account for that child. And once we start them in young, hopefully we’ll have these customers throughout their lifetime.”

Launched in 2023, the campaign runs continuously with “always-on” automation. Updating creative takes just minutes, and results can be tracked daily. This sustained effort continues to bring in new accounts while positioning INB as a forward-thinking, family-friendly bank.

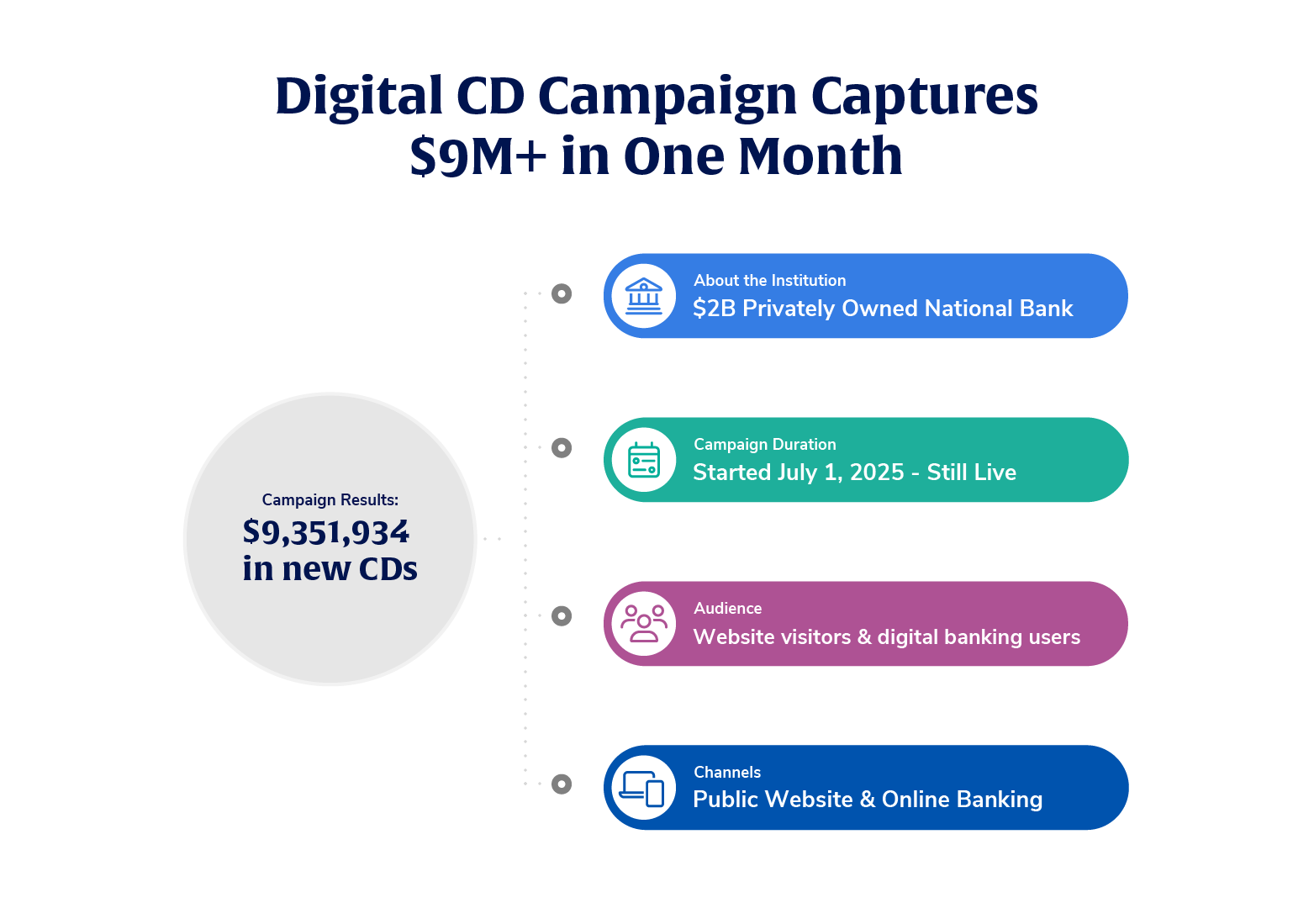

While targeted campaigns are powerful, INB also saw value in running a non-targeted CD campaign at the same time. This broader approach served ads to all website visitors and digital banking users, regardless of specific behaviors.

“People don’t know what they need until they need it,” Alysse said. “And you never know when they’re going to be like, oh, wait, maybe I need to look into this. If you don’t ask, you won’t get them.”

In just over a month, the results topped $9 million in new CDs. Running both targeted and broad campaigns allowed the bank to maximize reach while still delivering relevant offers.

One of the biggest advantages of INB’s data-driven financial services marketing automation approach is the ability to measure ROI with precision. Monthly reports shared with executives and the board highlight campaign performance, accounts opened, and new funds brought in. This level of reporting not only proves marketing’s impact, but it also builds alignment across the bank.

Lindsay said, “We do a report monthly for our board of directors and our senior management team. We kind of give them a breakdown of the campaigns that we are running, what’s working, what may not be working, how many accounts have been opened, and really just celebrate those wins with our retail team and the entire bank. It just goes to show that what we’re doing is working and we’re able to see new customers and new money come in.”

“The platform is so easy. To change the creative out, which we do a couple of times a year, it takes five minutes to upload it, not even,” Alysse said. “Then you can actually see those results after day one of running that creative. Did people like it? Is it working or do we need to make an adjustment? With Alkami, this is really the only platform that we can see a true return on investment. We’re not getting that with any other platform that we work with.”

Financial institutions can’t afford to rely solely on traditional advertising or static campaigns. As INB’s story shows, using data to guide targeting, creative, and timing leads to measurable results, and the ability to continually improve. By pairing targeted and broad campaigns, engaging in relevant digital touchpoints, and tracking performance in real time, banks and credit unions can grow deposits, attract new account holders, and strengthen relationships.