Selecting the right digital banking platform vendor is one of the most critical decisions a financial institution can make. Whether you’re seeking a more modern experience, greater flexibility, or deeper integration capabilities, knowing where to begin can feel overwhelming.

How to Begin a Digital Banking Evaluation: A Step-by-Step Guide for Financial Institution Leaders was created to help you build a framework to move forward with clarity. This guide breaks down the key phases of a successful evaluation—from aligning stakeholders and defining goals to identifying must-have requirements and engaging potential vendors. Along the way, it highlights the key roles involved, common challenges to anticipate, and best practices for laying the groundwork for long-term success.

Whether you’re just beginning to explore your options or preparing to launch a full-scale request for proposal (RFP), this resource will help you take the first steps with confidence and purpose.

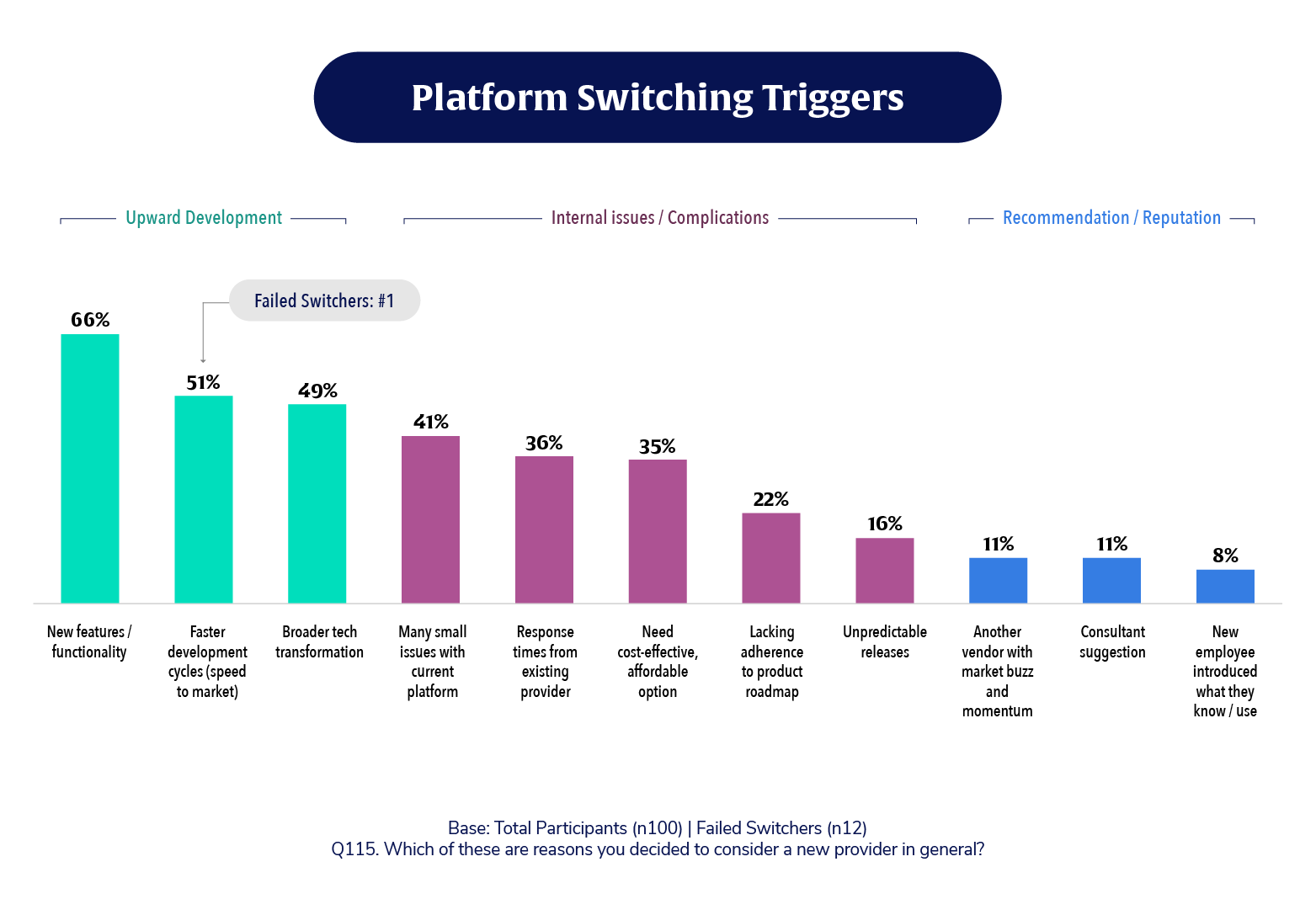

Before evaluating vendors, take time to clearly articulate why your institution is considering a digital banking platform change. Define the core business drivers – whether it’s modernizing outdated technology, improving the user experience, enhancing scalability and security, or enabling third-party integrations. Identify specific challenges your current technology may have that can be flipped to an opportunity with a new platform. Most importantly, align your internal teams around strategic goals such as growth, retention, and operational efficiency so every decision you make during the evaluation supports those priorities.

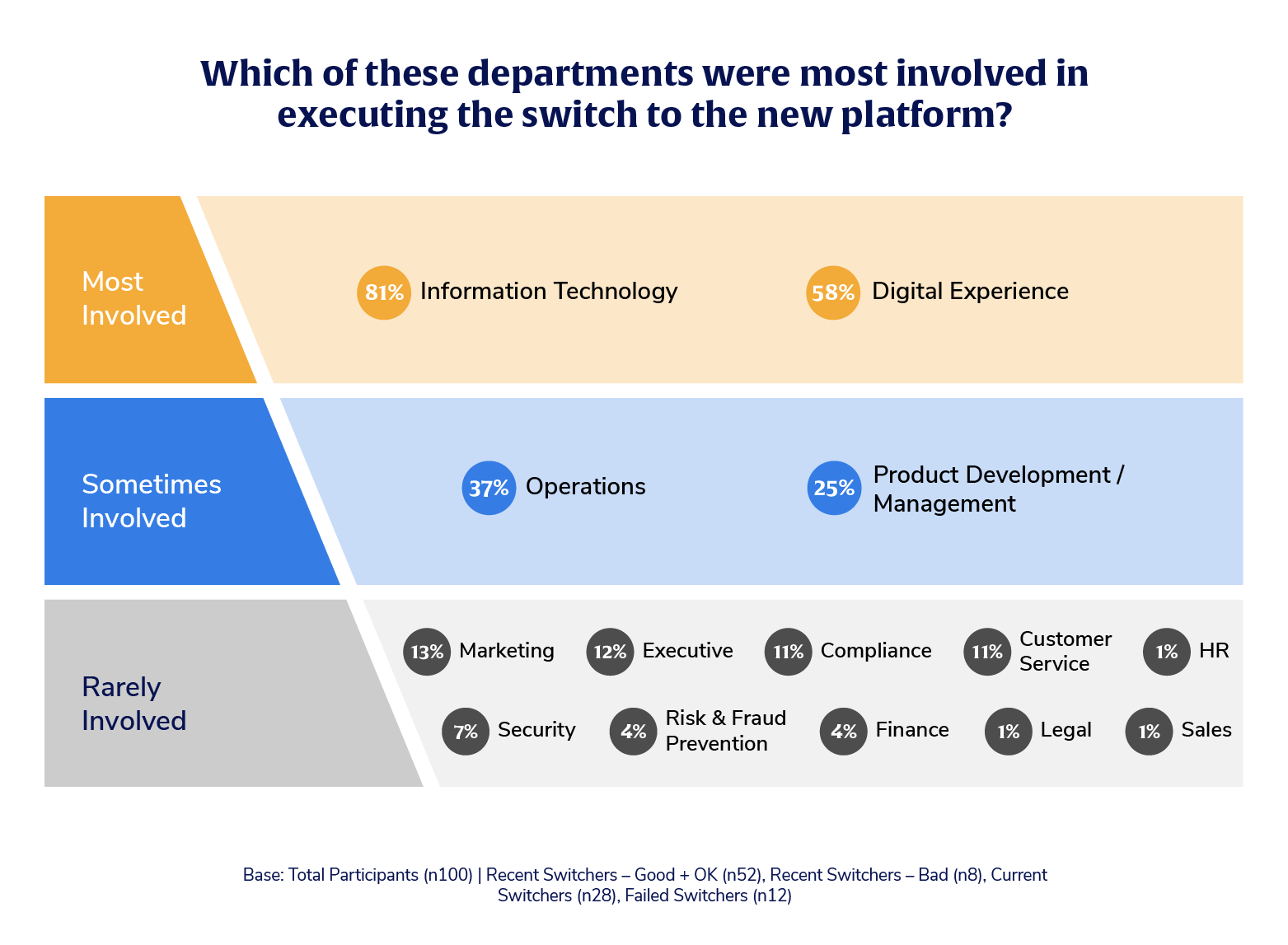

A successful digital banking software evaluation depends on collaboration across departments. Start by forming a cross-functional task force that includes representatives from information technology (IT), digital banking/experience, operations, marketing, and risk/compliance. Each brings a unique lens:

Appoint a dedicated project lead and an executive sponsor, ideally someone at the executive level to remove roadblocks and ensure alignment across stakeholders. Take time early on to define each team member’s role and area of input. The project lead and their team will engage in vendor communications, manage the request for proposal (RFP) process, and document technical requirements. A well-structured team helps maintain momentum and ensures the evaluation reflects the full scope of your institution’s needs.

Before engaging vendors, take the time to clearly define what you need in a new digital banking platform, and why. Align internal teams on your non-negotiables versus nice-to-haves, so everyone is evaluating solutions through the same lens. This clarity will keep your process focused and help you avoid being distracted by features that don’t serve your goals.

Identifying the right internal stakeholders is essential—from IT and operations to digital and user experience—to ensure cross-functional input and readiness from the start. Doing this upfront sets you up for a more efficient and informed evaluation.

View the Sample Needs Assessment to help your stakeholder team begin capturing and organizing the business needs driving your search for a new digital banking platform.

From platform-based solutions to point products, legacy systems to modern cloud-native offerings, the market is vast and moving quickly. Use this stage to educate your team, explore what’s possible, and build a broad view of the vendor ecosystem. The more informed you are now, the more confident and empowered you’ll be later, and able to narrow down your shortlist on your own terms, not just based on the most eyecatching demos or sales pitches.

Read analyst reports, peer referrals, and user communities to get a balanced view of the conversations being had in the industry. Here are some to consider:

Using Analyst Reports to Guide Your Evaluation

Analyst reports offer unbiased insights into vendors, market trends, and platform capabilities—helping you quickly understand who stands out and why. They’re a smart way to narrow your shortlist, validate assumptions, and uncover critical questions early. In short: they help you evaluate faster, smarter, and with more confidence.

Tapping Into Peer Insights for Digital Banking Evaluations

When starting a digital banking evaluation, connecting with peer institutions through user communities and groups is a smart first step. These conversations offer real-world insight into what others have learned—vendor performance, evaluation criteria, implementation challenges, and hidden costs.

By learning from those who’ve already been through it, you can avoid common missteps, uncover smarter strategies, and make more confident, informed decisions. It’s a small investment of time that can lead to better vendor alignment and stronger long-term results.

Begin building your vendor list, but keep in mind: features alone shouldn’t drive your shortlist. Focus instead on alignment with your long-term strategy, flexibility, and partnership potential.

As you evaluate vendors, it’s important to estimate the total cost of ownership including implementation, customization, licensing, integration, training, and ongoing support. Go beyond price alone by identifying key return on investment (ROI) drivers, such as faster feature deployment, improved operational efficiency, increased digital adoption, or stronger user retention. Start preparing early materials that clearly outline the business case, so you can secure leadership and board buy-in when it’s time to move forward.

Once you’ve defined your needs, begin reaching out to vendors with purpose. Set up initial discovery calls to assess strategic alignment and cultural fit. Request tailored demos that focus on your institution’s specific priorities, whether that’s configurability, real-time data access, or self-service tools. Be transparent about your goals, challenges, and any non-negotiables to ensure the conversations are productive and focused from the start.

A great digital banking evaluation doesn’t end with vendor selection – it prepares you for what’s ahead. Assess your internal capacity to manage implementation, including IT resources, training needs, and timeline expectations. Start outlining a change management and communication plan to keep staff and account holders informed and engaged. Finally, choose a vendor who does more than provide technology. Instead, find a partner who can support your long-term vision – one that enables ongoing innovation, extensibility, and a true collaborative relationship beyond go-live.

Bringing in a consultant can bring clarity, speed, and confidence to your digital banking evaluation. These experts understand the market, anticipate common pitfalls, and can help you define clear requirements, align internal stakeholders, and avoid costly missteps.

Whether you’re short on time, navigating internal complexity, or simply seeking an experienced advisor, a consultant can de-risk the process and position your institution to make a confident, future-ready decision.

Key considerations when selecting a consultant:

Choosing a digital banking software partner isn’t just a technology decision, it’s a strategic move that can shape the future of your institution. By following these steps, you’re already laying the foundation for a thoughtful, well-structured evaluation process rooted in clarity, collaboration, and long-term vision.

As you move forward:

Need a sounding board or want to see how other institutions are navigating their evaluations? Whether you’re just getting started or exploring what’s possible, our team is here to share real-world examples, success stories, and practical insights to help guide your next step.

The research provided in this blog is from:

Alkami Proprietary Research – Surveyed 100 digital banking platform decision makers/influencers who recently switched or explored switching platforms. Data collected November 27, 2024 – December 19, 2024.