For banks and credit unions, delivering personalized digital interactions isn’t optional anymore. It’s expected. Research has proved the digital experience is the banking experience. And at the center of the digital experience is data. Digital maturity has become a key factor to determine which financial institutions thrive, and the most digitally mature institutions are using financial services data analytics to keep ahead of the competition.

According to Alkami’s 2025 Update to the Retail Digital Sales & Service Maturity Model, financial institutions are segmented into four distinct cohorts—each representing a unique stage of digital growth, from Patiently Exploring (least mature) to Data-First (most mature). Understanding your institution’s cohort can help you clearly identify next steps toward digital excellence; learn more about each cohort and their unique characteristics in this blog.

Digital maturity defines how well a financial institution leverages technology across its business.

That includes:

Research shows that the most digitally mature institutions report up to 5X higher average annual revenue growth compared to their peers. One initiative that is contributing to the digital maturity of these organizations is they are moving beyond basic reporting to use financial services data analytics strategically, improving marketing results and the account holder experience.

As digital capabilities grow, so does the ability to deliver greater value to account holders and back-office teams.

The most advanced financial institutions use data analytics in banking to:

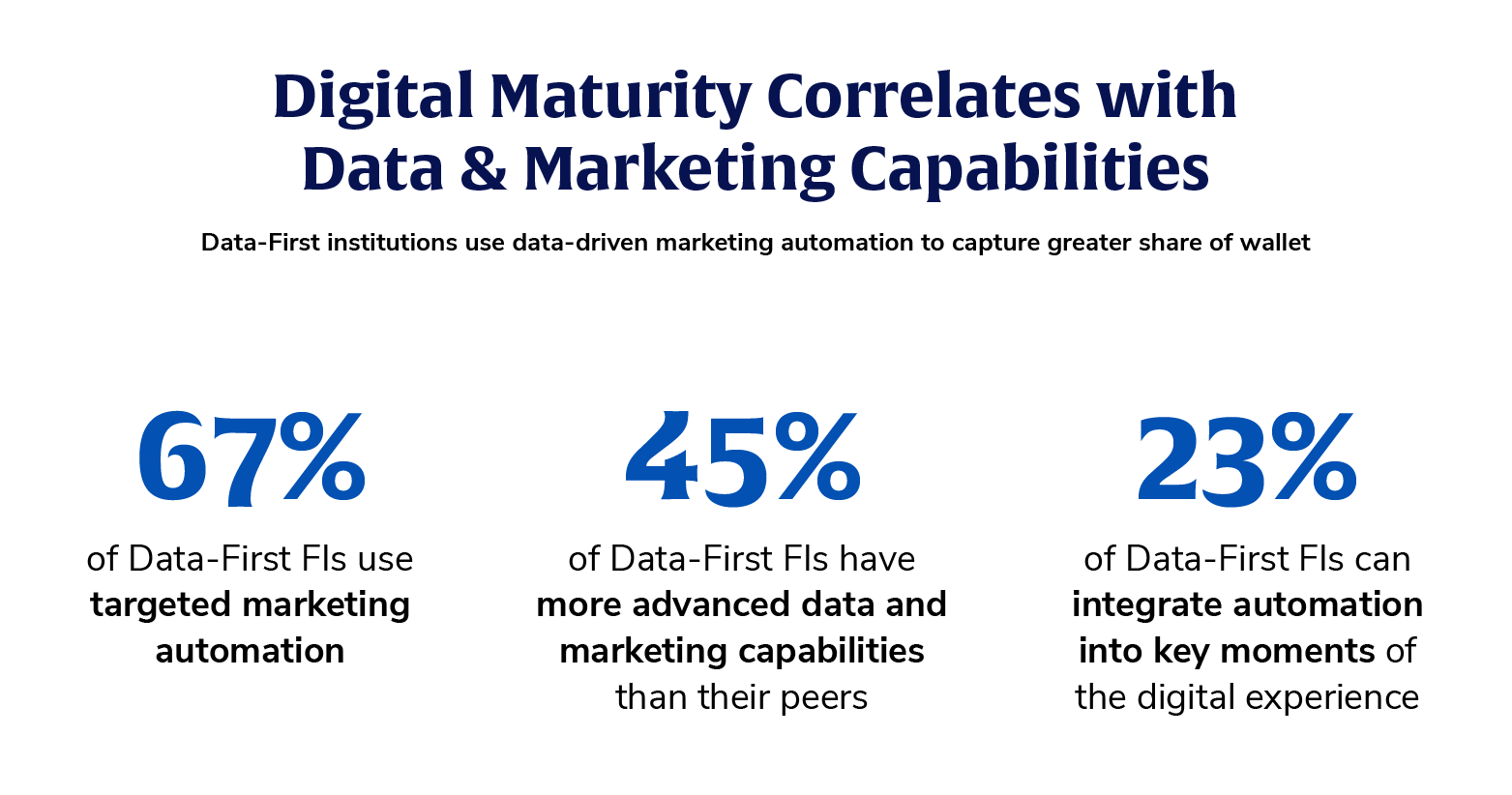

This shift from reactive to proactive engagement marketing leads to stronger relationships and better business results. In fact, 67% of the most digitally mature institutions use targeted marketing automation. Nearly half say they have more advanced data and marketing capabilities than their peers. And 23% have already integrated automation into key moments of the digital experience. This shows the most digitally mature financial institutions have a step up on using financial services data analytics to achieve better business results.

One of the things I marveled at when we launched Alkami Data & Marketing Solutions was our ability to identify microniches, even to the person-level if we wanted to.

– Chad Gramling, Assistant Vice President of Business Intelligence, 3Rivers Federal Credit Union

Discover how 3Rivers Federal Credit Union uses data analytics to meet members at the right moment.

Data challenges don’t disappear with digital maturity. They evolve.

Early-stage institutions often struggle with basic issues like data access and siloed systems. They’re still trying to bring their data together and make it usable. As institutions become Digital-Forward, the challenges shift to the time and resources required to transform data into actionable insights. These teams may have the right tools but lack the bandwidth to fully use them.

But Data-First institutions have already solved the basics. They’ve cleaned and organized their transaction data, integrated it across platforms and automated delivery. Now they’re focused on using those insights to influence behavior, whether that’s increasing product adoption, boosting wallet share or preventing attrition.

For Clearwater Credit Union, financial services data analytics is catalyzing the personal experience for account holders – converting financial institution leaders into data-informed digital bankers – where they can anticipate needs and optimize engagements.

Alkami’s technology allows our marketing team to do what they’ve long wanted to: connect the dots across data and behavior to deliver meaningful, timely communications to our members. The insights from the transaction data enables us to understand and walk alongside our members through all their life stages, helping them to thrive financially.

– Deborah Colby, Chief Marketing Officer, Clearwater Credit Union

Clean, structured data is the foundation of any strong artificial intelligence (AI) in banking strategy. And financial institutions are using data-powered predictive AI models to improve everything from operational efficiency to marketing performance.

With better data, predictive AI models can:

The result: More personalized experiences, stronger engagement and better outcomes for both the institution and the account holder.

For Capital Credit Union, Alkami’s Predictive AI cross-sell models captured prospects that wouldn’t have been found otherwise:

Read more about Capital Credit Union’s use of predictive AI here.

The gap between digital leaders and the least mature is widening. And one of the differences is how well they use their data. Advanced data and marketing capabilities correlate directly with revenue growth.

Financial institutions that invest in financial services data analytics are gaining a competitive edge by:

Financial services data analytics is no longer just a technology investment. It’s a strategy for growth, personalization, and long-term success. Now is the time to put your data to work.