Meet your users where they are with payment options that work around their schedule and lifestyle.

Managing loan payments shouldn’t feel like a chore. Today’s borrowers expect the same level of control, convenience, and flexibility from their loan payments as they do from every other digital experience in their lives. But too often, the loan payment process feels disconnected, as complicated steps, limited options, and friction leaves borrowers frustrated. With the right digital banking solutions in place, financial institutions can streamline the experience and meet borrowers where they are.

Through Alkami’s partnership with Alacriti, when you leverage integrated loan payment capabilities directly within your existing digital banking platform, you can give your users the self-service tools they expect. Making loan payments simple, seamless, and even an opportunity to build satisfaction and loyalty.

The Modern Payments Expectation: On-Demand, On Their Terms

Whether it’s ordering groceries, managing subscriptions, or transferring funds, consumers are accustomed to frictionless self-service. Digital banking solutions and loan payments are no different. Borrowers want the ability to manage payments anytime, anywhere, without logging into separate portals, calling in, or mailing a check. Seventy-six percent of consumers are likely to switch financial institutions if they find one that better meets their needs (up from 52% in 2020), which means financial institutions must act decisively to meet emerging challenges and seize new opportunities.

This pivotal shift defines the baseline for a positive user experience.

Self-Service Tools Reduce Friction and Boost Satisfaction

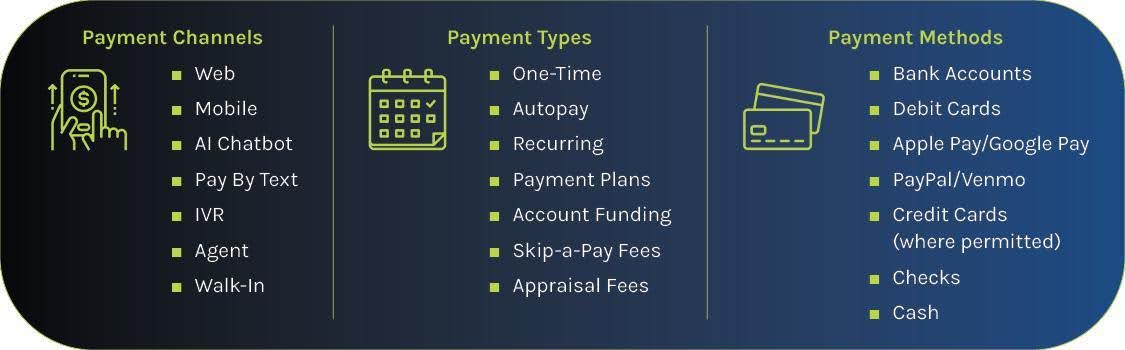

An embedded, intuitive loan payment experience makes life easier for borrowers and drives adoption of your digital channels. By integrating Alacriti’s payment capabilities into Alkami’s Digital Banking Platform, you can offer:

- Integrated Loan Payments: Borrowers stay within your digital banking experience with single sign-on, making payments from the same place they check balances or transfer funds.

- Recurring Payment Options: Automatic payments help borrowers stay on track, reducing missed payments and late fees, while giving them peace of mind.

- Timely Payment Reminders: Sixteen percent of consumers say that receiving bill due date alerts would improve their satisfaction with digital bill payment experiences.

- Skip-a-Pay: Flexible skip-a-payment options give borrowers the ability to defer a payment when needed, without disrupting their overall loan schedule or burdening your call center.

These tools remove common pain points and build confidence, two key ingredients for lasting satisfaction.

Flexibility That Matches Borrowers’ Diverse Needs

No two borrowers are alike. Some prefer to pay from their checking account, while others use debit cards, and many want the option to pay from an external account. A modern loan payment experience needs to support those preferences.

Alacriti’s EBPP solution is designed with that in mind. By offering a wide range of payment methods including automated clearing house (ACH), debit card, and external account options, borrowers can pay on their terms through multiple channels like mobile, text, and web. That flexibility doesn’t just meet expectations–it removes barriers and encourages consistent, on-time payments.

Why It Matters

When loan payments are easy, flexible, and part of your digital banking experience, everyone benefits:

- Borrowers stay in control, avoid frustration, and are more likely to engage with your digital banking platform and digital channels.

- Financial institutions see higher payment adoption rates, fewer missed payments, and increased digital engagement.

- Your financial institution earns trust by delivering a seamless experience that encourages customers or members to adopt more banking products.

With the partnership between Alkami and Alacriti, financial institutions can turn payments into positive, frictionless experiences with the flexibility and self-service borrowers want, and the operational efficiency you need.

The Bottom Line

Loan payments shouldn’t be complicated. By giving borrowers the tools to manage payments on their terms anytime and anywhere, you create an experience that fits their life and strengthens the relationship in the process.

Want to learn more? Connect with an Alkami representative to explore Alacriti’s payments solutions and how, together with your digital banking solutions, they can help you increase engagement and lasting loyalty.