When financial institutions combine data-driven strategies with Predictive Artificial Intelligence (AI), they gain the power to anticipate account holder needs and respond before those needs are expressed. This is the catalyst of Anticipatory Banking: moving from reacting to proactively predicting what account holders will want next.

Behavioral data tags, like these Top 100 Data Tags for Financial Institutions, are at the center of Predictive AI modeling. These are highly normalized, categorical data labels that feed predictive insights, built from real activity such as product usage, transaction history, and spending behavior. Organized into time-series data that can span multiple years, they turn messy data into clear signals.

With these signals, Predictive AI models can detect early patterns, like someone preparing to open a new loan, so your institution can act quickly and capture the opportunity. Models run daily, refreshing predictions of account holder interest, engagement, or attrition risk.

Because the data is already clean and actionable, you don’t need lengthy prep work. With AI Modeling, you can deploy predictive models quickly, turning insights into campaigns that drive lending, expand deposits, and strengthen loyalty. Instead of waiting for account holders to raise their hands, you’re already ready.

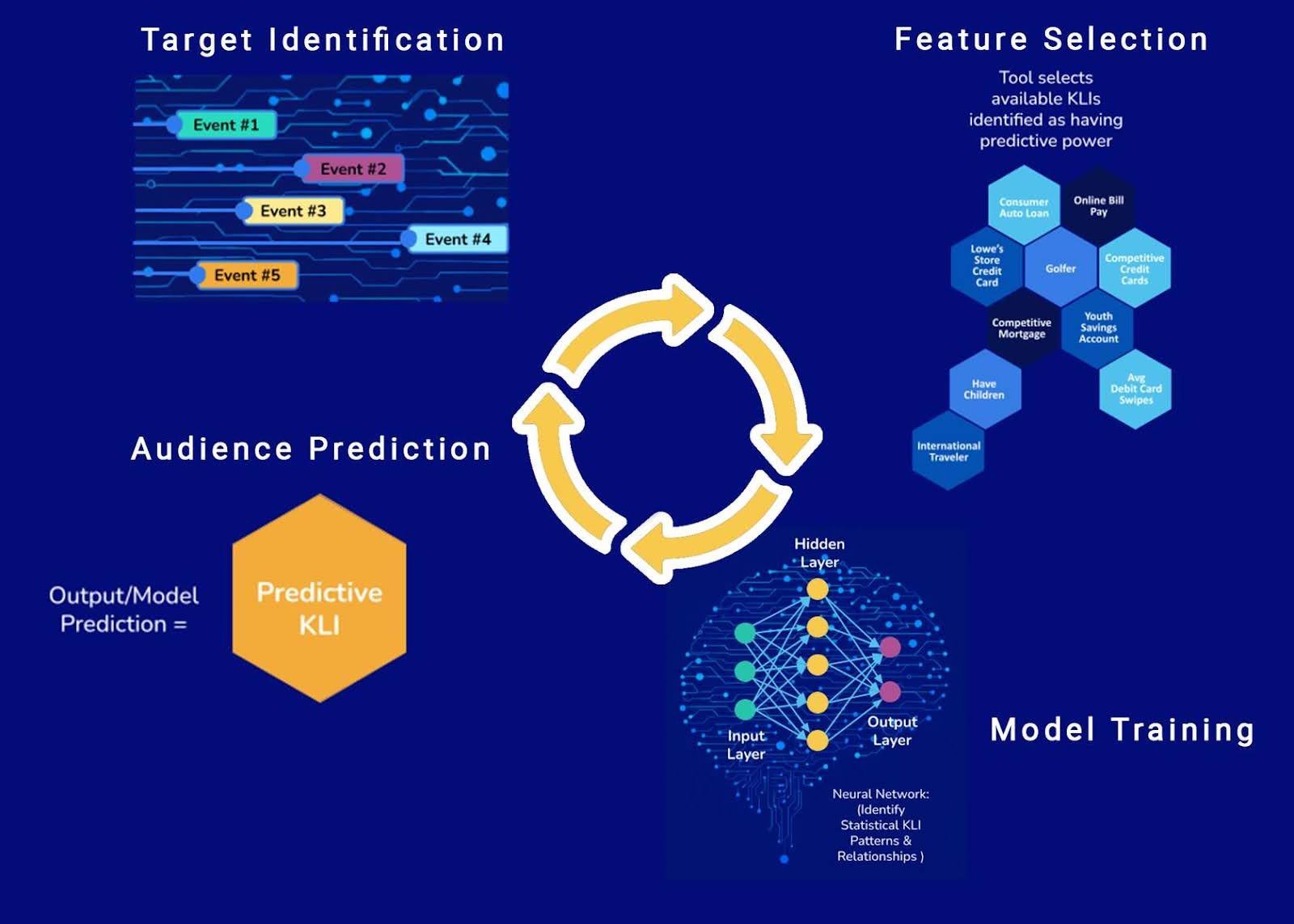

Predictive AI gives banks and credit unions a way to move from raw data to informed decisions. It automates the entire data science lifecycle, defining the behavior you want to predict, identifying the most useful data signals, training the model, and generating precise audiences for engagement. Along the way, it keeps detailed records to ensure accuracy and transparency.

Predictive audiences allow institutions to activate marketing campaigns right away. This closes the loop between analysis and execution, enabling teams to anticipate needs and deliver timely, relevant experiences.

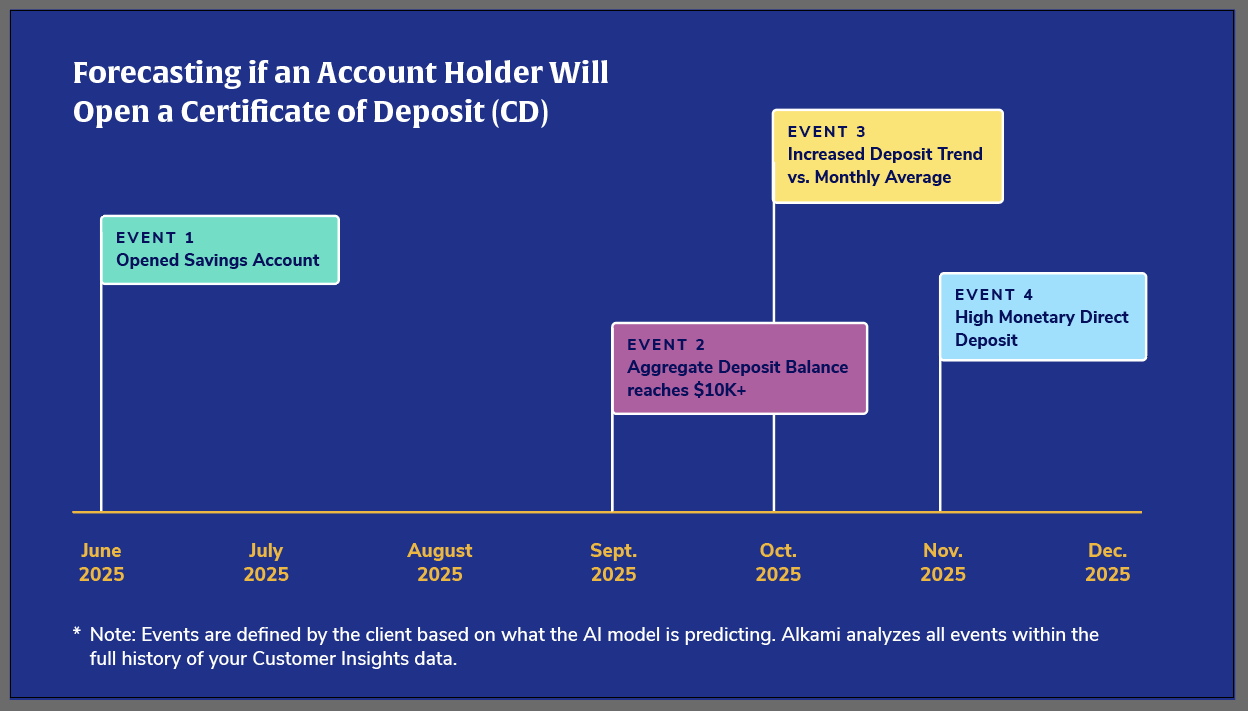

For example, a financial institution might want to predict which account holders are most likely to open a Certificate of Deposit (CD). The AI model analyzes historical behavioral data, such as deposit growth trends, direct deposit activity, and prior product adoption, to identify early signals of intent. With predictive insights like these, the institution can engage account holders proactively, even before they express interest.

Define the event and then identify examples of the event you are trying to predict.

Let’s say your goal is to identify which account holders are most likely to open a Certificate of Deposit (CD). The model begins by examining real behavior that has historically preceded that decision. It’s not guessing—it’s pattern recognition built on data.

In this case, the AI looks for a series of events that tend to signal intent:

By mapping and weighting patterns like this across your customer base, Predictive AI surfaces the people most likely to take action next. That’s not just better targeting; it’s anticipatory banking.

AI modeling identifies the most predictive behavioral data tags to include as features in the models.

From over 50,000 behavioral data tags, the system selects the signals most likely to predict the outcome, using an unbiased, automated approach. Product use, transaction history, and spending habits are weighed to determine what matters most.

AI Modeling mimics the human brain to identify predictive data patterns with speed and scale.

The selected tags are used to train a smart neural network that automatically adjusts for the best results. Models retrain monthly to adapt to new trends and incorporate new behavior patterns, ensuring predictions stay accurate and relevant.

Use predictive data to build relevant campaign audiences.

Each day, account holder behavior is assessed against predictive behavioral data tags, also known as Key Lifestyle Indicators (KLIs), combined with their activity over the prior six months. For example, a churn risk indicator or an auto-loan cross-sell signal, may qualify someone for inclusion. Qualified account holders are automatically grouped into campaign-ready audiences, a core example of data analytics in banking applied at scale.

AI modeling helps financial institutions achieve their goals, including growing deposits, driving lending, expanding commercial opportunities, boosting engagement, and more. Here’s what it delivers:

The demand for smarter, faster insights is accelerating: the global big data analytics in banking market was valued at about $41B in 2024 and is projected to reach $67B by 2032.

For banks and credit unions, the advantage goes to those who act early. Predictive AI powered by clean, ready-to-use data empowers banks and credit unions to anticipate account holder needs, design better campaigns, and prevent attrition before it happens. Like any discipline, success comes down to a few fundamentals: use history to inform predictions, keep data clean, retrain models regularly, and establish clear ownership for outcomes.