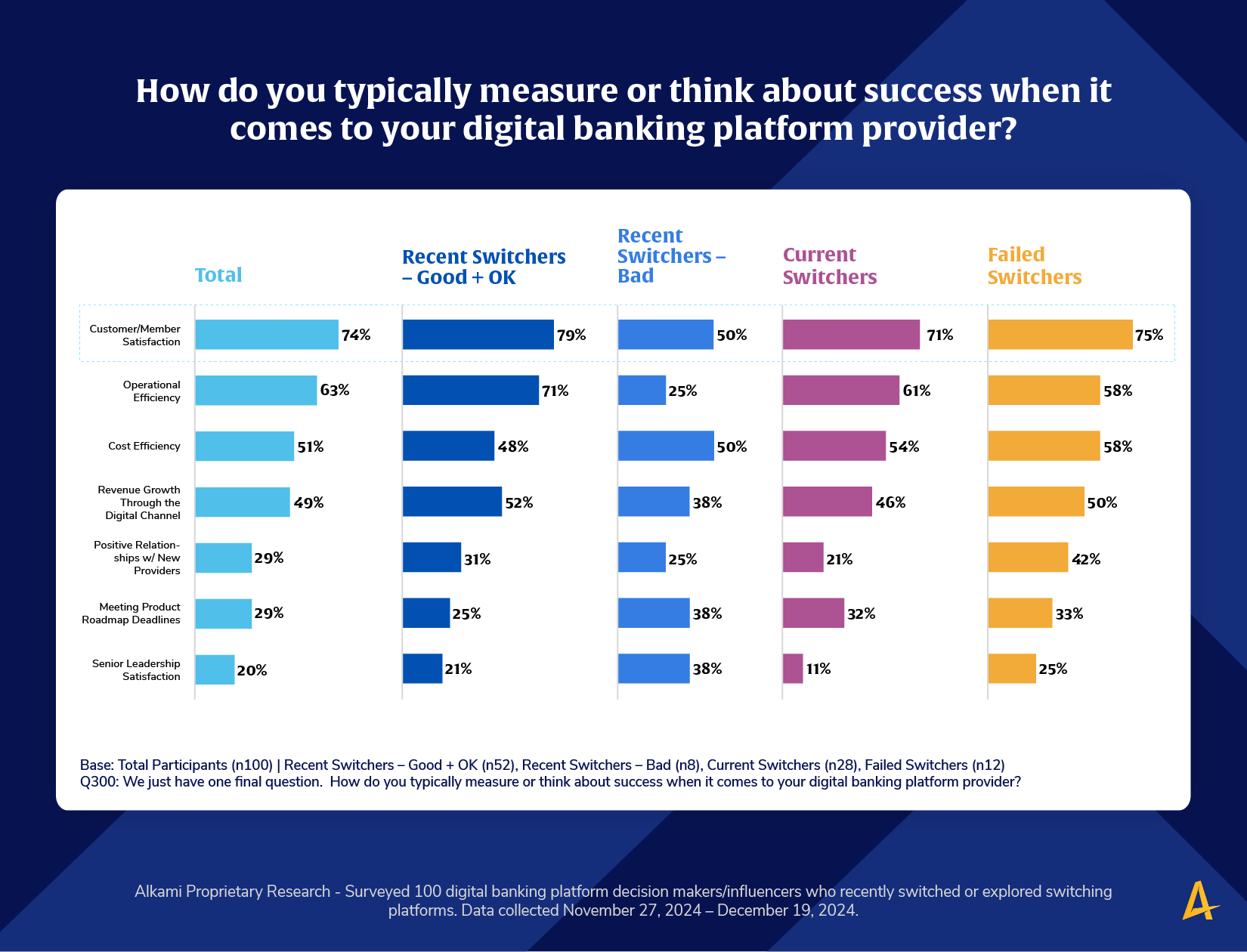

In Alkami’s survey of decision-makers who had recently switched or evaluated switching digital banking platforms, a distinct trend emerged: account holder satisfaction is the most commonly cited measure of success. Among recent switchers who had a positive experience, 79% listed this as their top metric. In contrast, just 50% of recent switchers with a bad experience prioritized it.

This signals a powerful shift: the institutions that experience successful conversions are those that center the experience around their account holders. Operational efficiency and revenue growth also play strong supporting roles, but a factor such as “senior executive satisfaction” was not a dominant indicator for successful institutions.

In fact, successful switchers were far less likely to focus on cost savings or product roadmap alignment—indicating that institutions that lead with the experience and effectiveness of the end-user are more likely to succeed. This isn’t just about having fewer bugs or more uptime; it’s about thoughtfully designing a digital banking platform transition that feels intuitive, supportive, and ultimately empowering to the account holder.

This data underscores a fundamental truth: conversions can’t be measured solely on spreadsheets. Yes, financial efficiency and system stability are table stakes, but if your digital banking platform transition isn’t satisfying account holders and their financial needs, then it’s not doing its job.

Financial institutions considering a platform switch should strategize about how they define success. Metrics like cost-cutting, vendor timelines, or back-office alignment are critical, but they shouldn’t eclipse the most important stakeholder: the account holder. Ultimately, it’s their behavior that determines retention, cross-sell potential, and long-term value.

Those that make the account holder experience the north star of conversion efforts will find that everything else, from efficiency to revenue, follows suit. That means deeply investing in partner collaboration, onboarding strategy, and change management across every channel. Make your digital banking platform change not just something you survive, but a moment of truth you capitalize on. Reimagine success from the outside-in.

*These findings have not been previously published.