What we’re seeing

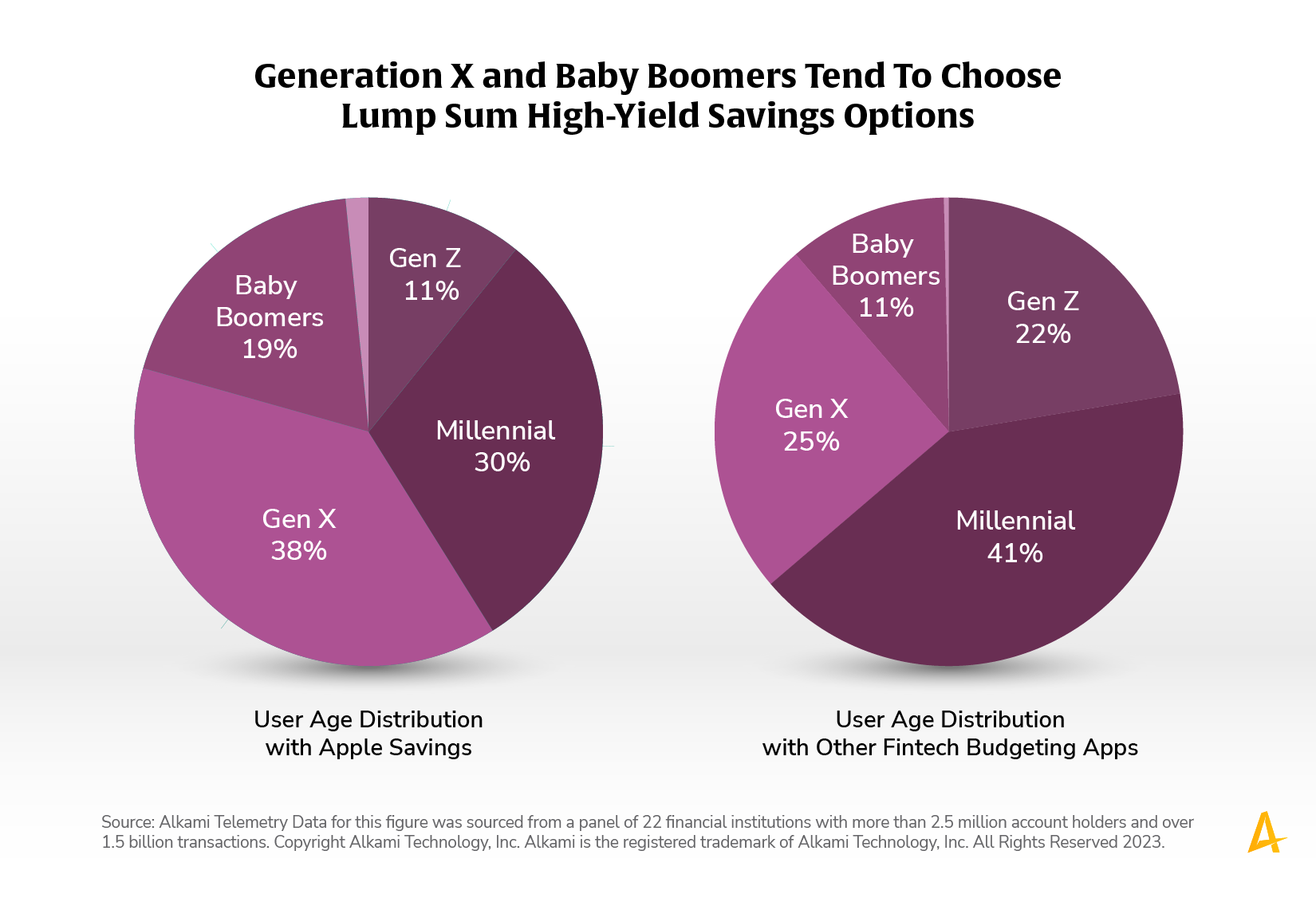

Previously, the usage of new personal finance apps showed consumers are responding to new ways of saving money and managing their finances. Account holders transferring funds to Apple’s new interest-bearing savings account tended to move much larger amounts than savers who moved funds using passive strategies with the fintech apps (medians: $1750 vs. $10, respectively). Additionally, the age of these savers was analyzed and the figure above illustrates that savers using budgeting apps tend to be younger than fintech app savers, with 62 percent in the millennial and Generation Z generations, compared to 41 percent for Apple savers. This suggests that the savings and budgeting app users are more likely to be in earlier stages of their financial journey where they are building savings while Apple savers are at a more mature financial stage.

Takeaway & Call to action for FIs

Financial institutions are under pressure to compete with non-traditional players offering high-interest savings or apps that implement “set it and forget it” saving strategies. But not all new savings products are alike – and consumers want the benefits that meet the needs of their personal financial goals. If financial institutions want to steal back large sums of deposits, offering wealth building products to Apple savers may do the trick. For the other fintech app audience, offering automated savings functions built into the online or mobile banking experience may bring them back.

Source: Alkami Telemetry Data for this figure was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.

Unlock the power of cleansed data for your financial institution