Marketing for financial institutions, whether banks or credit unions, is unlike marketing for any other industry. Traditional marketing tools can help with lead generation or targeting, but they sometimes fall short when it comes to the unique needs of financial institutions. Unlike retail or technology brands that rely on off-the-shelf tools for broad outreach, financial institutions face tight regulations, sensitive data, and account holders who expect highly personalized, relevant experiences. Marketing for banks and marketing for credit unions demands purpose-built solutions tailored to the financial journey of each account holder. It’s not a small adjustment. It’s a fundamentally different approach.

Account holders expect their financial institution to understand their needs and deliver personalized product recommendations based on their unique financial journey. Research shows that when data is used effectively for personalization, account holders are:

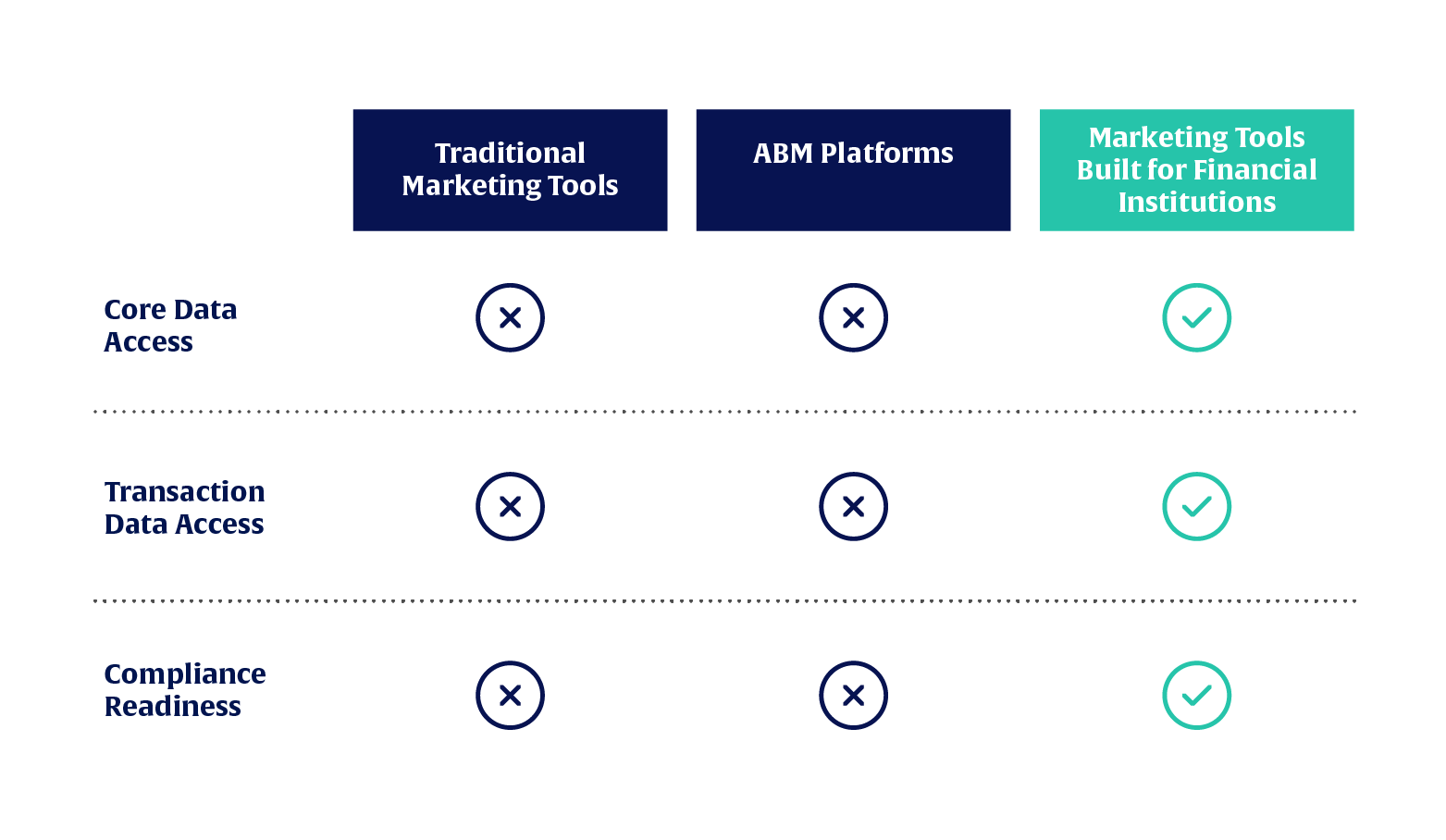

Yet most traditional marketing tools and account-based marketing (ABM) platforms fall short for financial institutions. While account based marketing (ABM) is great for targeting high-value accounts in business-to-business (B2B) contexts, it often lacks the deep, real-time financial and behavioral data required for personalized banking experiences. Similarly, general-purpose platforms can’t connect with core banking systems or access transaction histories, which are critical insights for campaign relevance.

Without access to this data, you won’t know if someone is making mortgage payments elsewhere, has stopped using your credit card, or is growing deposits without additional product engagement. Marketing for financial institutions demands this level of intelligence—without it, your campaigns lose relevance, timing, and impact.

Banks need more than flashy creative assets or retargeting tools. They need the ability to segment audiences by financial behaviors, product usage, financial milestones, and even competitive activity. For example:

One bank used behavioral data to move from reactive marketing to proactive, personalized engagement. By turning raw transaction data into meaningful insights, the marketing team at Westfield Bank launched campaigns that better matched account holders’ needs and saw a measurable lift in campaign results.

By leveraging data, we’ve been able to stretch our marketing dollars further, ensuring efficiency while staying competitive.

–Chris VanAusdale, Senior Vice President of Marketing and Communications, Westfield Bank

Read Westfield Bank’s story here.

Credit unions are rooted in relationships and member support. That makes trust, financial education, and proactive outreach even more important.

With the right data, a credit union can identify members showing signs of financial stress, like missed payments or low balances, and offer support before a crisis hits. Or they can pinpoint members who are financially healthy and ready for the next product, like an auto loan or credit card. They can drive deeper member engagement with financial wellness tools, credit score education, and proactive support. Using transaction data, credit unions can identify members who may need help or are ready for their next financial product.

One credit union used this kind of data-driven marketing strategy to grow deposits by targeting members based on actual financial behavior, not just demographics or guesswork.

We set a goal for our new money growth, and at the midyear point, we were at 11% of that goal. So, we put five campaigns in motion. They set off on July 1st. In June, we did $330,000 in new money. We did $5.2 million in July. And we did that using Alkami.

–Alisha Johnson, Chief Growth Officer, Ideal Credit Union

Read Ideal Credit Union’s story here.

Whether you’re focused on growing your commercial business or helping account holders build credit, your marketing platform should align with your goals. Marketing for banks and credit unions requires a deep understanding of financial data, account holder behavior, and regulatory requirements.

Engagement marketing for financial institutions needs to be:

Personalized: Show account holders you understand their financial situation. Don’t just blast messages—tailor them based on spending, balances, and product usage. Whether it’s promoting home equity loans to home improvers or college savings accounts for new parents, timing and relevance are everything.

Predictive: Instead of reacting, you should be predicting. Anticipatory marketing for credit unions and banks should help you know their needs. Find out who’s likely to leave, who’s ready for a new product, or who needs support.

Omnichannel: Your account holders engage with you across mobile banking apps, online banking, email, and even in-branch experiences. A consistent message across all these touchpoints is key.

Secure and Compliant: Financial-grade security isn’t optional. Your marketing platform needs to meet your institution’s privacy and compliance standards without slowing down execution.

Unlike generic platforms, marketing tools built for financial institutions provide capabilities that are essential for real-time, relevant engagement—and simply unavailable in traditional or ABM platforms:

The bottom line: Banks and credit unions need marketing tools that speak their language.

Generic solutions weren’t built to handle core data, regulatory hurdles, or the nuanced needs of financial wellness and account holder support. But an engagement marketing platform built for financial institutions can do all that and more. If you’re ready to move beyond guesswork and make every campaign count, it’s time to invest in a marketing solution built just for you.