Account holders expect more than convenience. They expect connection. They want their financial institutions to understand their needs by life stage, financial behavior, and personal goals. Engagement marketing empowers banks and credit unions to activate data to drive timely, personalized communication, so financial institutions can move from transactional interactions to meaningful engagement. According to an Alkami survey of its customers using the Alkami Data & Marketing Solution, financial institutions saw nearly 3X faster product adoption with data-activated campaigns. That’s the power of engagement marketing in action.

Most financial institutions have more data than they know what to do with, from core systems, digital banking solutions, transactions and more. But without the right tools, that data sits unused. Engagement marketing platforms transform raw data into insights you can act on.

To unlock growth, financial institutions must move beyond one-size-fits-all outreach and leverage their data to connect with individuals. Personalized, data-driven marketing increases relevance, builds trust, and delivers measurable impact. Engagement marketing combines behavioral insights, segmentation, and automation to make this possible at scale. Whether your goal is to grow commercial relationships, increase loan volume, or drive adoption of digital products, the right marketing platform should align with your strategy and understand your regulatory environment.

For example, by analyzing transaction data, you might identify account holders paying off auto loans at another institution and proactively offer competitive refinancing. Or if data reveals account holders moving funds to third-party savings applications (apps), your team can promote your own high-yield savings options to retain those assets.

When data meets strategy, marketing for financial institutions becomes more than communication. It becomes conversion.

Every financial institution’s data journey is different. Whether you’re just beginning to activate insights or ready to automate your entire marketing funnel, Alkami’s Data & Marketing Solution meets you where you are. Each path integrates with your existing technology stack, scales to your institution’s growth, and delivers clear return on investment (ROI).

What it is: Data insights transform raw account holder data into actionable intelligence. By leveraging advanced analytics and machine learning, it provides a comprehensive understanding of account holder behavior, preferences, and financial needs.

Ideal for: Financial institutions that are ready to invest in a deeper understanding of their account holder base, ensuring marketing campaigns are built on a foundation of solid, evidence-based understanding.

What it delivers: Data insights empower financial institutions to make informed strategic decisions, optimize their marketing spend, and ultimately enhance loyalty and profitability by:

What it is: Predictive AI leverages advanced machine learning models to anticipate account holder needs and behaviors. By analyzing datasets of past interactions, transaction histories, and demographic information, these models identify patterns and forecast future actions.

Ideal for: Marketing and engagement teams that are ready to transition from a reactive approach to a proactive, forward-thinking strategy. It empowers institutions to anticipate account holders’ needs, rather than just responding to them.

What it delivers: Predictive AI transforms raw data into actionable insights, enabling financial institutions to build stronger, more personalized relationships with their account holders and drive measurable business growth. Predictive AI enhances engagement marketing efforts by:

What it is: Full Funnel Marketing provides an integrated, data-driven approach to campaign orchestration. Through dynamic audience segmentation, it ensures that marketing messages are precisely tailored for each account holder.

Ideal for: Financial institutions that are ready to embrace always-on, automated marketing. It’s designed for organizations that understand the power of seamlessly connecting data, content, and channels to create a cohesive and highly effective marketing ecosystem.

What it delivers: Full Funnel Marketing offers several strategic advantages for financial institutions:

Not sure where to start? Take our quick quiz to discover which data-driven marketing path is right for your institution.

Alkami’s Data & Marketing Solution amplifies the value of your digital banking solution, be it from Alkami or another digital banking partner. But, when you add the Alkami Data & Marketing and Alkami Digital Banking Solution together, you unlock even more value. Together, they create an ecosystem where insights flow directly into action. Personalized offers appear within digital banking channels, campaigns adjust dynamically based on behavior, and institutions can track results in real time.

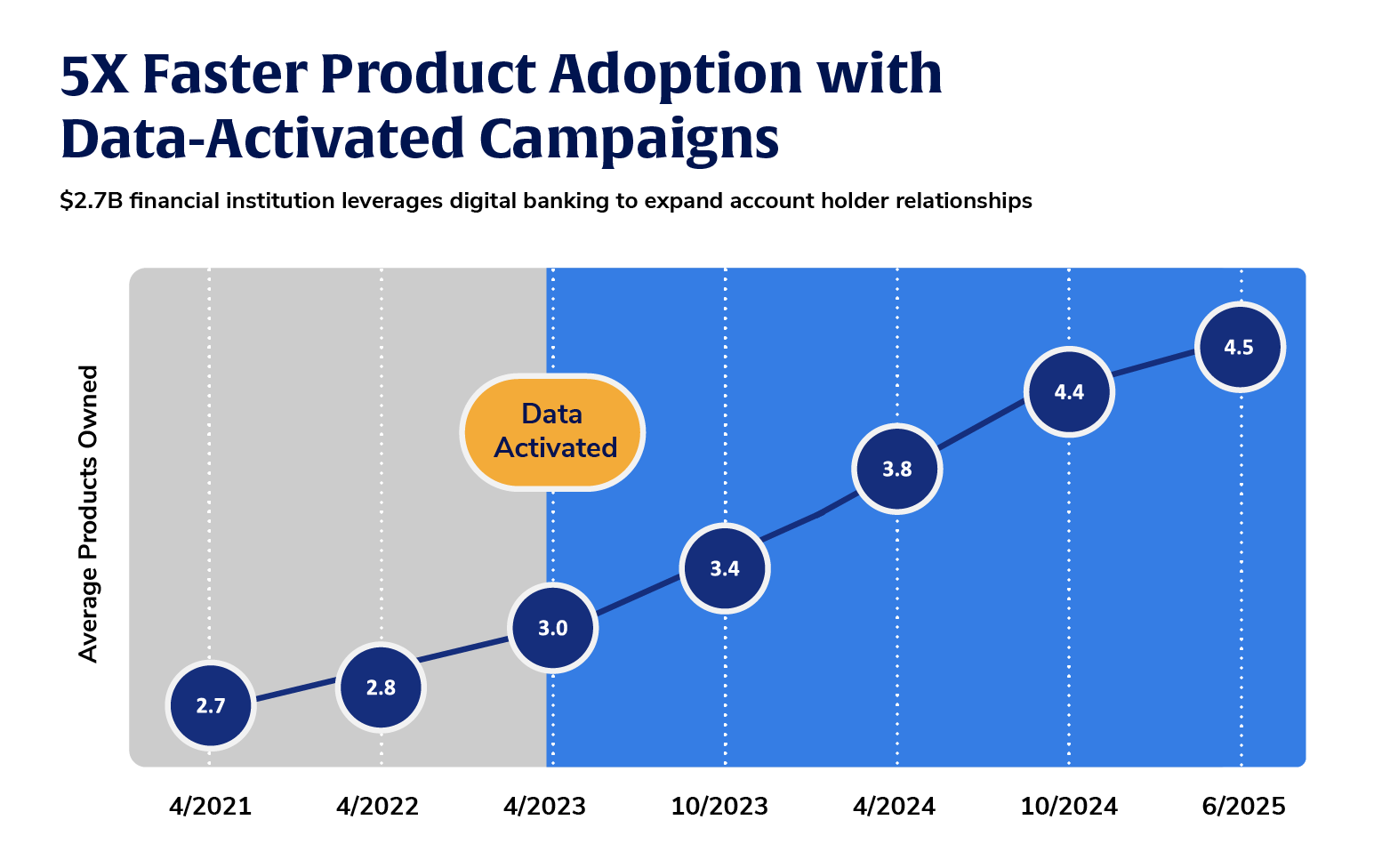

When a $2.7B financial institution began leveraging the Alkami Data & Marketing Solution inside its digital banking experience, the impact was immediate and measurable. For years, growth had been steady but incremental. Then in April 2023, the institution activated data-driven marketing within Alkami’s Digital Banking Platform. By unifying data from core systems and transaction histories, the institution was able to identify actionable insights and respond with personalized, automated offers.

The results tell a clear story of acceleration:

This transformation highlights what’s possible when engagement marketing and digital banking work hand in hand. Data no longer sits idle. It powers meaningful, measurable growth.

The future of financial services marketing belongs to institutions that know their account holders best. Engagement marketing, powered by data and automation, enables that connection, transforming insight into loyalty, and loyalty into growth.