Predictive AI Starts With the Right Data

Predictive AI works only when it digests precise, well-labeled information. For data analytics in banking, that means turning raw transactions into clear behavioral data tags—fast and at scale. And account holders are ready for it:

Sixty-five percent of digital-banking Americans say that within five years, AI will dramatically change how they do business with their bank or credit union, up from 61 percent last year.

It’s a big challenge; various studies and surveys have all concluded that the most time consuming portion of a data science or machine learning project is data cleansing. Data annotation for machine learning is projected to be a $5.33 billion industry by 2030, reflecting how much time and cash teams spend making data usable.

Alkami’s Data & Marketing Solution transforms data analytics in banking from a dreaded chore into something that actually feels doable. We translate raw, messy, hard-to-read transaction streams into clean, enriched, categorized data — a language your marketing systems, personalization engines, and analysts can actually understand and act on within days (even hours), not months.

How Alkami transforms a financial institution’s transaction data into behavioral data tags

Transaction files arrive looking like an unreadable data dump—millions of rows, vendor names misspelled, and cryptic codes no one recognizes. Alkami helps you tackle that chaos first, mapping every string to a standardized label we call a behavioral data tag. In one pass, transactions with dozens of variants are merged into a single, unified merchant name. Each transaction then becomes a clear, searchable clue about the account holder behind it.

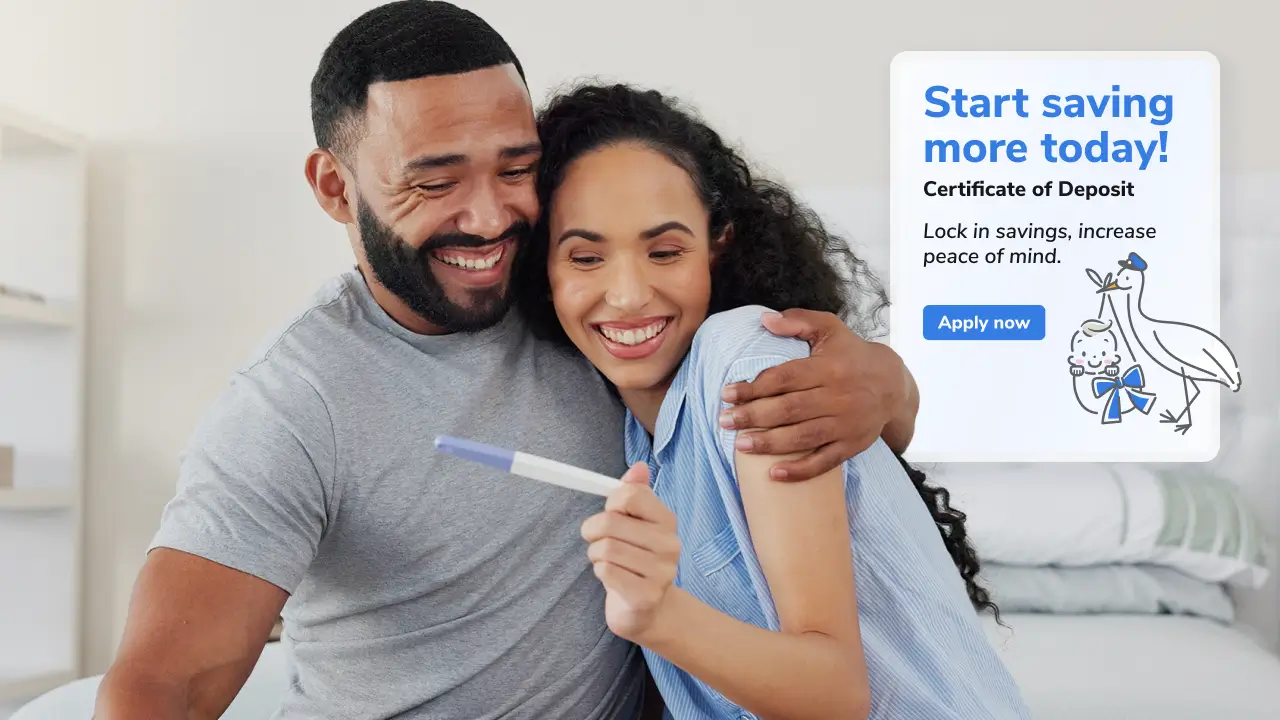

That clarity unlocks real stories hidden in the ledger. Transactions are carefully curated to inform data tag assignment. In some cases, a single transaction is enough: a payment to a mortgage lender is instantly tagged with the lender. A steady mortgage payment to another financial institution points to wallet share at risk. For others, it takes more than one transaction. For example, a single diaper purchase would not be enough, it could be a gift for a friend or relative. In this case, an account holder needs to have a sufficient intensity of spend in that category to be assigned the appropriate data tag. Frequent, recent diaper purchases with an appropriate associated spend signal a family entering a new life stage and needing smarter savings options. A monthly credit-card payment to a rival hints at rewards envy and an opportunity to win that spend back. Once tagged, these signals feed directly into our automated machine-learning engine, giving Predictive AI a rich, structured view of every account holder’s financial life rather than a sea of raw numbers.

Scale is built in. We can cleanse and tag billions of transactions in a short time frame and continuously refresh so new behaviors flow into models without manual work. Marketers can skip the most time-draining part of any artificial intelligence (AI) project, data preparation, and move straight to action. When a tag shows rising direct deposit inflows, the system can instantly surface an incentive that encourages the account holder to make your institution their primary financial institution. When it spots an external auto loan payment, it can trigger a refinance campaign. Clean tags become the fuel that lets financial institutions predict needs, personalize outreach, and protect relationships better than ever.

Behavioral data tags are the ultimate inputs for predictive modeling

Behavioral data tags give data scientists and institutions exactly what they need: consistent, well-structured signals that can be plugged straight into predictive AI models.

- Normalized at scale

Messy merchant strings get cleaned up fast. For example, “DOCTORSASSOCINC” becomes “Subway.” No noise, no extra scrubbing. - Extensive catalog

Alkami maintains tens of thousands of tags, from brand-level purchases to counts of products a customer or member has with an institution. That coverage captures nearly every financial behavior. These are the top 100 most popular data tags used by Alkami Data & Marketing Solution customers. There are more than 50K additional data tags available to create hyper-personalized, targeted account holder experiences. - Contextual taxonomy

Each tag sits in a clear hierarchy. “Wells Fargo Mortgage,” for instance, is grouped with hundreds of similar providers. Predictive AI can scan that group to spot churn risk, cross-sell potential, and more. - Continuously updated

As new data is received, we assign behavioral data tags and the AI Modeling platform rescores on a daily basis, minimizing the time that it takes for the latest transactions to be considered by a predictive model. - Adaptable

The Engagement AI Model, the first model built on the AI Modeling platform, helps financial institutions spot account holders most likely to stay, grow, and use more products. And because any behavioral data tag can serve as a target, you can develop new predictive models for whatever goal comes next.

Clean, contextual labels like these turn raw transactions into high-value inputs, making data analytics in banking faster, more accurate, and easier to scale. You can transform transaction noise into predictive insight to elevate personalized banking to true Anticipatory Banking. This solves a real pain point: nearly half (46%) of digital banking Americans wish their primary financial provider did a better job of anticipating their financial needs and goals. By spotting signals before they surface, you can reach account holders when it matters, before they move deposits, apply at another lender, or switch cards.

Want to learn more? Connect with an Alkami representative to explore our Predictive AI solutions and see how smarter data insights can boost engagement, grow deposits, and build lasting loyalty.