Gain valuable data insights with automated transaction data cleansing

This blog post was originally published in December 2024 and was updated and republished August 6, 2025 to include updated research.

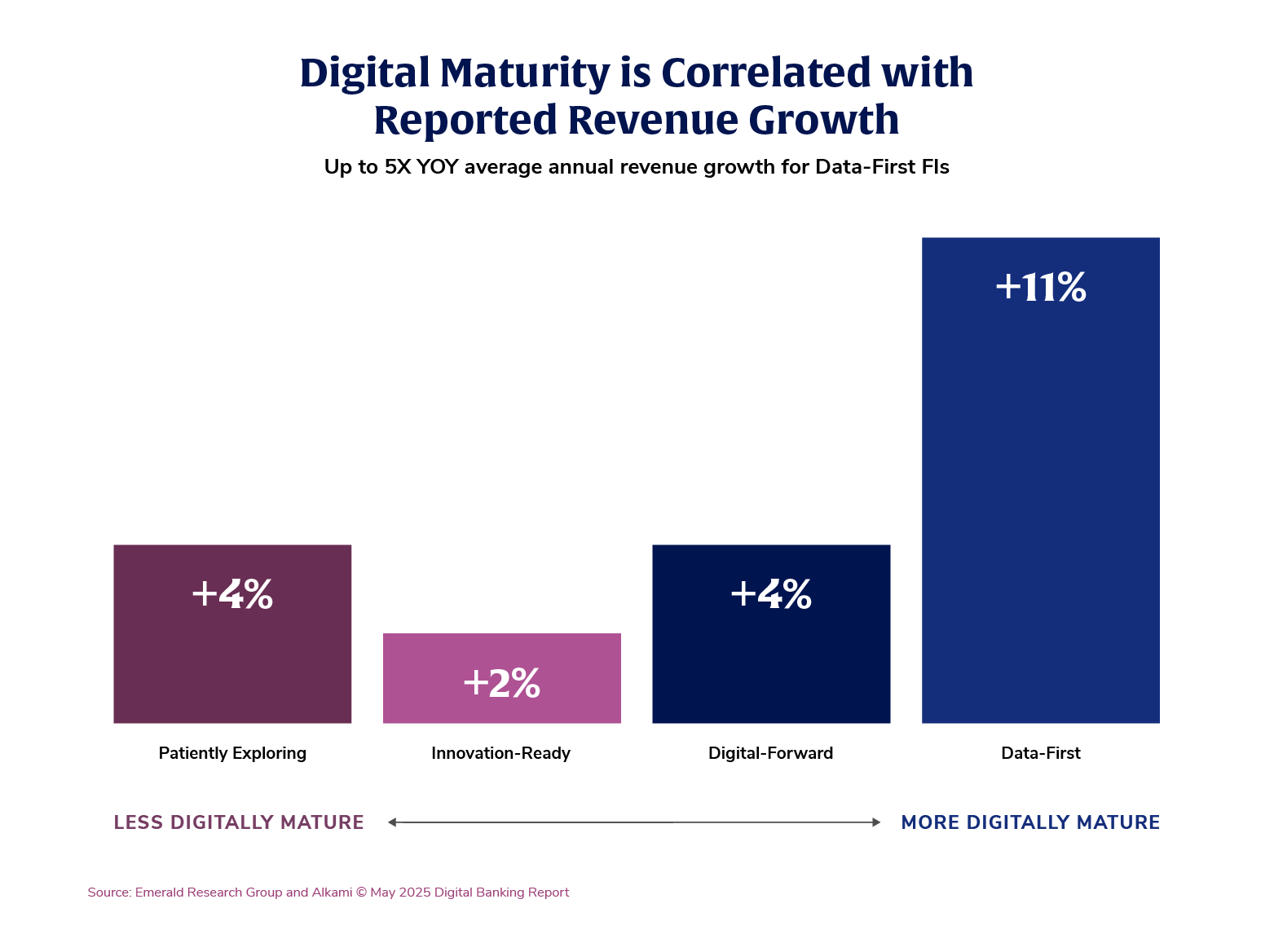

As shown in The 2025 Digital Banking Playbook, data insights is the foundation across a financial institution’s technology stack. Research proves financial institutions that put data first and execute a data modernization strategy represent the most digitally mature institutions in the market — and also report up to 5x the average annual revenue growth compared to their peers.

Transaction data cleansing is one of the most time-consuming processes in data analytics in banking. This stage is where financial institutions transform raw data into actionable data insights that drive business decisions. But the reality is, the process of data cleansing can be so intensive and time consuming that simply tackling it can justify the investment in dedicated solutions.

The daily cycle of data cleansing

For most regional and community financial institutions, the task of data cleansing isn’t just demanding; it’s perpetual. New data flows in daily from multiple sources, such as account holders’ transactions and digital banking activities. With it can often come inconsistencies, errors, and duplications that need attention. The more data a financial institution generates, the more it needs to be cleansed, categorized, and prepped for analysis. However, banks and credit unions face a major challenge: most of them don’t have data scientists on staff to manage this daily workload.

Even for financial institutions fortunate enough to employ data scientists, up to 40% of their time is spent on the basic, repetitive tasks of aggregating, standardizing, cleansing, and categorizing data, not on high-level analysis. This can be a costly use of high-value talent and resources, as data scientists could otherwise spend that time generating data insights that could directly impact the institution’s strategic initiatives.

A solution that automates even part of this process can be invaluable. Transaction data cleansing can automate repetitive tasks and free data analysts to focus on data insights rather than clean-up. This helps financial institutions save time and resources to achieve a higher return on investment (ROI).

Example use case: activating data insights from the core banking system

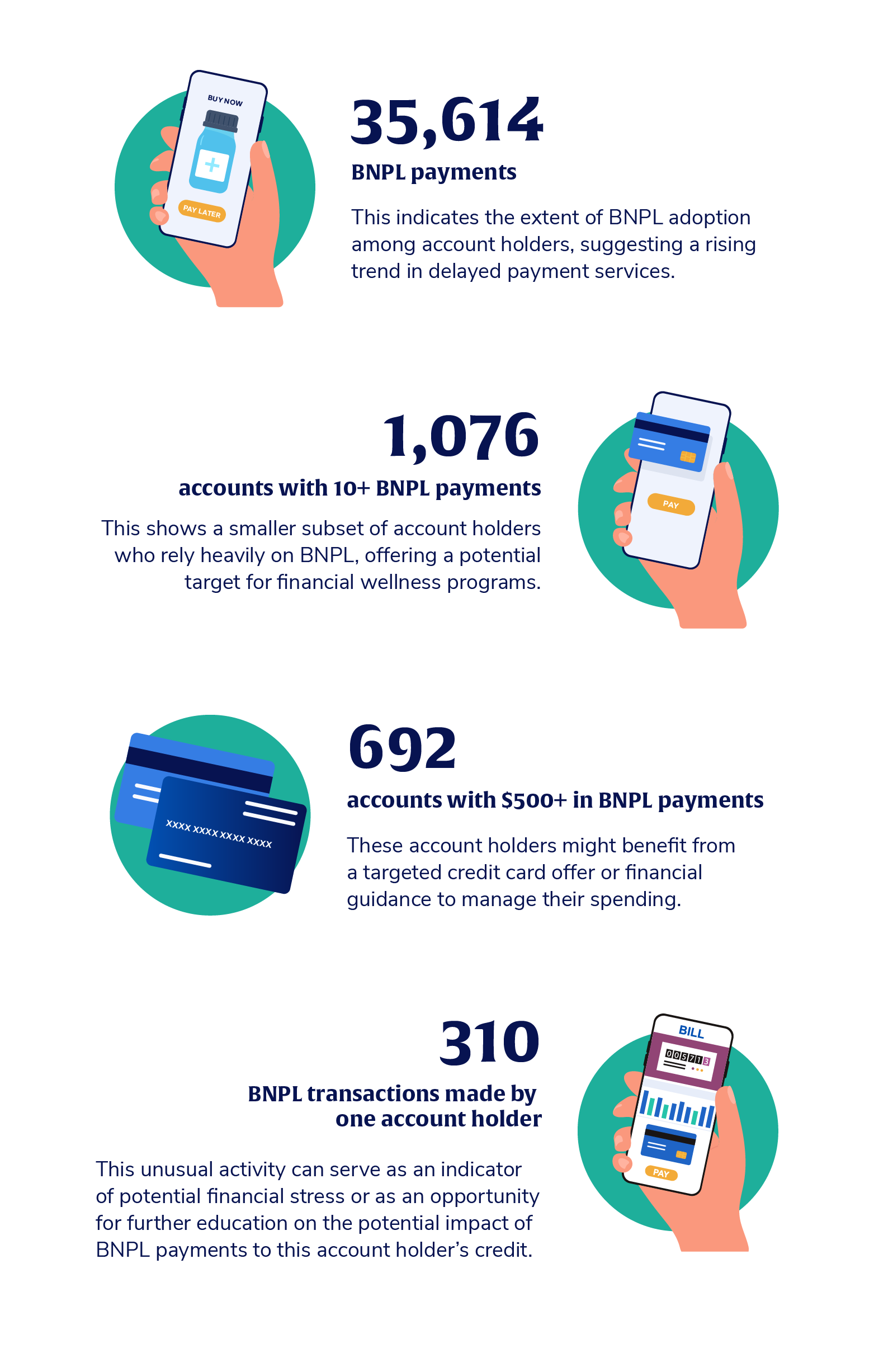

Clean, structured data allows banks and credit unions to unlock data insights hidden in their core systems. For example, core transactional data can reveal patterns in account holder behavior, like the increased adoption of buy now pay later (BNPL) services. This is more than just a payment trend; it’s a rich source of information that can have a big impact on account holders’ financial lives.

In a single month, a financial institution discovered the following BNPL metrics from their core transaction data:

When core data is properly cleansed and categorized, it becomes actionable, allowing banks and credit unions to make more informed decisions about how to support and engage their account holders.

3 ways to activate data insights throughout the institution

The possibilities for utilizing clean data are endless, but here are a few ways different teams within a financial institution can leverage these data insights:

- Marketing: By examining data insights on high BNPL usage, the marketing team can target account holders with tailored financial wellness education and credit-building products and services.

- Product management: With a clear picture of demand for BNPL services, the product team might consider developing or integrating BNPL as a product within their digital banking solutions. This could set the financial institution apart from competitors, providing a popular payment method directly through their own platform.

- Customer service: Integrating data analytics in banking into the teller system would allow customer service representatives to see relevant data insights in near real-time, making interactions with account holders more personalized. For instance, if an account holder frequently uses BNPL, the representative could offer personalized tips or products to help them manage their finances.

The foundation for strategic decision-making

The incessant job of data cleansing is an ongoing process, yet it’s one that pays off significantly when done right. Investing in data cleansing capabilities allows financial institutions to spend less time preparing data for analysis and more time using data insights to deliver value. For banks and credit unions that want to stay relevant and competitive, data cleansing is not an option but a necessity—one that ultimately supports their mission to deliver personalized service to account holders.