What we’re seeing:

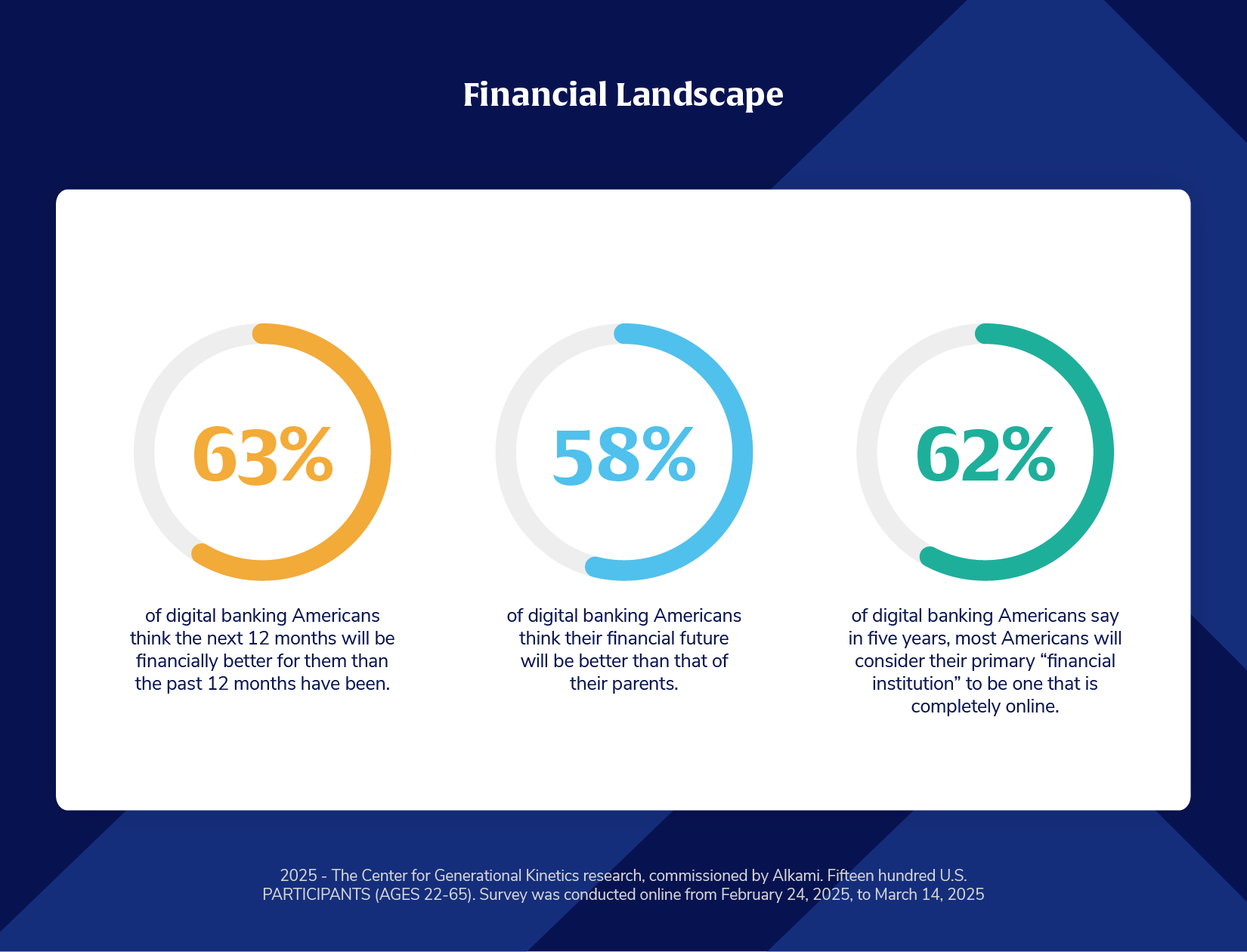

When it comes to digital banking, what people do is only half the story—how they feel about their finances paints a deeper picture of their mindset, motivations, and unmet needs. The 2024 national study commissioned by Alkami through The Center for Generational Kinetics (CGK) surveyed 1,500 adults aged 22 to 65 and revealed a financial landscape that is at once optimistic, evolving, and under pressure. Among Americans who use digital banking, 63% believe their financial situation will improve over the next 12 months. That’s a striking display of short-term optimism—especially in a time marked by economic uncertainty, inflation concerns, and interest rate volatility.

That optimism extends to long-term expectations as well: 58% believe their financial future will be better than that of their parents. This sentiment reveals a growing belief in self-determination and digital empowerment. Tools, technology, and education are shifting the mindset from inherited outcomes to personal progress.

There’s also a clear signal about the direction of banking itself. Another 62% of respondents say that within five years, they expect most people will consider their primary financial institution to be a completely online experience, including 68% of Generation Z, the highest of any generation. That’s a seismic shift from traditional assumptions of what a financial institution looks like. It tells us that consumers—especially digital ones—aren’t just embracing change; they’re expecting it.

Takeaway and Call-to-Action:

This data isn’t just about emotion—it’s about strategy. Financial institutions that treat digital banking as a transactional utility miss the bigger picture. Digital platforms are now the primary touchpoints shaping how people feel about their financial health. And those feelings—of excitement or anxiety, empowerment or confusion—drive behavior. They influence loyalty, engagement, and share of wallet.

This isn’t a “glass half full or half empty” story—it’s both. Digital banking users are expressing hope and ambition while living with real financial fragility. Digital banking experiences must support real-life financial journeys—offering education, encouragement, and solutions that serve account holders’ needs today and tomorrow’s aspirations. With tools that anticipate financial behavior, automate smart nudges, and create personalized journeys, institutions can do more than manage accounts—they can empower account holders to build a more stable, confident future.

*These findings have not been previously published.