Digital transformation isn’t just about technology. It’s about alignment—between institutions and the innovators who can help them grow, move faster, serve account holders smarter, and compete.

That’s where partnerships come in. But not just any partnerships. The fintech space is crowded, and what financial institutions need isn’t more noise—they need clarity. Confidence. And collaborators who truly move the needle.

We sat down with Josh Winstead, vice president of corporate development at Alkami, to talk about what sets a good fintech partnership apart from the rest. In this conversation, he breaks down how Alkami curates a partner ecosystem that acts as a strategic multiplier for banks and credit unions. By blending platform extensibility with pre-vetted, complementary solutions, Alkami enables institutions to innovate with speed—and with trust.

Source: 2025 – The Center for Generational Kinetics research, commissioned by Alkami. Fifteen hundred U.S. PARTICIPANTS (AGES 22-65). Survey was conducted online from February 24, 2025, to March 14, 2025

This isn’t a vendor list. It’s a vision. A blueprint for how modern financial institutions can future-proof their digital strategy without starting from scratch. Because when partnerships are intentional, they don’t just plug gaps. They open doors.

Molly Irelan: Josh, can you start by telling us about your role at Alkami and how it connects to our fintech partner ecosystem?

Josh Winstead: Absolutely. I’m the VP of corporate development at Alkami, overseeing our fintech partnership ecosystem and merger and acquisition (M&A) activities. Essentially, in my role, I get to be at the tip of the spear in augmenting Alkami’s innovation with the broader fintech community, which ultimately aims to deliver significant value to Alkami and, most importantly, our customers.

Molly Irelan: What makes you passionate about your role?

Josh Winstead: It’s the pace and variety that excites me. Having worked previously at banks, I know firsthand that even the most innovative banks can move slowly compared to a technology company. Being at Alkami is different—our agenda advances daily. No two days are the same. My role also allows me to engage across our organization and externally with future-thinking financial institution leaders and brilliant fintech leaders. Mixing my background with those experiences, I am able to think with the customer-first mindset while connecting and learning from others.

Molly Irelan: What sets Alkami’s partner program apart from others in the industry?

Josh Winstead: Being in the customer seat for a long time, I understand the challenges banks and credit unions face with managing vendors and scaling technology. Keeping that top of mind, at Alkami, we want to present our customers with the best possible solutions and confidently stand by each and every one of the fintech partners we put in front of our clients. On top of that, we take on a lot of the vendor and risk management processes that financial institutions would need to complete for third-party vendors.

Other partner programs offer an a la carte menu, but Alkami has thoughtfully curated a selection of specialized partners. At Alkami, we believe less is more. This tailored strategy provides our customers with the best available solutions, while deepening the relationship, integration, and connectivity between the third-party and Alkami’s Digital Banking Platform.

Molly Irelan: How do we ensure our partner ecosystem aligns with our customers’ needs?

Josh Winstead: It’s straightforward: we listen. Our team of partner relationship managers actively engage with clients and our customer-facing teams at Alkami so that we can truly understand their demands and challenges. Client feedback drives our ecosystem, ensuring our solutions are always relevant and impactful. These partner relationship managers are real experts on the domain that they manage in the respective product areas. Their entire job is focused on meeting with fintechs and seeing what the latest innovations are, determining who offers solutions that will be the most valuable for our customers, and identifying ways to strengthen those partnerships throughout their lifecycle.

Molly Irelan: How does this ecosystem help banks and credit unions differentiate themselves in a competitive market?

Josh Winstead: For financial institutions with limited tech resources, our ecosystem is crucial. I think innovation happens so quickly that budget cycles have become so constrained in financial services that there’s just no way that really anyone, not even the megabanks in some cases, can do it alone. Innovation is rapid and resource-intensive. Alkami’s ecosystem allows institutions to leverage our extensive R&D (research & development) investments alongside our partners’, enabling them to deliver a best-in-class digital banking experience they likely couldn’t achieve independently – and without significant investment spent developing it in-house. This collaborative approach helps institutions differentiate, excel, and bring forward a holistic digital banking experience that can compete with anyone in the marketplace. We are focused on delivering the power of Alkami’s Digital Sales & Service Platform, while our partners have become experts in their own niches. By working together, we are able to extend the value to customers and empower them with the ability to deepen banking relationships with market-leading capabilities, like retirement planning or home value tracking.

Molly Irelan: How does our ecosystem support specific client goals like increasing deposits or digital adoption?

Josh Winstead: Our partner ecosystem addresses diverse goals with a spectrum of different partnerships from payments to customer service and security and fraud. These fintechs are focused on delivering on these goals whether its deposit growth, enhancing engagement, improving digital adoption, or fortifying security, we have specialized partners aligned with these objectives. We don’t see these as individual solutions, but pieces to a larger puzzle. By combining them with Alkami’s Digital Sales & Service Platform, we are able to empower financial institutions with actionable tactics and features that help them achieve their desired goals. For example, if an institution was focused on deposit growth, we could take a consultative approach with that customer to see what would move the needle the most – whether it’s a partner for seamless direct deposit switch or an automated campaign promoting certificates of deposit (CDs).

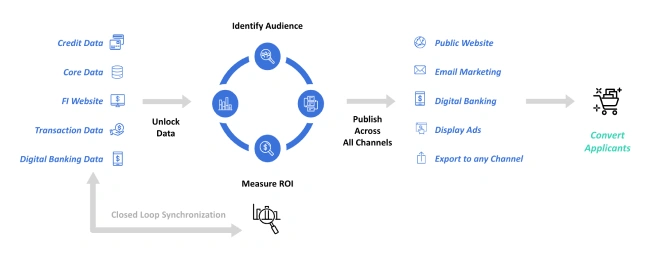

There’s two things at play here. As I mentioned before, in my role I am focused on the partner ecosystem, but I also support Alkami’s M&A activities. This allows me to see that holistic picture of how these technologies could work together. And then as a result, you start to see more unique value propositions through partnerships with Alkami than you might see in other places in the market. For example, with SavvyMoney and Alkami’s Data & Marketing Solutions (plus online banking, of course), financial institutions can tap into their data to deliver automated marketing campaigns across multiple channels and convert applicants via a streamlined application process in digital banking. By tapping into data from credit, digital banking, and transactions, financial institutions can power their engagement and cross-sell strategies with personalized banking experiences and marketing offers.

Molly Irelan: How does Alkami’s partner program help financial institutions manage third-party vendors more effectively?

Josh Winstead: Vendor management can be challenging. It takes expertise and practice, and is a skill that needs to be regularly exercised to be effective. Alkami takes on the brunt of the vendor management, enabling us to expertly manage due diligence, compliance, and relationship oversight on behalf of our clients. While each partnership has different levels of support and integration, every vendor in our network is carefully vetted to enhance the digital experience while delivering real operational value. With some of our most developed partnerships offering centralized billing and frontline support to compliance and security. By partnering through Alkami, institutions streamline risk assessments, standardize contracts, improve vendor oversight, and strengthen contingency planning—all while accelerating access to innovation. On top of that, our team continuously monitors partnership health, performance, and adoption, significantly reducing customer burdens. Recognizing diverse risk tolerances, we help customers understand why one partner might fit their specific needs better than another, providing comprehensive guidance and support throughout their decision-making processes. Put simply, we carefully curate and empower our customers with the ability to choose what’s best for them.

Molly Irelan: What’s Alkami’s strategy when selecting new fintech partners? How do you balance client needs with emerging fintech trends?

Josh Winstead: We focus primarily on partners beneficial to a significant portion of our client base. We also receive specific client requests and have occasionally pursued those partnerships driven by their feedback. However, our primary outbound approach targets scalable third-party solutions with broad client appeal. Customer needs and emerging trends are closely intertwined at Alkami. Our customers are digitally savvy and keenly aware of industry shifts. Listening closely to their feedback naturally aligns us with both current demands and future trends.

Molly Irelan: Internally, how do Alkami’s teams collaborate to support the ecosystem?

Josh Winstead: Collaboration is our strength. Partnerships originate from various teams—whether product, technology, or partnership management—but everyone plays a crucial role. This unified approach ensures we strategically deliver impactful solutions effectively to our customers. There’s no pride in ownership. We know the Product team has a really important job of making sure they understand how it fits in strategically to what Alkami is trying to achieve in The Digital Sales & Service Platform and how we would slot that in to deliver the highest impact for our clients. And ultimately, without the means of delivery, the Technology team, none of that’s possible. Everybody understands that they play an equally important role in executing and managing the lifecycle of a new partnership in the partner ecosystem. And I think that’s a real strategic advantage for us here.

Molly Irelan: What’s your long-term vision for the fintech partner program?

Josh Winstead: I want Alkami to be known as an easy and valuable partner within the fintech community. Our vision includes maintaining strong, clear alliances and expanding our capability to quickly introduce new partnerships to our customers so they can achieve their goals effectively and efficiently. We view our strategic partnerships as a way to augment that innovative arm for any desires or aspirations our clients or prospects may have.

Molly Irelan: How do we measure our ecosystem’s success?

Josh Winstead: Success for us is measured by client adoption rates, retention, and positive customer outcomes. We also closely track anecdotal feedback and specific performance metrics provided by our clients, ensuring our ecosystem continuously delivers value. For example, after launching Chimney, Direct Federal Credit Union saw average monthly home equity line of credit (HELOC) volume increase by 40% for the next six months. That’s a real metric we can point back to and celebrate. That customer outcome is proof that these initiatives are moving the needle.

Molly Irelan: Lastly, what excites you most about the future direction of Alkami and our partner ecosystem?

Josh Winstead:

In the fintech market, you’d think there would be a lull at some point, a shortage of great ideas, but there aren’t. There’s something new and innovative or a new spin on something that’s always coming. And at the same time, we get to watch this fintech community do some really cool things that make you think, “wow, why didn’t I think of that?”

Alkami’s commitment to our partnerships is really strong. It’s an area we see ourselves continuing to grow and continuing to forge new relationships every single year. There are a bunch of innovative companies out there and we can bring more value to our customers together than we can apart. There’s no shortage of groundbreaking ideas in fintech, and watching these innovations come to life while playing an integral part in bringing them to our clients is incredibly rewarding.

By choosing Alkami, we are able to support financial institutions in accomplishing more of their digital strategy because we bring the pieces together in our fintech ecosystem. It’s much easier than having to go and find disparate providers for digital banking, chat, money movement, marketing, and so on. You can do it all in one transaction.

As financial institutions navigate competitive pressure, shifting regulations, and rising expectations, they face a critical choice: go it alone or go further with the right allies.

This is where Alkami’s partnership philosophy becomes a strategic advantage. It’s not about filling a marketplace with logos. It’s about solving for real gaps, amplifying institutional strengths, and accelerating outcomes. Every fintech vendor in the ecosystem is selected with precision—tested for performance, aligned to strategy, and integrated in a way that feels native, not bolted on.

For financial institutions, this means fewer compromises, faster deployments, and a platform that scales in step with their ambitions. For their account holders, it means more personalized banking experiences, seamless access, and more reasons to stay loyal.

In a world where sameness is the status quo, differentiation is everything. And innovation—when built on trust—is the most powerful differentiator there is.